對衝基金錯誤看多遭損失

在市場陷入動盪之際,對衝基金似乎選擇了一個最糟糕的時機來看好美元。

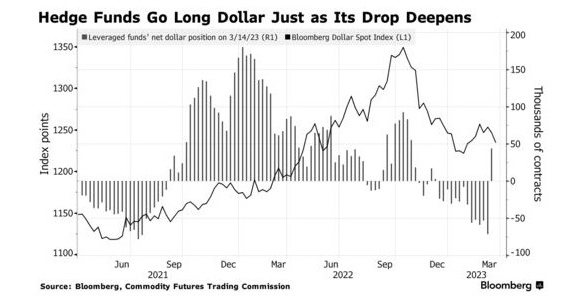

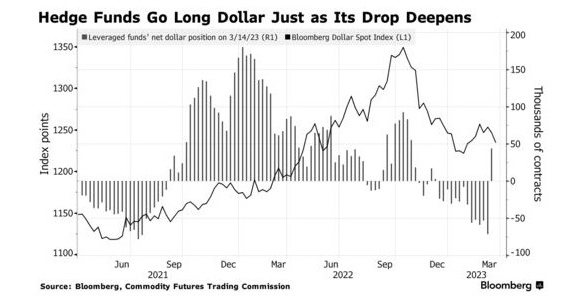

根據美國商品期貨交易委員會(CFTC)的數據,在連續13周做空美元後,投機者在截至3月14日當週轉向淨多頭頭寸。就在這一轉變發生的幾天前,美聯儲在可能需要進一步收緊政策力度的問題上緩和了措辭,美元因此下跌。

澳洲國民銀行駐悉尼高級外匯策略師Rodrigo Catril表示,“在美國地區銀行業陷入困境之際,美元避險買盤的缺乏讓許多人,包括一些對衝基金,陷入了困境。對美聯儲寬鬆政策的預期正壓倒其他因素”,並打壓美元前景。

預測美元走勢已成爲一項越來越棘手的任務,因爲全球銀行業的動盪使美聯儲遏制價格上漲壓力的努力變得更加複雜。近幾個交易日,美國國債收益率大幅波動,突顯出市場對美國加息前景的押注在快速變化。

衡量美元走勢的Bloomberg Dollar Spot Index週三暴跌0.9%。早前,儘管美聯儲暗示,在最近一次加息25個基後可能會採取進一步的緊縮措施,但其仍調整了有關經濟前景的措辭。該指數週四下跌0.4%,交易員加大了對今年降息的押注。

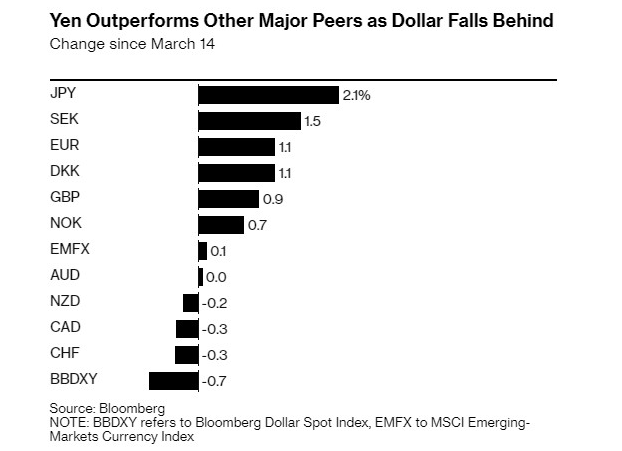

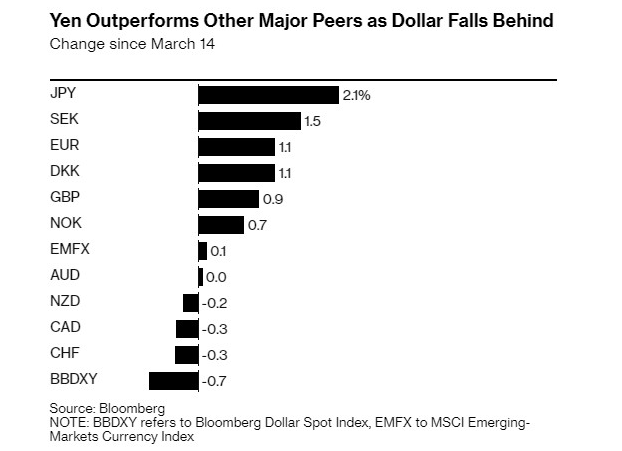

本週,美元兌10國集團貨幣的多數匯率均出現下跌,策略師預計這種疲軟將持續下去。T.Rowe Price認爲,隨着美聯儲與其一些主要同行之間的利差縮小,美元將下跌,而澳洲聯邦銀行的Carol Kong預測,隨着英國通脹率持續上升,英鎊將獲得支撐。

週四,韓元在亞市交易中領漲,兌美元匯率上漲逾2%。對風險敏感的新西蘭元和澳元上漲超0.6%。

“如果市場動盪和流動性問題繼續消退,美聯儲的‘鴿派加息’應該會爲未來幾天和幾周內美元的普遍走軟鋪路,”包括Mike Schumacher在內的富國銀行策略師在一份報告中寫道,“未來一段時間,來自相對實際利率和經濟表現的支持可能會減弱,尤其是在信貸緊縮的背景下。”

大勢已去

雖然有部分策略師依然認爲,美元有可能捲土重來,因爲美元仍然是壓力時期的首選避風港,這從2020年3月疫情擔憂最嚴重時人們爭相購買這一貨幣就能得到證明。上週三,由於圍繞瑞信的緊張情緒震動了市場,美元也上漲了0.9%。

Monex Europe策略師Simon Harvey在一份報告中寫道:“美國銀行股的再次暴跌,尤其是對旗艦股的影響,可能會使風險狀況保持在暫時的基礎上,這應該會繼續在戰術基礎上支撐美元。”

然而,越來越多的市場參與者表示,美元的強勢可能已經見頂。

荷蘭國際集團表示,儘管美聯儲週三加息,但與歐洲央行相比,美聯儲的言論明顯更加溫和,這將有助於歐元在年底前攀升5%以上,至1歐元兌1.15美元左右。

包括Francesco Pesole在內的荷蘭國際集團策略師在一份報告中寫道,美國“2023年下半年降息仍是我們的預測”。隨着圍繞銀行業危機的恐慌情緒緩解,風險情緒有所改善,美元已經“失去了底部”。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.