CICC: raise the target price of HSBC Holdings (00005.HK) to HK $62.32 to maintain a neutral rating CICC published a research report that Huihang earned US $12.772 billion in the second quarter, an annual increase of 1.6%. The net profit of common shareholders belonging to the parent company was US $5.486 billion, an annual increase of 61.5%, which was significantly higher than the bank's expectations. it is mainly due to the improvement of net interest income driven by the rise in interest rates, good control of operating expenses, better-than-expected provisions and one-off factors of deferred income tax assets. The bank believes that the currency control cost reduction plan still has US $1 billion to cut and US $2.4 billion to meet the target expenditure, and it is expected that meeting the target expenditure and selling the French retail business in the second half of the year will put some short-term pressure on the company's operating expenses, but in the medium to long term, the current discipline of currency control cost is significantly better than the historical level. In addition, CICC raised its profit forecasts for 2022 and 2023 by 43.4 per cent and 12.4 per cent, respectively, to $13.224 billion and $18.647 billion. Maintain its neutral rating and raise its target price by 8.9% to HK $62.32.

CICC: downgrade the target price of 00968.HK to HK $17.50 and outperform industry CICC said in a report that Xinyi Solar Energy's performance in the first half of the year was in line with expectations, and profitability was expected to improve in the second half of the year, maintaining an outperform industry rating, but cut the target price by 8% to HK $17.50 in view of the decline in the profitability of photovoltaic glass in the first half of the year. The report points out that with the release of silicon production capacity in the second half of the year, the price of silicon is at a high level, and it is believed that the demand for photovoltaic installation is expected to increase significantly in the second half of the year, which is good for photovoltaic glass demand. Taking into account the pressure on photovoltaic glass gross profit in the first half of the year, the bank lowered Xinyi Solar's profit forecast for this year and next by 26% and 8% respectively to 5.413 billion and 8.465 billion yuan respectively. It is believed that after the cost pressure falls, the profitability of photovoltaic glass will improve in the second half of the year.

Credit Suisse: cut the target price of Xiaomi Group (01810.HK) to HK $14.20 to maintain an outperform rating. Credit Suisse released a rating report that expects Xiaomi's revenue to fall 20% year-on-year to 70 billion yuan in the second quarter, below Bloomberg's forecast of 12%. Gross profit margin is 17%, in line with market expectations. Based on lower sales, higher expenses and less non-operating income, the bank expects adjusted net profit to fall 68 per cent year-on-year to 2.1 billion yuan, also lower than Bloomberg forecasts. The bank cut its smartphone delivery forecasts for this year, next year and 2024 from 178 million to 165 million, from 196 million to 182 million and from 206 million to 191 million respectively, reflecting the weaker-than-expected impact from overseas markets. The bank also lowered the group's adjusted earnings per share by 23%, 13% and 14% for this year, next year and 2024 to reflect lower sales or average selling prices and higher operating expenses, and lowered its target price from HK $15.50 to HK $14.2, maintaining its rating as outperforming the market.

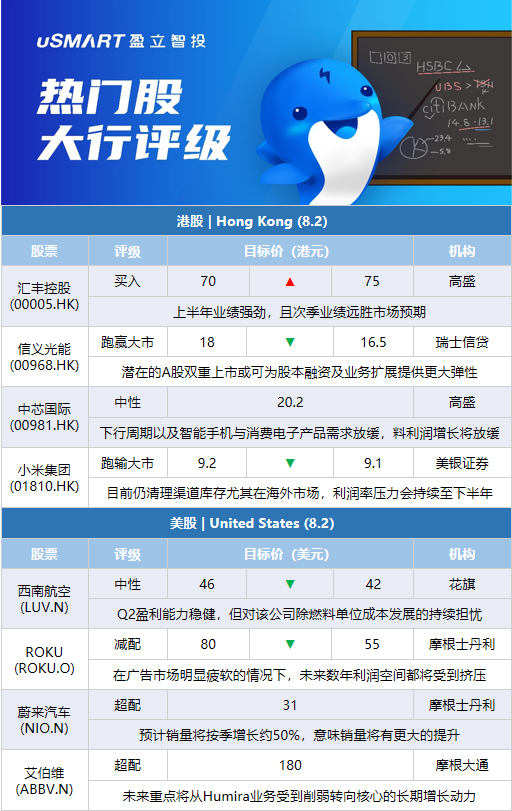

Credit Suisse: cut its target price of 00968.HK to HK $16.50 to outperform the market Credit Suisse reported that its net profit in the first half of this year was 1.9 billion yuan, a year-on-year drop of 38%, in line with the 33% to 43% drop announced earlier by PCO. The profit decline is mainly due to the return of solar glass gross profit margin from a high base of 51% in the same period last year to 27% in the first half of this year. The bank said that Xinyi Solar announced plans to list A-shares, while the group currently has net cash and believes that a potential dual listing of A-shares may provide more flexibility for equity financing and business expansion. Credit Suisse lowered the target price of Xinyi Solar from HK $18 to HK $16.5, maintained its rating to outperform the market, and lowered the group's earnings per share forecast for this year to 2024 by 3% to 19%, reflecting higher cost assumptions.

Goldman Sachs: raise the target price of HSBC Holdings (00005.HK) to HK $75 Buy Goldman Sachs released a report that HSBC Holdings achieved strong results in the first half and far exceeded the bank and market expectations in the second quarter. It raised its earnings per share forecast for each year from 2022 to 2025 by 11%, 6%, 3% and 4%, respectively, and its dividend forecast per share by 4%, 3%, 4% and 8%, respectively, and raised its target price from HK $70 to HK $75. Rating buy. Compared with the group's expected return on tangible equity (ROTE) of at least 12 per cent from 2023, Goldman Sachs expects ROTE to reach 12.1 per cent in 2023 and 12.8 per cent in 2024. Goldman Sachs estimates that the next buyback will take place in the fourth quarter of 2023, worth $500m.

Goldman Sachs: lowering the target price of 03868.HK to HK $5.90 to maintain certainty on the buying list Goldman Sachs reported that Sinotrans's poor performance in the first half of this year is expected to see net profit rise 0.4 per cent year-on-year to 623 million yuan, 26 per cent lower than the bank's forecast, mainly due to higher tax rates and a slowdown in project mergers and acquisitions. The bank said the group's electricity generation grew steadily, but the tax breaks for some projects expired, raising the effective tax rate. Affected by the epidemic, the group's new projects are expected to be delayed this year, but may accelerate next year. Goldman Sachs lowered the target price of Xinyi Energy shares from HK $6.3 to HK $5.9, maintained its buy rating, continued its convinced buy list, and lowered its profit forecasts for each year from this year to 2025, ranging from 2% to 12%, reflecting the latest effective tax rate.

Goldman Sachs: downgrade 00981.HK to neutral target price to HK $20.20 Goldman Sachs released a research report that although SMIC is still optimistic about SMIC's long-term growth prospects, profit growth is expected to slow in the near future as the industry enters a downward cycle and demand for smartphones and consumer electronics slows. Revenue is expected to grow by 40% and 29% year-on-year from the second to third quarters of this year. Growth slowed to 10 per cent in the fourth quarter, is expected to fall by 6 per cent in the first quarter of next year, and will not resume growth of 6 per cent until the second quarter of next year. Goldman Sachs forecasts that SMIC's operating profit will rise 30 per cent year-on-year this year and fall 5 per cent next year. In view of weak market demand, Goldman Sachs cut SMIC's revenue forecast for 2023-2028 by 1 per cent, gross profit forecast by 0.4-0.7 percentage point, operating profit and net profit forecast by 3-5 per cent for 2023-2028, and target price to HK $20.2. the rating was downgraded to neutral from buy.

Bank of America Securities: downgrade the target price of Xiaomi Group (01810.HK) to HK $9.1. BofA Securities released a report that lowered Xiaomi's adjusted net profit forecast for the second quarter by 28% to RMB 1.9 billion, meaning a quarterly decline of 33% and a year-on-year decline of 70%, reflecting a slowdown in smartphone shipments in the second quarter, pressure on average sales prices or profits during promotions, inventory clearance, and rising operating expenses for electric vehicles. The sales of the line materials group recorded 69.6 billion yuan, which means that it fell by 5% in the quarter and 21% in the year-on-year, while the actual operating profit margin may further drop to 2.5% in the quarter, meaning 1.2% in the quarter and 3.5% in the year-on-year. The bank said the group was still clearing channel inventory, especially in overseas markets, meaning that pressure on its average sales price or profit margin would continue into the second half of the year. The bank said it cut the group's adjusted earnings forecast by 7 to 15 per cent between 2022 and 2024 to reflect a weak outlook and cut its target price from HK $9.2 to HK $9.1, reiterating its rating as outperforming the market.

JPMorgan Chase: maintain the ABBV.N overweight rating target of $180 JPMorgan analyst Chris Schott sees Friday's decline in Aberway shares after the earnings report as an opportunity to increase their holdings. The analyst believes that over the next six to nine months, the company's focus will shift from a weakened Humira business to a core long-term growth driver. Schott said in a research report that Friday's weakness mainly reflects the lack of additional clarity of Humira's weakening curves in 2023 and 2024. Analysts point out that Aberdeen remains one of his favorite companies, rating it as super-matched, with a target price of $180.

Citigroup: cut the target price of Southwest Airlines (LUV.N) from $46 to $42 to maintain a neutral rating. Citibank analyst Stephen Trent lowered Southwest's target price from $46 to $42 and maintained a neutral rating on the stock. Trent said in the research report that the risk / return of Southwest Airlines stock "seems to be quite balanced", on the one hand, because of solid profitability in the second quarter and the balance sheet is "industry-leading", on the other hand, it also takes into account continuing concerns about the development of the company's unit cost except fuel, as well as management's comments that June is the peak month for revenue generation.

Guggenheim: cut BBY.N 's target price from $100 to $85 maintain buy rating Guggenheim analyst Steven Forbes lowered Best Buy's target price from $100 to $85 and maintained its buy rating on the stock. Forbes told investors that while he lowered his expectations after the company released a "disappointing" preliminary second-quarter earnings report, he thought the incremental risk for the company's updated outlook for 2022 was limited, in part because net sales in the second half of the year were now below 2019 levels. He still believes that the risk / return is in good shape, especially given the management's commitment to pay a 4.6 per cent dividend per year.

Summit Insights: downgraded on Semiconductor (ON.O) from buy to hold Summit Insights analyst KinNgai Chan downgraded on Semiconductor from buy to hold, but did not set a target price. The analyst now expects on Semiconductor's financial performance to slow in the near to medium term. The consumer and computing end markets have entered "adjustment mode", while "industry-wide double orders" in the automotive and industrial end markets will slow in the coming quarters, Chan said in a research report.

Atlantic Equities: downgrade ABBV.N from overweight to neutral Atlantic Equities analyst Steve Chesney downgraded Aberdeen from overweight to neutral, with a target price cut to $162from $178. The analyst said the "gradual weakness" of the company's core business hinted at a slowdown in the pace of raising expectations. With most of the new indications for the anti-inflammatory drug Skyrizi/Rinvoq approved, Chesney believes that the long-term growth prospects for Abowei's immune drugs are not optimistic.

Morgan Stanley: cut the target price for ROKU (ROKU.O) from $80 to $55 to maintain the downgrade rating Morgan Stanley analyst Benjamin Swinburne lowered the target price for Roku from $80 to $55 and maintained the downgrade rating. In a review of the company's results, analysts said that while he expected growth to slow, the pace of the slowdown, coupled with lower gross margins and looming bigger losses in EBIT profits, "posed more questions, including the relative value of Roku inventories to advertisers and how to determine the lower valuation of the share price." Swinburne added that Roku's decision to significantly increase operating expenses this year "proved to be anachronistic" because profit margins would be squeezed in the coming years when the advertising market was "significantly weak".

Barclays: raise the target price of TMO.N to $685 from $630. maintain an overrated rating. Barclays analyst Luke Sergott raised its target price to $685 from $630 and maintained its overweight rating on the stock. Sergott said in a research report that the company's results for the current quarter continued to "hit a home run, and we see room for further development." The analyst said that the company has "many aspects of business that can offset many macro disadvantages and create a very stable growth situation."

Morgan Stanley: NIO.N sales are expected to grow by 50% month-on-month, Morgan Stanley analyst Tim Hsiao pointed out that sales reached 10052 units in July, up 27% from a year earlier, down 22% from a month earlier, at the low end of his forecast of 10-11000. Analysts added that Xilai had been working closely with supply chain partners and expected to accelerate car production in the coming months. Hsiao expects sales to grow by about 50% on a quarterly basis to 3.6-38000 vehicles, which means a bigger increase in August / September sales, mainly driven by ET7 and ES7, as well as improved ES8, ES6 and EC6. There are also reports that another sub-brand may be launched by Weilai, but this is not an important event until it further clarifies its strategy. The analyst rated the stock as overweight, with a target price of $31.