這兩隻太陽能股值得關注

在可投資的可再生能源企業中,太陽能企業佔了相當大的比例。儘管太陽能產業的長期前景光明,但太陽能企業不穩定的財務表現是投資者的主要擔憂。

在過去的十年裏,美國有數百家太陽能企業破產,主要原因是在價格方面的激烈競爭。不過,也有一些企業實現了不俗的增長,例如Enphase Energy(ENPH.US)和SolarEdge Technologies(SEDG.US)。

Enphase Energy主要爲太陽能光伏行業設計、開發、製造和銷售微型逆變器系統。SolarEdge同樣致力於能源技術的開發,提供逆變器解決方案,其產品和服務包括光伏逆變器、功率優化器、光伏監控、軟件工具和電動汽車充電器。

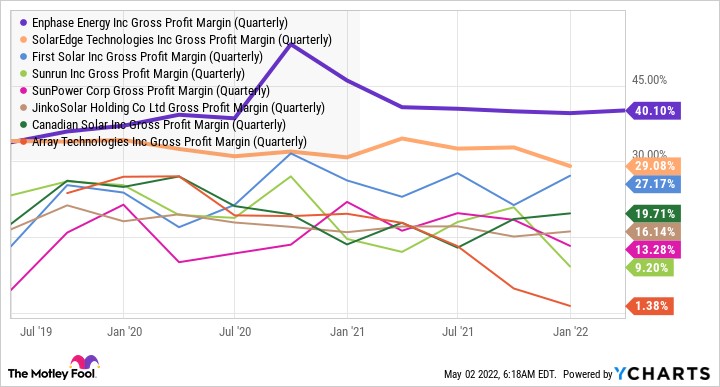

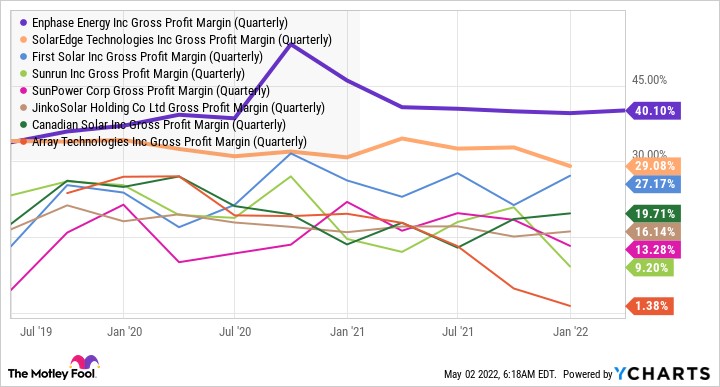

上圖顯示了八大太陽能股的季度毛利率。數據顯示,Enphase Energy和SolarEdge長期以來的盈利表現都好於其他太陽能企業。Enphase Energy在2022年第一季度的毛利率爲40.1%,在過去三年中,該公司的毛利率一直是同行中最高的。SolarEdge在2021年第四季度的毛利率則約爲29%。

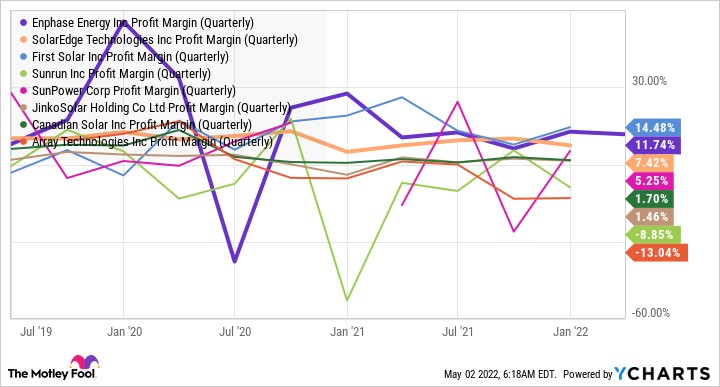

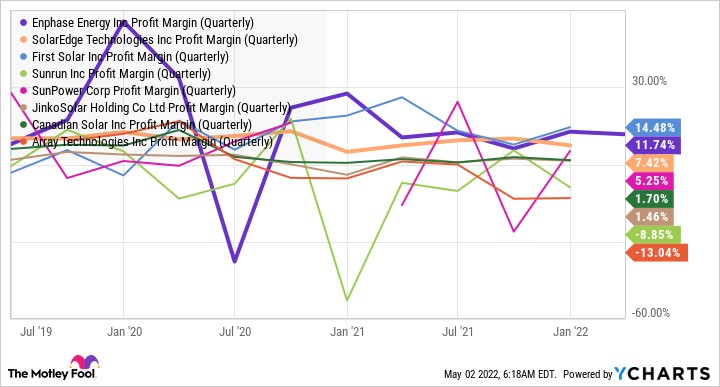

此外,這兩家公司都能將高毛利率轉化爲利潤。Enphase Energy在2022年第一季度的利潤率爲可觀的11.7%,SolarEdge在2021年第四季度的利潤率爲7.4%。相比之下,Array Technologies(ARRY.US)和Sunrun(RUN.US)的利潤率爲負值,而阿特斯太陽能(CSIQ.US)的利潤率則非常低。

Enphase Energy和SolarEdge的表現令人印象深刻。鑑於美國太陽能公司長期以來很難在定價方面與低成本的亞洲製造商競爭,這兩家公司在太陽能逆變器和蓄電池市場上展開了競爭。與此同時,它們還面臨着來自傳統逆變器製造商的競爭,包括SMA Solar Technology、ABB等。

Enphase Energy和SolarEdge與其他公司的最大區別在於其產品背後的技術。Enphase Energy的微型逆變器和SolarEdge的帶優化器的逆變器不僅比其他可用的逆變器具有顯著優勢,而且具有非常高的成本競爭力。高質量的產品有助於Enphase和SolarEdge的銷售增長,同時也獲得了良好的利潤。這兩家公司憑藉技術出衆的差異化產品在競爭中脫穎而出,並使其股票具有吸引力。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.