美光科技優秀基本面不容忽視!

受"內存芯片凜冬將至"相關言論影響,美光科技(MU.US)股價受創,多家大行紛紛下調該股評級。值得注意的是,在評估美光科技的未來潛力時,投資者還能從瞭解公司基本面中獲益。本文將通過分析美光科技的資產負債表,來觀察該公司是否有能力實現更大的增長。

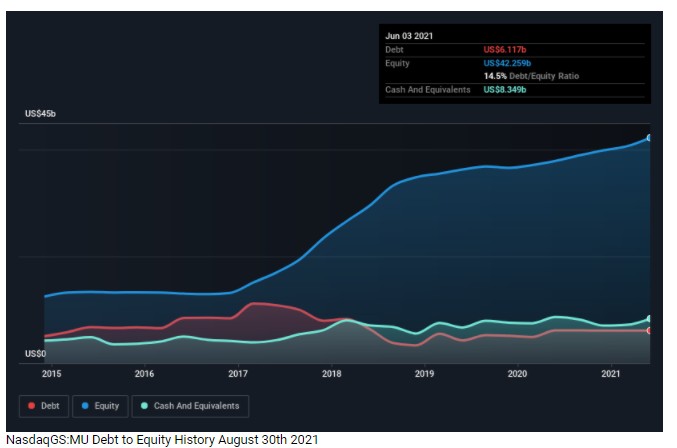

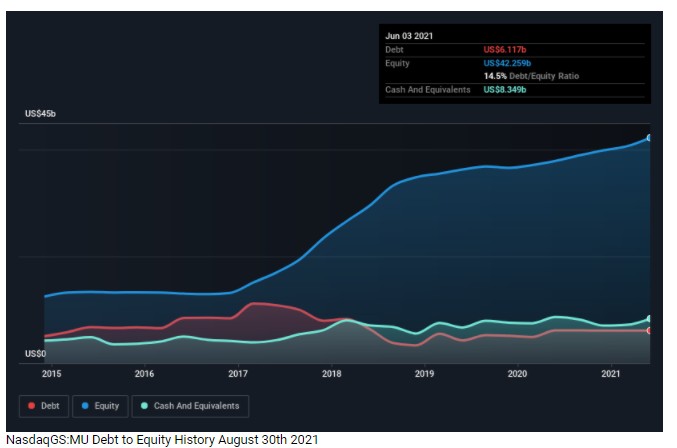

資產負債表中有許多組成部分值得關注,比如債務、股權和流動資產。這些數據可以體現這家公司是否有能力償還負債,以及是否具備剩餘資金用於投資其業務。

美光科技現狀

如圖所示,截至2021年6月,美光科技負債61.2億美元,與前一年持平。此外,該公司持有83.5億美元現金,因此其實際擁有22.3億美元淨現金。以上數據一定程度上體現了公司戰略的一致性,換句話說,美光科技近期並不需要更多的長期債戶,即便有需要,該公司也有足夠的現金以備不時之需。

該公司近期在融資方面也沒有十分急迫。據瞭解,美光科技在近兩次的融資分別是獲得匯豐銀行25億的循環授信(revolving credit)及申請了3500萬普通股的儲架註冊(shelf registration),以通過發行股票籌集資金。

因此,結合債務、現金及股權總體情況,由此可見美光科技是一家非常穩定且發展均衡的公司。

美光科技是否負債過重?

最新的資產負債表數據顯示,美光科技有54.6億美元的債務將在一年內到期,還有82.2億美元的債務將在一年後到期。與此相抵消的是,該公司擁有83.5億美元的現金和42.3億美元的應收賬款,這些應收賬款將在12個月內到期。因此,美光科技的負債總額比該公司持有的現金和短期應收款之和多出11億美元。

考慮到美光科技的公司規模,其流動資產似乎與總負債保持了良好的平衡,但其資產負債表還是值得投資者多加關注。儘管如此,由於美光科技擁有淨現金,所以公平地說,該公司並沒有過於沉重的債務負擔。

值得一提的是,美光科技在過去12個月裏的息稅前利潤增長了103%。如果該公司能保持這種增長,該公司未來幾年債務將更加可控。

總結

美光科技的22.3億美元淨現金爲後期發展擴大了公司的債務融資空間,該公司的市值也允許其通過股權融資。此外,該公司也不存在過重的負債風險,同時去年103%的EBIT同比增長也確保了該公司有進一步增長的潛力。因此,從基本面的角度看,美光科技總體來說具備良好的成長基礎,有望實現進一步增長。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.