8月27日(週五)美股盤前,美股三大股指期貨齊漲。截至發稿,道指期貨漲0.24%,標普500指數期貨漲0.30%,納指期貨漲0.34%。

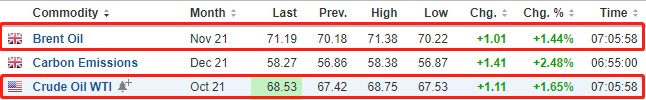

截至發稿,WTI原油漲1.65%,報68.53美元/桶。布倫特原油漲1.44%,報71.19美元/桶。

市場消息

北京時間今晚22:00美聯儲主席鮑威爾將在傑克遜霍爾全球央行年會中發表講話,鮑威爾的態度備受市場關注,屆時市場將關注其是否對縮減購債規模釋放時間方面的信號,及其對美國經濟前景的觀點。目前多位美聯儲鷹派成員已發聲,布拉德表示,通貨膨脹比預期的要高,美聯儲正在就縮減購債規模的計劃達成一致。但Jefferies預測美聯儲不會在當前疫情危機下承諾具體的縮減時間表。

傳美國總統拜登的顧問們正在考慮推薦鮑威爾連任美聯儲主席,並推薦美聯儲理事佈雷納德擔任副主席。但是拜登尚未參與美聯儲的人事決策,預計他將於今年秋季纔會做出最終決定。

達拉斯聯儲主席卡普蘭週四表示,美國經濟仍處於正軌,美聯儲是時候在9月份的會議上宣佈縮減購債計劃,並將在10月或之後不久開始縮減現階段的大規模債券購買計劃,同時他淡化了德爾塔變異毒株的影響。而橋水對衝基金的聯席首席投資官Greg Jensen預計,美聯儲減碼幅度可能比市場預期更大,利率升速也會更快。

美聯儲博斯蒂克表示,重要的是美聯儲要開始討論在應用新的平均通脹框架時將使用什麼時間範圍,並在實踐中如何應用時保持“透明”。如果美國就業增長保持強勁,從10月份開始縮減債券購買計劃是“合理的”。 高盛預測美聯儲11月宣佈縮減QE的機率從25%升至45%(之前大部分人認爲會發生在9月)——今年11月正式宣佈,到2022年9月完成。

比特幣今日下跌幅度一度超5%,目前價格徘徊在4.7萬美元左右。專業人士指出,比特幣的漲勢正在消退,比特幣目前面臨5萬美元至5.1萬美元的阻力區間,而4.67萬美元是關鍵的支撐價位。截至發稿,該幣報47319美元/枚。

重要經濟數據:北京時間20:30,美國7月PCE物價指數年率(%)、美國7月核心PCE物價指數年率(%)、美國7月批發庫存月率初值(%)、美國7月個人支出月率(%);北京時間22:00,美國8月密歇根大學消費者信心指數終值、2021年傑克遜霍爾全球央行年會會議開始,美聯儲主席鮑威爾將發表講話;北京時間明日00:00,IMF首席經濟學家戈皮納特參與主題爲“財政政策與貨幣政策的相互作用”的小組討論。

個股消息

科技股方面,蘋果(AAPL.US)盤前漲0.49%,Facebook(FB.US)盤前漲0.35%,亞馬遜(AMZN.US)盤前漲0.16%,微軟(MSFT.US)盤前漲0.34%,谷歌(GOOG.US)盤前漲0.33%。

區塊鏈概念股盤前走強,比特礦業(BTCM.US)漲2.1%,嘉楠科技(CAN.US)漲2.81%,MicroStrategy(MSTR.US)漲1.19%,Marathon Digital(MARA.US)漲2.51%,Coinbase(COIN.US)漲0.95%,第九城市(NCTY.US)漲2.44%。

惠普(HPQ.US)盤前跌3.37%,Q3營收不及預期。

Peloton(PTON.US)盤前跌9.28%,2022財年展望不及預期。

戴爾(DELL.US)盤前無漲跌,Q2總淨營收同比增長15%,調整後EBITDA同比增長7%。

熱門中概股方面,阿裏巴巴(BABA.US)盤前跌2.82%,嗶哩嗶哩(BILI.US)盤前跌1.36%,百度(BIDU.US)盤前漲0.01%,滴滴(DIDI.US)盤前漲0.95%,京東(JD.US)盤前漲0.99%。

1藥網(YI.US)盤前漲8.57%,公司發佈Q2財報,營收達30.24億,連續12季度實現營收增長。

BOSS直聘(BZ.US)盤前無漲跌,Q2營收11.68億元,經調整利潤2.46億元。