全球风险偏好提升 原油、贵金属整体向好

uSMART盈立智投 07-09 17:31

全球市场周回顾

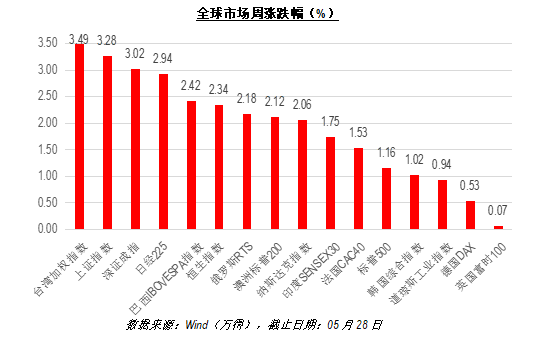

上周,全球投资者风险偏好提升,大中华区市场涨势喜人。

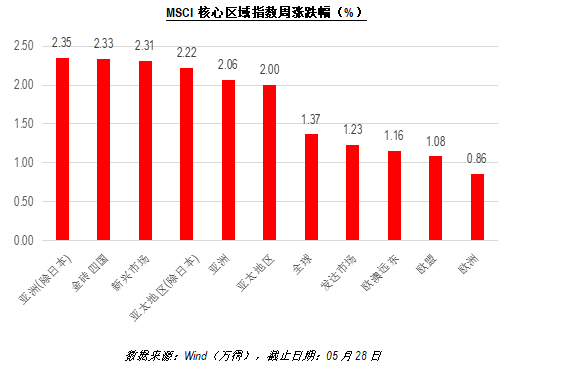

全球核心区域指数亦普涨,其中以亚洲(除日本)领涨。

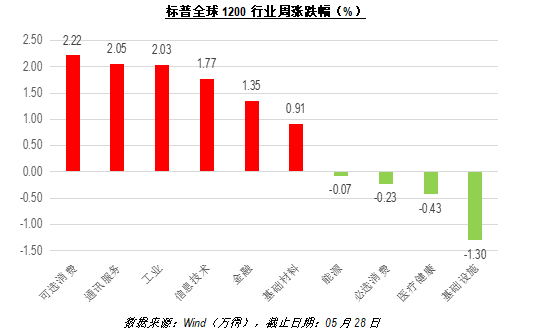

全球各行业整体向好。其中,可选消费、通讯服务、工业板块领涨。

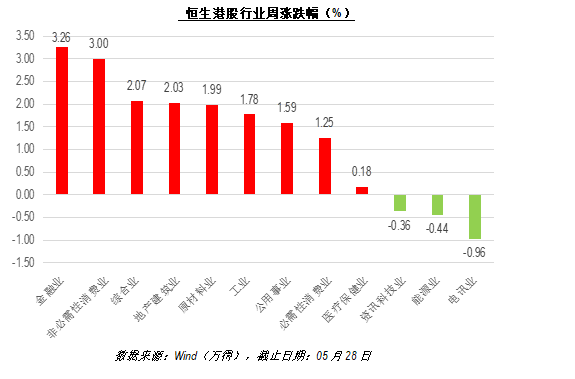

上周,港股板块亦整体向好。金融、可选消费板块领涨。

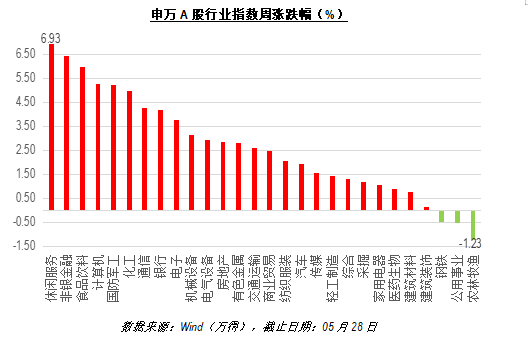

上周,申万一级行业亦普涨。其中,休闲服务、非银金融和食品饮料板块涨幅最为靠前。

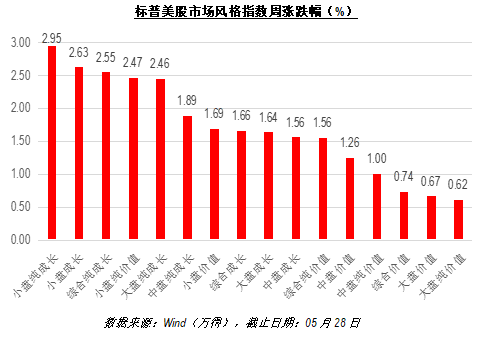

上周,小盘风格领涨美股。

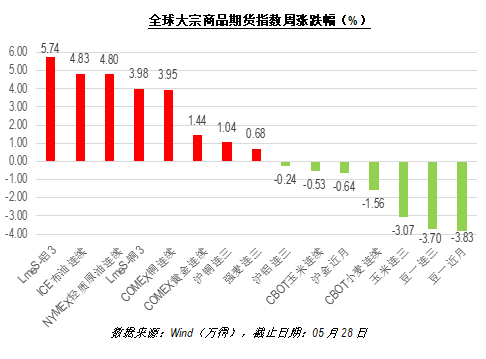

全球大宗商品期货现分化行情。其中,原油、贵金属表现整体较好。

全球基金投资者动态

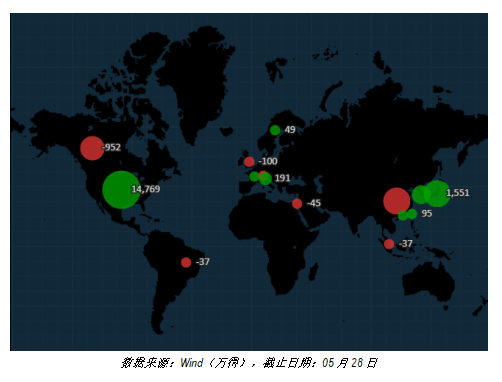

上周,美国、日本、及欧元区获最大净流入。除美国市场外,中国市场虽为最大资金流入国,但受累于较多的资金流出,整体呈净流出趋势。

大类资产方面,大盘、全市场股票ETF仍最受投资者青睐。固定收益ETF方面,投资者信用偏好整体下沉。信用等级偏低信用债、高收益债ETF获得最大净流入。策略层面,平衡、价值股票ETF,公司债和混合债券ETF最受投资者青睐。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.