期權大單 | 科技股集體回調,SoFi期權成交量大漲!

一、期權異動

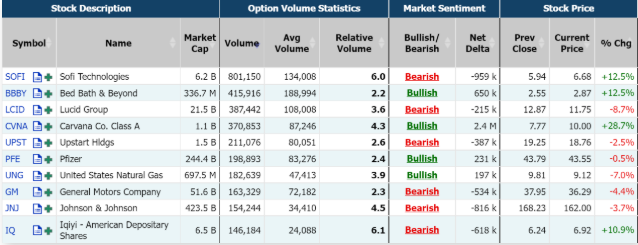

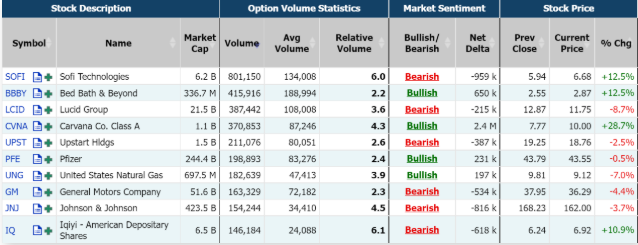

1月30日,美股SOFI、3B家居、Lucid等標的出現了期權成交量上的較大變化,分別爲日常成交量的6、2.2、3.6倍。

科技股隔夜集體回調,特斯拉、亞馬遜、蘋果、英偉達期權成交量環比前一交易日大幅下降,分別爲299.7萬張、72.97萬張、68.6萬張、50.38萬張;

金融科技公司SoFi Technologies大幅收漲逾12%,消息面,Q4業績、2023年利潤指引均超預期;期權成交80.33萬張,較90日平均成交量放大6倍,看漲期權佔比73.5%;其中2023年2月3日到期的7美元行使價看漲期權的成交量特別高,成交量爲14.23萬張;

美國大型家居零售商3B家居大幅收漲逾12%,最新消息是,公司發言人上週五證實,計劃關閉87家3B家居門店和5家buybuy Baby門店,並削減所有50家Harmon門店;期權成交41.59萬張,看漲期權佔比59.4%;其中2023年2月3日到期的3美元行使價看漲期權的成交量特別高,成交量爲3.57萬張;

電動汽車生產商Lucid Group收跌8.7%,大摩分析師預計Lucid將得到沙特支持,但短期內面臨行業阻力;期權成交38.74萬張,看漲期權佔比68.8%;其中2023年2月3日到期的13美元行使價看漲期權的成交量特別高,成交量爲3.72萬張;

美國二手車電商平臺Carvana暴漲近29%,期權成交37.09萬張,較90日平均成交量放大逾4倍,看漲期權佔比71.7%;值得注意的是,Carvana在1月份迄今爲止上漲了111%,有望成爲有史以來表現最好的一個月。

隔夜美股在今年首個“超級央行周”來臨之際集體走弱。截至週一收盤,標普500指數跌1.30%,報4017.77點;納斯達克指數跌1.96%,報11393.81點;道瓊斯指數跌0.77%,報33717.09點。

期權市場總成交量3762.05萬張合約,環比前一交易日(5331.74萬張合約)大幅下降,且低於90日平均成交量(4001.7萬張合約),其中看漲期權佔比54%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.