空頭稍安勿躁!

在全球股市上漲的背景下,美元出現了爲期三天的拋售,但分析師警告稱,在這個節骨眼上做空美元有點太早,風險也有點太大。

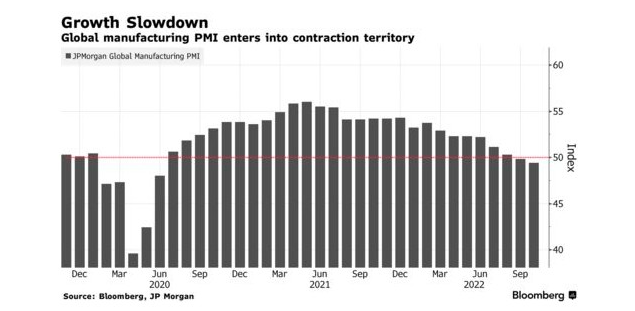

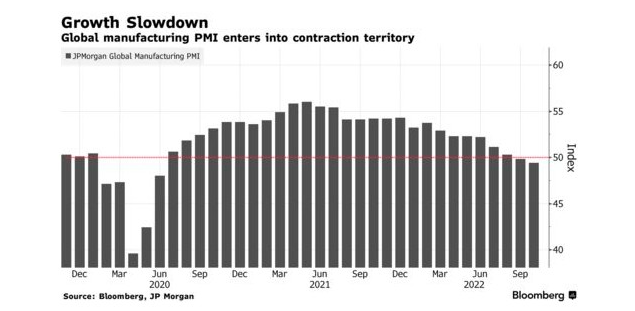

分析師們表示,如果說有什麼不同的話,那就是美聯儲堅持其鷹派立場並暗示終端利率水平將高於此前預期,再加上全球經濟增長放緩,這增加了其他國家央行被迫放慢加息步伐的可能性,而這反過來可能會導致本國貨幣走弱。

荷蘭合作銀行駐倫敦策略師簡·福利表示:“這是一個厄運循環,世界其他地區越疲弱,美元的前景就越好。儘管美元走得越強,其他國家的處境就越艱難,尤其是大宗商品進口國。”

隨着美元在今年早些時候飆升至幾十年來的最高水平,其他貨幣走弱,日元跌至30年低點,而英鎊一度貶值約五分之一。日本央行是少數幾個將利率維持在極低水平的央行之一,使其成爲今年10國集團成員國中表現最差的貨幣。

其他國家已經開始踩下緊縮的剎車。上個月,加拿大將隔夜拆借利率從75個基點上調至50個基點,令投資者感到意外。上週,英國央行駁斥了市場對未來加息幅度的預期,稱加息幅度過高,並警告稱,如果按照這條道路走下去,將引發爲期兩年的衰退。

倫敦TS Lombard的經濟學家達瑞奧•帕金斯表示,無論本國政策如何,澳大利亞、新西蘭、加拿大、英國、北歐國家和部分歐元區國家的貨幣都將面臨壓力。“我們已經到了美聯儲進一步加息將其他央行置於不可能不受影響的地步。”

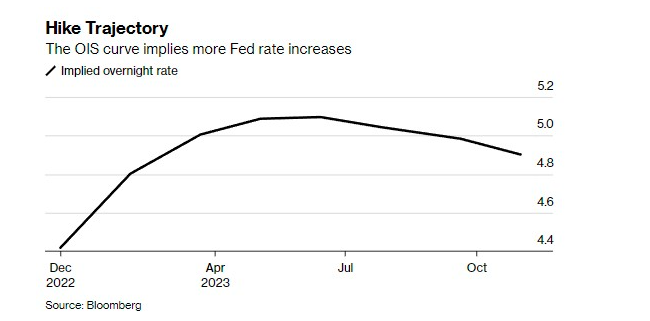

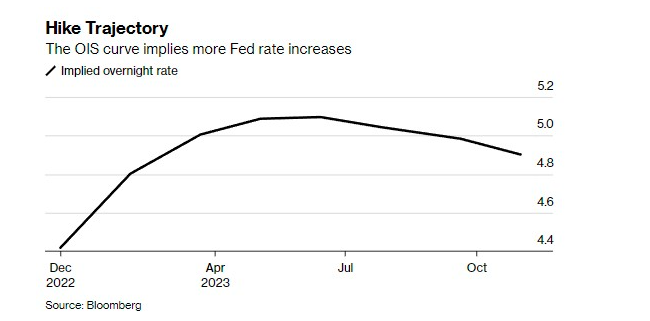

掉期交易員一直在爲美聯儲12月下次會議時至少加息50個基點做準備。美元匯率在上週五創下2020年以來的最大跌幅後,週二跌至七週低點。

拉丁美洲可能是一個例外。高盛基金經理們指出,巴西雷亞爾和墨西哥比索能夠很好地抵禦利率上升和對全球經濟衰退擔憂加劇的影響。花旗和大摩也認爲新興市場的情況正在好轉。

但這種觀點也不是共識。富國銀行策略師表示,儘管一些新興市場可能能夠抵禦美聯儲的強硬舉措,但終端利率上升應會給多數貨幣帶來貶值壓力。"由於美聯儲可能保持強硬立場,美元應會繼續跑贏市場,並對新興市場貨幣形成廣泛的下行壓力" 。

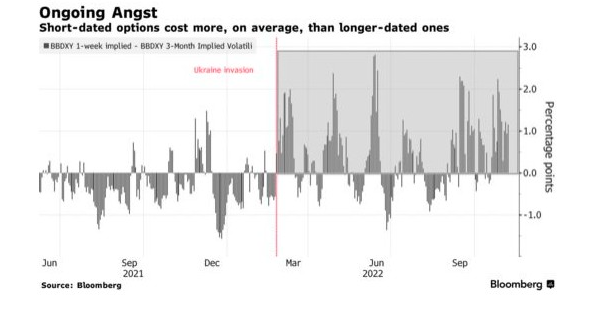

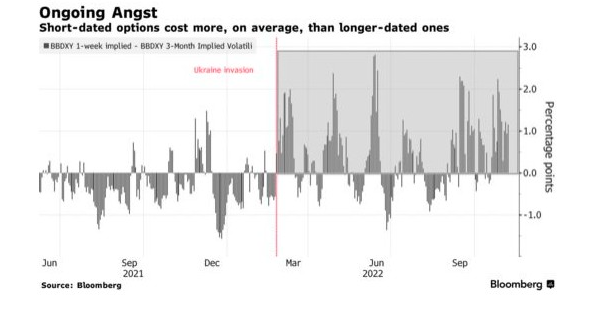

目前可以肯定的一點是,外匯交易員正在爲更大的波動做準備,併爲突然的衝擊做準備。

道明證券外匯策略全球主管馬克•麥考密克總結道:美元指數明年確實會下跌約10%,不過在轉向之前還會進一步攀升。現在就押注美元將會逆轉還爲時過早。美元將在明年第二季度左右見頂,而不是現在。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.