9月27日(週一)美股盤前,美股三大股指期貨漲跌不一。截至發稿,道指期貨漲0.15%,標普500指數期貨跌0.14%,納指期貨跌0.63%。

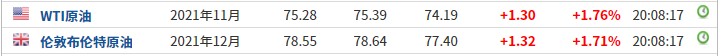

截至發稿,WTI原油漲1.76%,報75.28美元/桶。布倫特原油漲1.71%,報78.55美元/桶。

市場消息

美國衆議院議長佩洛西(Nancy Pelosi)承諾本週通過一項5500億美元的基礎設施法案,並暗示更大規模的支出和稅收措施的總金額將從3.5萬億美元下調。佩洛西表示,她將在週一推動參議院通過的法案,不過她建議在投票時間上留有餘地。

本週美聯儲官員將密集發表講話,北京時間 21:00 FOMC永久票委、紐約聯儲主席威廉姆斯將發表講話。

明日凌晨00:00 FOMC永久票委、紐約聯儲主席威廉姆斯就美國經濟前景發表講話,凌晨00:15 美聯儲理事佈雷納德發表講話。

美聯儲埃文斯:美國經濟“接近”在開始縮減債券規模方面取得實質性進展。

美聯儲FOMC 2022年票委梅斯特表示,支持在11月縮債,在2022年上半年結束;預計將在2022年底前滿足加息條件,但加息之後還需要維持一段時間的寬鬆政策。同爲明年FOMC票委的喬治表示縮債的標準已經達到。

美國信用卡債務的下降趨勢正在被扭轉,紐約聯儲的最新數據反映了這一點,其《家庭債務和信貸季度報告》指出,2021年第二季度,美國信用卡賬單增加了170億美元,達到7900億美元。這是連續四個季度下滑後的首次回升。

美國主要港口由於勞動力短缺,導致出現嚴重擁堵。最新的衛星圖像顯示,60多艘集裝箱船被困在洛杉磯和長灘港口外等待停靠。據媒體25日報道,等待停靠的船隻數量在過去兩個月裏增加了兩倍,達到62艘。負責跟蹤船舶交通的南加州海事交易所稱,這些貨船包括42艘靠近停泊區和20艘在漂移區域的集裝箱船。

日本央行行長黑田東彥週一表示,鑑於經濟增長前景仍面臨諸多挑戰,且通脹率上漲趨緩,日本央行將繼續專注於緩解新冠疫情對經濟增長的衝擊,央行準備在必要時進一步放寬貨幣政策。

德國社會民主黨總理候選人肖爾茨宣佈,他已獲得授權與綠黨和自由民主黨(自民黨)組成新的德國政府。

重要經濟數據:北京時間20:30 美國8月耐用品訂單月率初值(%)。

個股方面

科技股方面,蘋果(AAPL.US)盤前跌0.60%,Facebook(FB.US)盤前跌0.63%,亞馬遜(AMZN.US)盤前跌0.48%,微軟(MSFT.US)盤前跌0.05%。

油氣概念股盤前集體走強,美國能源(USEG.US)漲8.49%,阿帕奇石油(APA.US)漲2.56%,卡隆石油(CPE.US)漲3.35%,墨菲石油(MUR.US)漲近2.96%,西方石油(OXY.US)漲2.99%,馬拉鬆石油(MRO.US)漲2.49%,康菲石油(COP.US)漲1.74%。

部分新能源汽車股盤前上漲。圖森未來(TSP.US)漲3.42%,Lucid Group(LCID.US)漲1.53%,Workhorse(WKHS.US)漲0.13%。

Gores Guggenheim(GGPI.US)盤前漲近3%,報11.330美元。該公司已與吉利旗下電動汽車製造商極星(Polestar)達成協議合併上市,合併後公司的估值將達200億美元左右(包含債務)。

熱門中概股方面,阿裏巴巴(BABA.US)盤前跌0.19%,拼多多(PDD.US)盤前漲0.33%,京東(JD.US)盤前漲0.28%,嗶哩嗶哩(BILI.US)盤前跌0.92%,百度(BIDU.US)美股盤前跌0.29%。

普惠財富(PHCF.US)盤前漲55.51%,報3.81美元。

財報

盤後:普益財富(PUYI.US)