01 market

Last night, the three major indexes of US stocks reversed several times and closed down. By the close, the s & p was down 0.43%, the Nasdaq was down 0.95%, and the Dow was down 0.34%. The yield on ten-year US Treasuries rose 1.87 per cent to 1.99 per cent, breaking through 2 per cent at one point in intraday trading, a difference of 28 basis points from the yield on two-year Treasuries. The panic index, VIX, closed down 6.84 per cent. Oil prices continued to fall, with WTI crude falling 3.45% to close at $105.7 a barrel. Spot gold rose 0.21% to close at $1996.5 an ounce. The dollar index rose 0.58% to 98.53.

Before the trading, a new round of negotiations between Russia and Ukraine still failed. The Ukrainian foreign minister said that no progress had been made on the ceasefire issue, and stock index futures plunged by about 1%. In addition, the talks discussed the possibility of a meeting between the presidents of the two sides, and media sources said that Putin did not refuse to meet, but had to do some preparatory work. At 08:45 Beijing time, the European Central Bank issued an interest rate resolution, leaving the three key interest rates unchanged, in line with market expectations. 09:30, the United States released February CPI data, up 7.9 percent from a year earlier, setting a 40-year high, mainly due to energy prices. The three major stock indexes opened lower, while the s & p opened about 1% lower.

& nbsp;

As the conflict between Russia and Ukraine fuelled inflation, the European Central Bank turned the eagle and planned to withdraw its stimulus measures early, ending asset purchases in the third quarter of this year, a move that exceeded market expectations. Speaking after the meeting, ECB president Christine Lagarde cut 22-year GDP growth by 3.7 per cent, compared with a previous forecast of 4.2 per cent, while sharply raising 22-year inflation expectations to 5.1 per cent from 3.2 per cent and 23-year inflation expectations to 2.1 per cent from 1.8 per cent. However, she expects inflation to stabilize at around 2% in 24 years, in line with the long-term target. During the session, US Treasury Secretary Yellen said in a speech that salary increases have exceeded the price increases of low-end products, that most American consumers are in good financial condition, and that tackling inflation is the top priority of the Federal Reserve. The stock index fell further, and the S & P fell as much as 1.5%, but rebounded in late trading. The US State Department said that the United States has no intention of imposing any new or specific sanctions on Russia.

& nbsp;

The US Securities Regulatory Commission disclosed online that five companies entered the identified list because of the Foreign Company Accountability Act, namely, Yum China, Baiji China, Zaiding Pharmaceuticals, Hutchison Pharmaceuticals and ACMR,. Analysts say the incident is not sudden, and the problem of audit manuscripts between China and the United States has existed for a long time. The Foreign Company Accountability Act is a regional risk. As long as the company is in China and asks a Chinese auditor to do the audit work, the draft needs the approval of the Chinese Ministry of Finance and relevant departments. The United States believes that under the existing framework, the reports issued by Chinese audit firms do not meet the requirements.

& nbsp;

The CSRC responded to the inclusion of some Chinese stocks in the "pre-delisted list": firmly opposing the erroneous practice of some forces politicizing securities supervision. Recently, the China Securities Regulatory Commission and the Ministry of Finance have continued to engage in communication and dialogue with (PCAOB), the Accounting Supervisory Board of American Public companies, and made positive progress. It is believed that through joint efforts, the two sides will be able to make cooperation arrangements that meet the legal and regulatory requirements of the two countries as soon as possible, jointly protect the legitimate rights and interests of global investors, and promote the healthy and stable development of the two countries' markets.

& nbsp;

02 Industry & amp; stocks

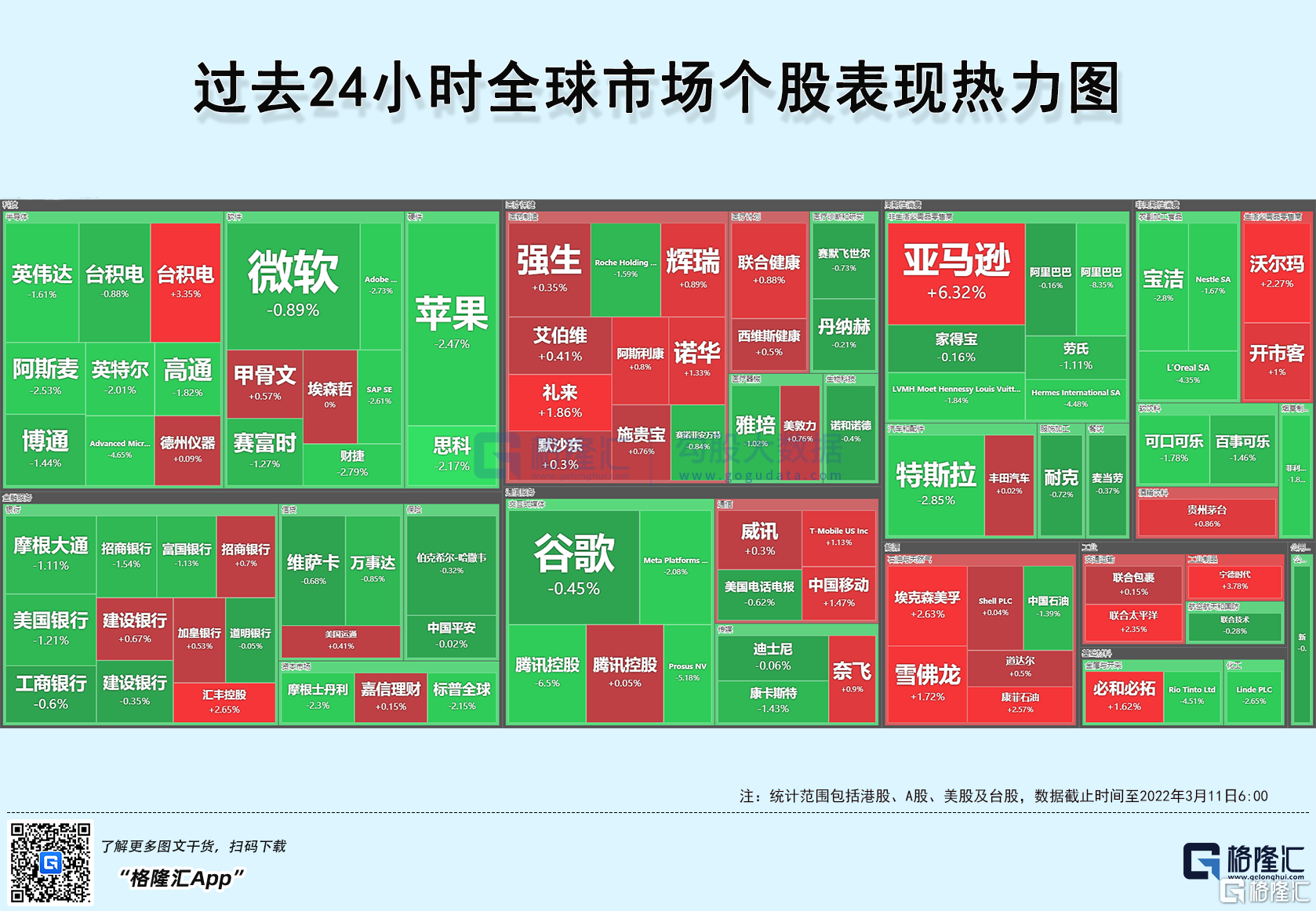

In terms of the industry sector, the S & P 11 sectors were mixed, while the energy sector closed up 3 per cent, while utilities, optional consumer, real estate REITS and materials sectors all closed up less than 1 per cent. The industrial and medical sectors closed flat, the financial sector fell 0.84%, and the high-tech sector fell the most, closing down 1.75%. The Philadelphia semiconductor index SOXX fell 2 per cent. The coking coal and heat media sectors rose sharply again, up 10% and 8.5% respectively, and up 74.7% and 64% respectively so far this year.

& nbsp;

In terms of the concept plate, the shale oil plate led the gains, closing up 3%. The cruise ship concept rose 2.2%, up nearly 12% for three consecutive trading days. The solar sector fell 2.55% after news that the EU's carbon-neutral policy might shift in the short term. Affected by the disclosure of the list of identified companies by the US Securities Regulatory Commission, Chinese stocks generally plummeted. Shell and iqiyi are down more than 20%, pinduoduo is down 17%, Futu Holdings, JD.com, Wanguo data and bilibili are down about 15%, and the rest of the hot spots are generally down about 10%.

& nbsp;

With the exception of Amazon, large technology stocks generally closed lower, but most V-shaped reversals in intraday trading. Amazon rose 5.41% after releasing good news about its 1:20 split and approving a $10 billion buyback. Apple fell 2.72%, and analysts expect iPhone SE to sell 28 million units this year. Tesla fell 2.41%. According to the Chinese official website, the prices of Model 3 high-performance version and Model Y long-term and high-performance version have increased by 10, 000 yuan. Analysts say the cost has risen due to supply chain problems, but the impact on demand is limited. Microsoft fell 1% to $19.7 billion to buy Nuance, the AI company behind Siri. Google fell 0.88% to buy cyber security company Mandiant for $5.4 billion. Meta fell 1.66%.

& nbsp;

03 abnormal movement

Chip giant AMD traded $10.7 billion, ranking sixth, closing down 4.13%. Intel confidently said that 3nm process surpassed AMD+ TSMC system and took the lead two years later. Buffett's position in Chevron ranked ninth with a turnover of $6 billion and closed up 2.74 per cent, up 47 per cent year-to-date, spurred by oil prices and shale oil concepts. Buffett trailed shares of western oil with a turnover of $4.7 billion, up 1.1% at the end of the year, doubling so far this year. The cyber security concept stock Crowd Strike ranked 15th with a turnover of US $4.6 billion, closing 12% higher than the same period last year, with revenue up 63% year-on-year, and the new ARR reached an all-time high.

& nbsp;

04 Forecast of Today

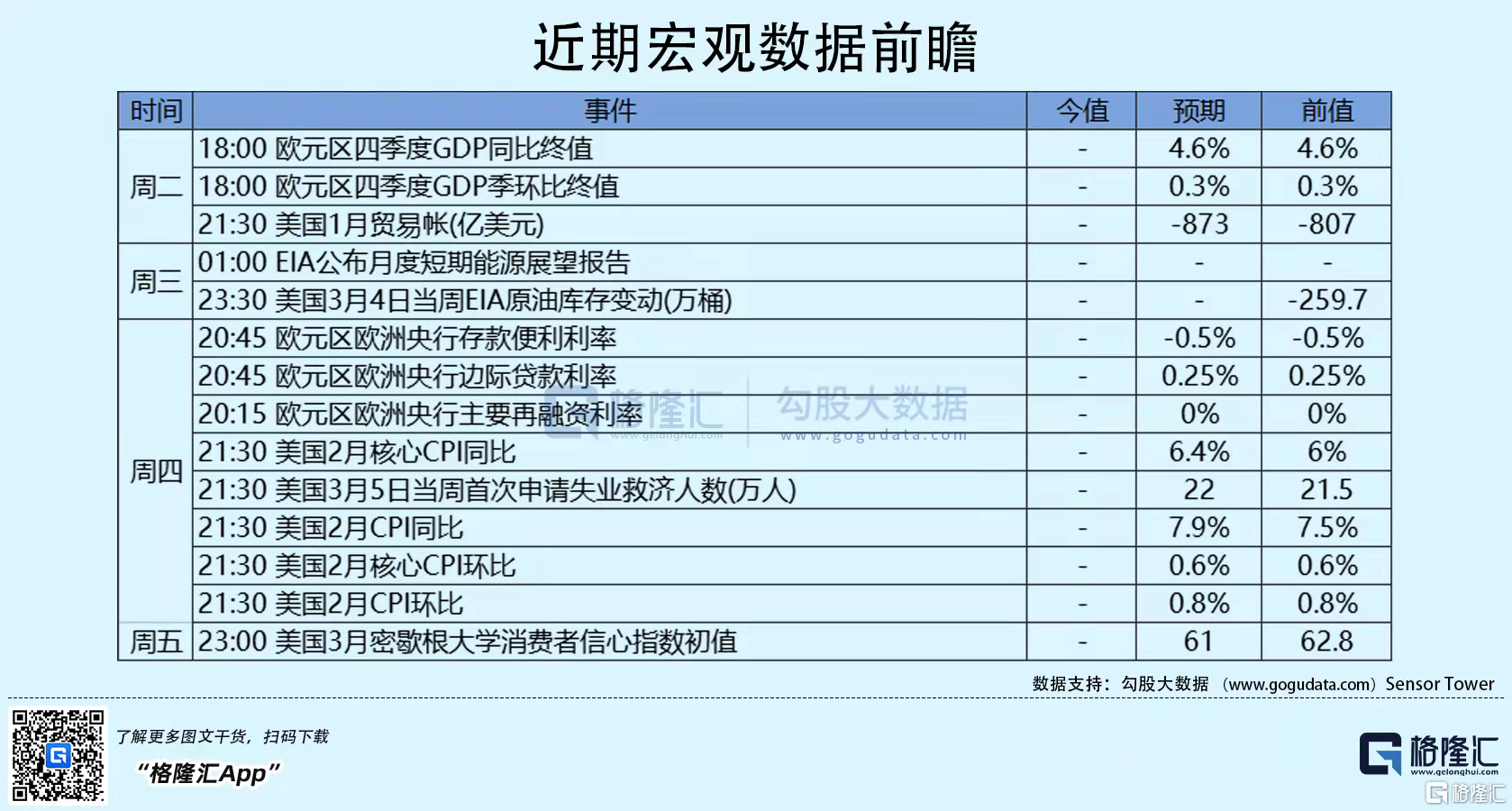

Today's key financial events:

15: 00 Beijing time, Germany released the final monthly rate of CPI in February.

21:30 Canada announces employment figures for February.

23:00 the United States released the preliminary consumer confidence index of the University of Michigan in March.