After the epidemic is brought under control, more targeted policies may usher in a window for centralized landing and effectiveness, and steady growth will become a more important goal, judging that June is the window for centralized landing and effectiveness.

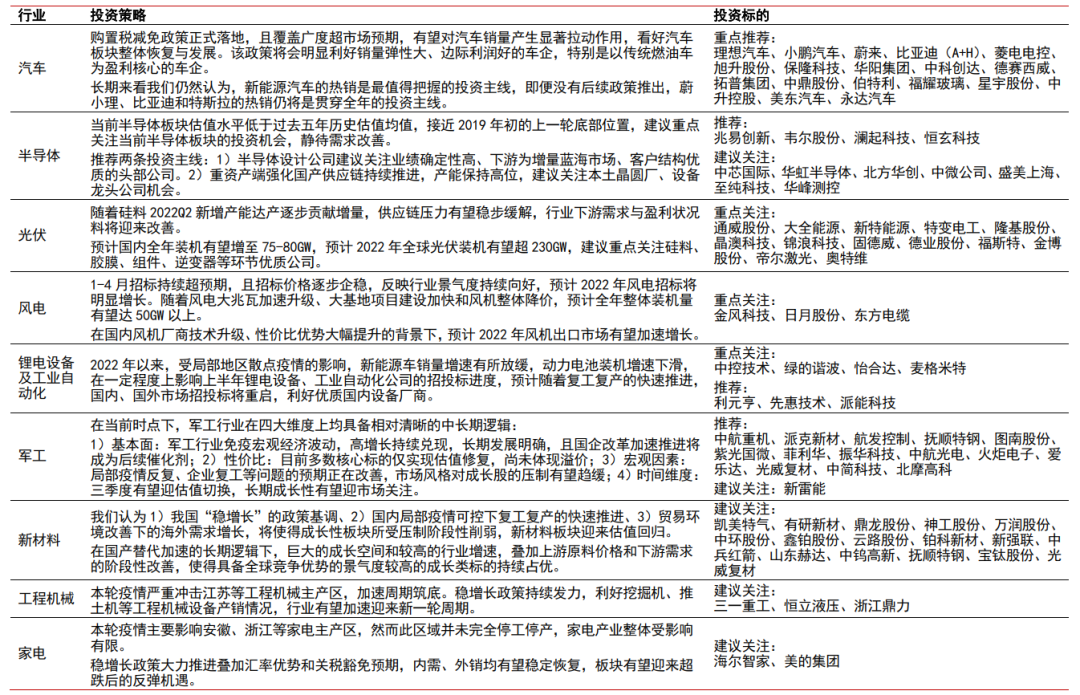

The core logic of the main line investment of "return to work and return to production" is the overfall rebound. First of all, the main line of the manufacturing industry related to the resumption of work and production, especially the growth and manufacturing, which is negatively affected by internal and external risk resonance, has a large cumulative decline before this round of rebound, and the characteristics of this round of oversell rebound are obvious. Second, the market has strengthened the confidence that Omicron can be effectively controlled, and the data of local outbreaks and resuming work and production can be verified in a more timely manner. Thirdly, the export manufacturing in the main line avoids the shortcomings of insufficient domestic demand and insufficient overseas supply at the same time, and short-term profits also benefit from the devaluation of the RMB. Related industries, it is recommended to focus onIntelligent cars and parts, semiconductors, photovoltaic wind power equipment, lithium equipment, industrial automation, construction machinery, home appliances and so on.

From the perspective of the whole year, infrastructure and real estate determine the "market" of the domestic economy, and are also the main direction of stable growth policies. The performance of these two main lines has been relatively weak since April, and their cumulative performance has been at the top since the beginning of the year, mainly due to repeated local outbreaks that have led to delays in the pace of construction and sales. Under the mutual verification of policy landing and data improvement, it is expected thatThe main line of modern infrastructure and real estate completion has the strongest certainty, and it has the value of bottom position allocation throughout the year.

As the resumption of work and production is imminent, it is judged that June is the window for policy concentration and effectiveness.

The resumption of work and production and the resumption of business in Shanghai continued to move forward, and on June 1, it entered the third stage of the process of returning to normal. As of May 28, the number of new local positive cases in Beijing has dropped for six consecutive days, and the epidemic has been fully brought under control. Changchun, which had an early large-scale epidemic, achieved "double clearance" for 14 consecutive days, announcing that all kinds of production and operation entities would resume business in an all-round way from May 28.

After the epidemic is brought under control, more targeted policies may usher in a window for centralized landing and effectiveness, and steady growth will become a more important goal, judging that June is the window for centralized landing and effectiveness.

According to the macro group of the CITIC Securities Research Department, the impact of the epidemic on the economy has basically receded in June, and the 33 measures in six areas deployed by the State Council have gradually shown their effect, leading to a recovery of economic growth of more than 5 per cent in that month, and GDP growth in the second quarter is expected to achieve about 1 per cent in a single quarter. In the third quarter, it is expected that the downward trend of real estate sales has gradually stabilized, real estate investment has gradually returned, a large amount of funds such as special debts have been put in place to promote infrastructure construction into a stage of rapid formation of physical volume, manufacturing profits have improved, the growth rate of manufacturing investment has continued to be high, the scissors gap between PPI and CPI has been more convergent, the squeeze problem of upstream price increases on the middle and lower reaches has been effectively alleviated, and the growth rates of loans and social finance have returned to normal. The policy of stabilizing growth has been fully implemented in various fields. it is worth noting that the base of GDP growth in the third quarter of last year was also relatively low (4.9%), and various factors supported the higher growth rate of GDP in the third quarter.

Quarterly dimension pays attention to the main line of "resumption of work and production".

The core logic of the main line investment of "return to work and return to production" is the overfall rebound. First of all, the main line of the manufacturing industry related to the resumption of work and production, especially the growth and manufacturing, which is negatively affected by internal and external risk resonance, has a large cumulative decline before this round of rebound, and the characteristics of this round of oversell rebound are obvious. Second, the market has strengthened the confidence that Omicron can be effectively controlled, and the data of local outbreaks and resuming work and production can be verified in a more timely manner. Thirdly, the export manufacturing in the main line avoids the shortcomings of insufficient domestic demand and insufficient overseas supply at the same time, and short-term profits also benefit from the devaluation of the RMB. Related industries, it is recommended to focus on intelligent cars and parts, semiconductors, photovoltaic wind power equipment, lithium equipment, industrial automation, construction machinery, home appliances and so on.

From the perspective of the whole year, infrastructure and real estate determine the "market" of the domestic economy, and they are also the main direction of stable growth policies, and the flexibility of the former and the repair of the latter are the basis for achieving the set economic goals this year. The performance of these two main lines has been relatively weak since April, and their cumulative performance has been at the top since the beginning of the year, mainly due to repeated local outbreaks that have led to delays in the pace of construction and sales. Under the mutual verification of policy landing and data improvement, the main line of modern infrastructure and real estate completion is expected to have the strongest certainty, with bottom position allocation value throughout the year.

Manufacturing industry: will usher in the repair market

This round of epidemic mainly affects seven provinces and cities of Jilin, Liaoning, Beijing, Shanghai, Jiangsu, Anhui and Zhejiang. The scope of impact is in China's main industrial areas, most of the traditional four major industrial areas are affected. It is analyzed that the main manufacturing industries and related products of the affected provinces and cities account for the national proportion, the most important mid-stream manufacturing industry is automobiles, and the products mainly include ships, machine tools, excavators, motorcycles and integrated circuits, etc. In addition to the above-mentioned industries and products, new energy-related products, some special equipment, 3C-related TMT equipment and so on are less damaged. Although ships, metal forming machine tools and other products are the main products in the epidemic area, but due to the particularity of production has not been affected, some equipment is growing against the trend, with a high degree of prosperity.

The stable growth policy takes the lead in supporting the real estate and infrastructure industry chain, and construction machinery and home appliances both belong to the manufacturing industry in the related industry chain. At present, the construction machinery acceleration cycle is at the bottom, and the impact on home appliances is limited. The market performance of photovoltaic, wind power and electrical equipment sectors has bottomed out since the end of April, and investor confidence has been gradually restored. we believe that with the acceleration of the process of resuming work and production, listed manufacturing companies will usher in a full-year dimensional repair market:

1) under the resonance of internal and external demand, the prosperity of the new energy track less affected by the epidemic remains high. It is suggested to focus on photovoltaic, wind power and lithium power equipment and industrial automation that are expected to continue to exceed expectations in 2022. It is suggested that attention should be paid to Tongwei shares, which benefit from the continuous tension in the supply and demand pattern in the photovoltaic field, Shuangliang energy saving, which has brought about performance growth due to the release of large-size silicon wafers, and Meichang shares, the leader of the Diamond Line, and so on. In the field of wind power, it is recommended to focus on Goldwind technology, which is expected to benefit from the upgrading of wind power technology, as well as new Qiang Lian and Jinlei shares, which are expected to benefit from global share substitution and long-term competitiveness. In the field of industrial automation, it is recommended to pay attention to central control technology with long-term investment value, green harmonics, Yiheda, Magmet, etc., in the field of power battery equipment, it is suggested to pay attention to Liyuan Heng, Xianhui technology, which is expected to benefit from the outbreak of home storage leading technology in the future, and so on. The military industry suggests that we should pay attention to the continuous realization of high growth and clear long-term development of Parker new materials, new Leineng and so on.

2) the combination of stable growth policies continues to hit the ground, driven by the depreciation of RMB and the expectation of tariff exemption, the marginal improvement of domestic demand and the strong export of construction machinery and household appliances are expected to usher in the opportunity to rebound after the overfall. It is recommended to pay attention to Hengli hydraulic, Sany heavy Industry, Zhejiang Dingli, Haier Zhijia, Midea and so on.

Table 1: investment opportunities in the manufacturing industry and related industrial chains

Real estate: the bottom of the fundamentals is already there, and the policy will make efforts to restore market confidence.

Various localities have stepped up efforts to return to work and production, the number of daily new infections across the country is also declining, and the transaction order in the real estate market in key cities is being restored. We believe that the bottom of the fundamentals has appeared in April-May, the year-on-year decline in second-hand sales has significantly narrowed, and prices in the second-hand housing market in core cities no longer continue to decline. With the further accumulation of policies, we believe that market confidence in some low-line cities is also expected to recover.

Optimistic about housing transaction service platform shell, optimistic about high-credit and efficient real estate development blue chip, including Poly Development, Jindi Group, Vanke A, Merchants Shekou, Midea Real Estate, Binjiang Group, Huafa shares, Greentown China, Longhu Group and China Resources Land.

Risk factors.

"Macroeconomic growth is declining; domestic economic recovery is not as fast as expected; and anti-epidemic relief policies are not as expected.

The epidemic situation at home and abroad is repeated; geopolitical conflicts intensify; and the contraction of quantitative easing by the Federal Reserve causes global systemic risks.

The installed growth of new energy is not as expected; the supporting capacity of the industrial chain is limited; the price of products has dropped sharply; the landing of favorable policies is not as expected; the investment in power grid is not as expected; the rhythm of UHV approval is not as expected; the industrial boom is not as expected; the growth rate of electricity consumption is slowing down; domestic substitution is not as expected.

The downstream demand of the semiconductor plate is lower than expected, and the competition in the industry intensifies.

The regional shutdown and logistics restrictions caused by repeated local outbreaks; the risk of lower-than-expected demand for new materials; the risk of raw material price fluctuations; the uncertainty of policy fluctuations; production expansion is not as expected; the risk of product price adjustment

The pace of military weapons and equipment construction is lower than expected; the policy support for civil-military integration is lower than expected; and the progress of the reform of state-owned enterprises in the military industry is slower than expected.

The sales volume of the automobile industry falls short of expectations; the lack of core aggravates.

"the risk of shrinking the balance sheet of some real estate development enterprises, as well as the risk of declining profitability.