“財報殺”將到?

uSMART盈立智投 03-27 19:57

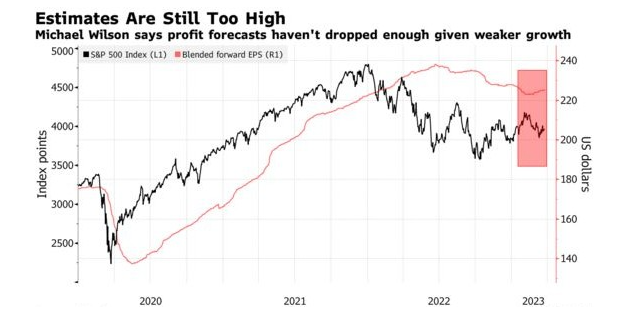

華爾街知名美股“空頭”、摩根士丹利策略師邁克爾•威爾遜(Michael Wilson)表示,銀行業的動盪導致盈利指引看起來過高,使樂觀的股市面臨大幅下跌的風險。Wilson週一在一份報告中寫道:"鑑於過去幾周發生的事件,我們認爲指引看起來越來越不現實。"

威爾遜在去年的機構投資者調查中排名第一,因爲他正確預測了股市的拋售。威爾遜指出,這在一定程度上是由於本月股市和債市走勢的背離。在一系列美國地區性銀行倒閉後,投資者消化了潛在衰退的影響,導致債券波動率飆升,而股市則因押注政策制定者將進行幹預危機而收復失地。標普500指數有望連續第二個季度上漲。

現在市場焦點轉向4月中旬開始的第一季度財報季。Wilson稱,今年迄今爲止的盈利預期下滑幅度與前兩個季度持平,表明業績尚未見底。他補充稱,鑑於市場仍對下半年利潤將大幅回升的預期,通脹上升對利潤率的威脅仍"未得到充分認識"。

此外,摩根大通策略師們還表示,第一季度可能是今年股市的“高點”,他們預計在美聯儲發出降息信號之前,“股市風險回報不會出現根本性改善”。此外,Mislav Matejka領導的團隊稱,去年債券和股市走勢方向一致,這是不尋常的現象,今年衰退概率上升可能會再次扭轉這種關係。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.