期權大單 | 特斯拉霸榜,暴漲還是暴跌?阿里巴巴出現新動態

市場概覽 (4月20日)

週四美股低開低收,三大指數收盤集體下跌。特斯拉令人失望的業績拖累科技股走低。此外,美聯儲多位官員又接連發出“鷹派”信號。截至收盤,納斯達克指數跌0.8%,標普500指數跌0.6%,道瓊斯指數跌0.33%。

當日美股期權市場總成交量38,838,134張合約。其中,看漲期權佔比51%,看跌期權佔比49%。

期權成交總量TOP10

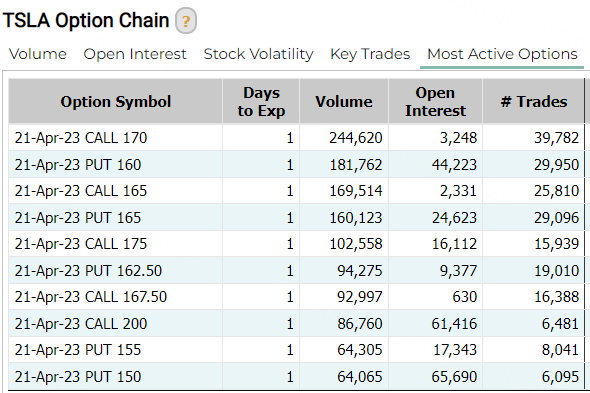

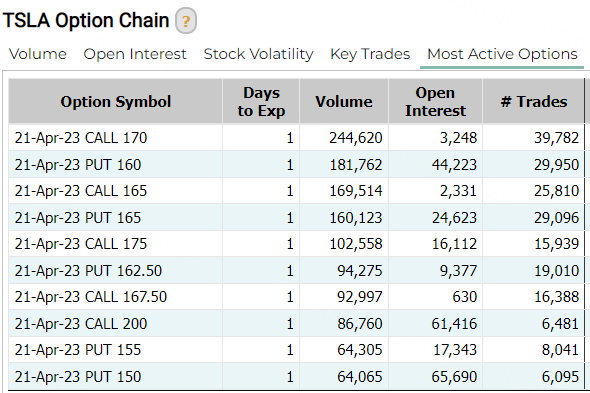

特斯拉罕見地攀上了總成交榜的第二位,當日其股價收跌9.75%,至近三個月最低,創1月3日以來來最大跌幅,同時創2019年7月以來的最差財報次日表現。

消息面上,財報過後,馬斯克稱特斯拉將繼續看輕利潤率、追求銷量。而在週四,馬斯克旗下的太空探索技術公司SpaceX“星艦”火箭首次入軌飛行試驗發射失敗,升空後不久發生爆炸。

不過也有一些好消息。被稱爲“女股神”的木頭姐Cathie Wood旗下基金ARKK和ARKW週四合計買入25.6萬股特斯拉股票,按當天收盤價162.99美元計,價值4170萬美元(約合人民幣2.87億),可謂是大手筆。

當天,木頭姐旗下方舟投資更新的特斯拉定價模型顯示,在基準情境下,特斯拉2027年每股預期價值將達到2000美元,比特斯拉週四收盤價162.99美元高出1127%。

特斯拉是木頭姐旗艦基金ARKK的最大持倉股,權重爲9.4%,她之前對特斯拉的目標價是到2026年達到1500美元。木頭姐對媒體表示,她並沒有被特斯拉一季度的業績所困擾。

從期權成交上看,投資者對特斯拉的情緒還是比較複雜的,短線波動很可能繼續增強。

異動觀察

異動榜方面,特斯拉繼續高居榜首,阿里巴巴緊隨其後,京東也繼續排在靠前的位置。

消息面上,知情人士說,阿里巴巴旗下的食品雜貨連鎖店盒馬鮮生,已開始籌備在香港首次公開募股。

2022年1月,盒馬鮮生考慮以100億美元的估值融資。從那以後,隨着股市暴跌和投資者回避風險較高的資產,全球私營公司的估值都在下降。

消息稱審議工作正在進行中,而阿里巴巴官方對此沒有迴應。

阿里3月出人意料地宣佈拆分六大業務後,盒馬鮮生是首批準備上市的阿里巴巴子公司之一。該公司將分爲電子商務、媒體和雲計算等六個主要部門。 據彭博社報道,價值200億美元的物流部門菜鳥網絡科技有限公司最快將於2023年底進行IPO。

彭博行業研究分析師Catherine Lim和Trini Tan在一份報告中寫道,IPO計劃“增加了虧損的超市部門在截至2024年3月的本財年實現盈利的可能性,從而提振了其盈利前景”。他們表示,與$高鑫零售(06808)$、叮咚和$每日優鮮(MF)$等同行相比,盒馬鮮生的估值可能更高。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.