美股前瞻 | 三大股指期貨齊跌

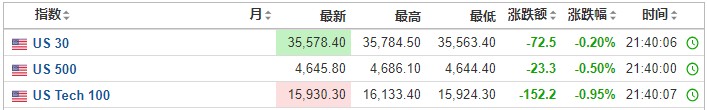

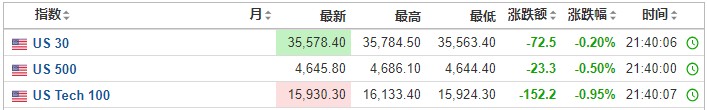

12月14日(週二)美股盤前,美股三大股指期貨齊跌。截至發稿,道指期貨跌0.20%,標普500指數期貨跌0.50%,納指期貨跌0.95%。

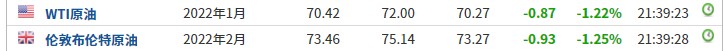

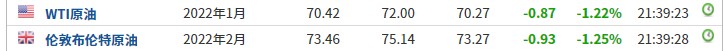

截至發稿,WTI原油跌1.22%,報70.42美元/桶。布倫特原油跌1.25%,報73.46美元/桶。

市場消息

美國11月PPI同比上漲9.6%,續創歷史最快增速,預測值9.2%,前值8.6%;美國11月PPI環比漲0.8%,爲7月來新高。

美國參議院將在週二就提高政府債務上限避免違約風險的立法進行投票,但尚未有消息說會提高多少,此前民主黨人表示,希望提高債務上限,以便將美國的舉債授權延長到2022年中期選舉之後。

紐約聯儲調查顯示消費者對未來一年通脹預期升至6%新高,但三年通脹預期自6月來首次下降,同時對未來收入增長的預期下降,暗示消費者預期短期物價漲幅將超過工資漲幅。

美聯儲12月會議前夕,大摩CEO呼籲:應儘快加息以應對未來經濟低迷。

與歐佩克預測截然不同!IEA:Omicron將影響石油需求復甦,下調明年全球石油日需求量。

美國太陽能產業增速將將比之前的預測低25%,成本上升、光伏大州擬減少補貼。

沙特警告:化石燃料投資減少,到2030年全球石油產量或暴跌30%。

馬斯克表示特斯拉將接受使用狗狗幣支付一些商品,此消息一出,狗狗幣(Dogecoin)應聲大漲33%。

新西蘭三季度GDP或好於央行預期,通脹壓力將持續至2022年

澳洲商業信心指數增速高點回落,降至12%,總體前景依然樂觀。

重要經濟數據:次日北京時間05:30,美國截至12月10日當週API原油庫存變動(萬桶)。

個股消息

科技股方面,蘋果(AAPL.US)盤前漲0.59%,Meta Platforms(FB.US)盤前跌0.62%,亞馬遜(AMZN.US)盤前跌0.66%,微軟(MSFT.US)盤前跌0.72%。

美國鋁業(AA.US)盤前漲4.14%,報49.73美元。消息面上,美國鋁業將取代百特國際(BAX.US)進入標普中盤股400指數,該納入將從12月20日開始生效。

SeaChange(SEAC.US)盤前跌18.02%。該股週一收漲近130%,傳其與TikTok競爭對手Triller達成合並協議。

WSB概念股盤前齊挫,AMC院線(AMC.US)跌超6%,遊戲驛站(GME.US)跌2.83%,Clover Health(CLOV.US)跌2.12%,Roblox(RBLX.US)跌1.90%,Robinhood(HOOD.US)跌0.66%。

熱門中概股方面,阿裏巴巴(BABA.US)盤前跌1.68%,嗶哩嗶哩(BILI.US)盤前跌1.69%,百度(BIDU.US)盤前跌1.54%,京東(JD.US)盤前跌1.84%,滴滴(DIDI.US)盤前跌0.93%,愛奇藝(IQ.US)盤前跌0.82%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.