透視港股通丨騰訊再獲淨買入超41億港元

北水總結

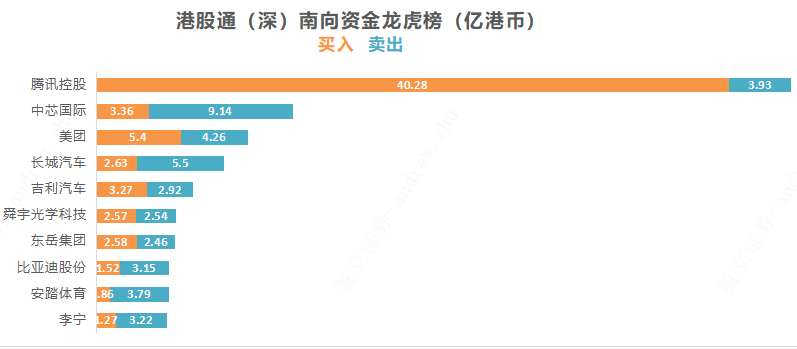

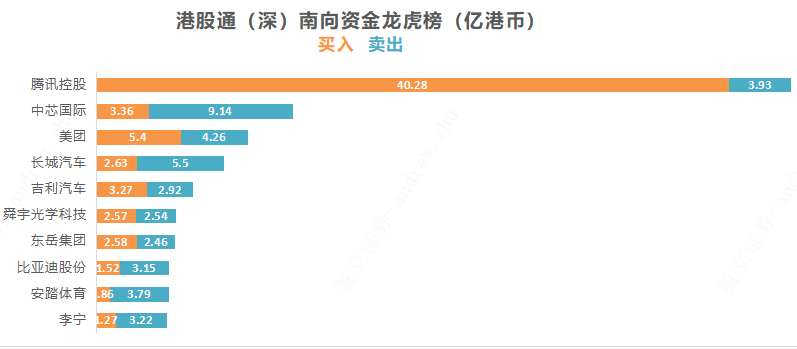

8月9日港股市場,北水成交淨買入34.48億,其中港股通(滬)成交億淨買入4.44港元,港股通(深)成交淨買入30.04億港元。

北水淨買入最多的個股是騰訊(00700)、美團-W(03690)、吉利汽車(00175)。北水淨賣出最多的個股是中芯國際(00981)、港交所(00388)、李寧(02333)。

數據來源:盈立智投APP

十大成交活躍股

數據來源:盈立智投APP

個股點評

騰訊(00700)獲淨買入41.39億港元。消息面上,高盛近日發表報告表示,騰訊基本業務穩固,公司正加大對內地及全球網遊業務投資、廣告、小程序及視頻業務變現化正轉強,並認爲其股價調整已屬過度。重申對騰訊“買入”投資評級,決定將騰訊納入該行的“確信買入”名單,但考慮到所面臨的監管不明朗風險因素,將其目標價由906港元降至759港元。此外,搜狗在財報中表示,私有化交易現在預期將在今年下半年完成,搜狗將成爲騰訊的間接全資子公司。

吉利汽車(00175)獲淨買入2.14億港元。消息面上,美銀證券發佈研究報告,將吉利汽車評級升至“買入”,因旗下星越L、星瑞和極氪001的銷量增長,令下半年的車型週期更強,及因反映Zeekr的價值而改變的估值方法,目標價上調至36港元。東吳證券則表示,吉利汽車汽車在海內外市場同步發力,未來三年銷量有望實現持續提升,單車盈利能力改善,產品和業績進入改善週期。該行維持吉利汽車“買入”評級。

東嶽集團(00189)獲淨買入1151萬港元。消息面上,中信建投化工團隊發佈報告稱,近期PVDF板塊標的股價有所回調,主要源於關注函中的回覆,導致市場擔心光伏、塗料替代品出現,以及後續產能的投放對市場的影響。報告稱,在PVDF下遊幾大應用中,光伏和塗料領域一直存在替代產品:鋰電正極粘結劑性能要求較高,此領域PVDF單品爲王,未來仍將保持剛性需求,其他替代材料尚處雛形階段。報告還稱,PVDF現有規劃產能投產時間是在2022年中以後,而鋰電池級別下遊客戶測試認證時間相對較長,2022年底之前鋰電池級PVDF供需仍然處於緊平衡狀態。

港交所(00388)將於本月11日發佈業績,今日遭淨賣出3.94億港元。消息面上,野村發佈研究報告稱,維持香港交易所“中性”評級,降2021年盈利預期6.6%,並大致維持2022-23年盈利,目標價升0.2%至514.3港元報告中稱,降港交所2021年度日均交易量預測9.3%至1800億元,以反映第二季交易量較預期弱。目前估算上半年盈利增長39.5%至36.5億元,相信市場結構和上市機制改善,提升2022-23年日均交易預測分別1.9%及5%。

中芯國際(00981)遭淨賣出5.66億港元。消息面上,大和發佈研究報告稱,中芯國際次季業績表現向好,指引超出預期,但市場對其庫存、資本開支等仍維持關注,重申“沽售”評級。該行未來會關注龐大資本開支對中芯結構盈利能力的影響,以及其他因素對業務營運及擴張的影響,目標價由19港元升至22港元。

此外,美團-W(03690)、舜宇光學(02382)、中航科工(02357)分別獲淨買入6.31億、302萬、198萬港元。而長城汽車(02333)、李寧(02331)分別遭淨賣出9308萬、1.94億港元。

當日港股通淨買入和淨賣出排行榜

(港股通持股比例排行,交易所數據T+2日結算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.