January 19, 2026 — Shares of Qutian Group (00917.HK) surged sharply in early trading on the Hong Kong market. The stock once climbed to a high of HK$31.32 during the session and was last quoted at HK$29.64, representing a gain of 17.53%. Trading volume increased notably, making the company one of the more closely watched stocks in the market.

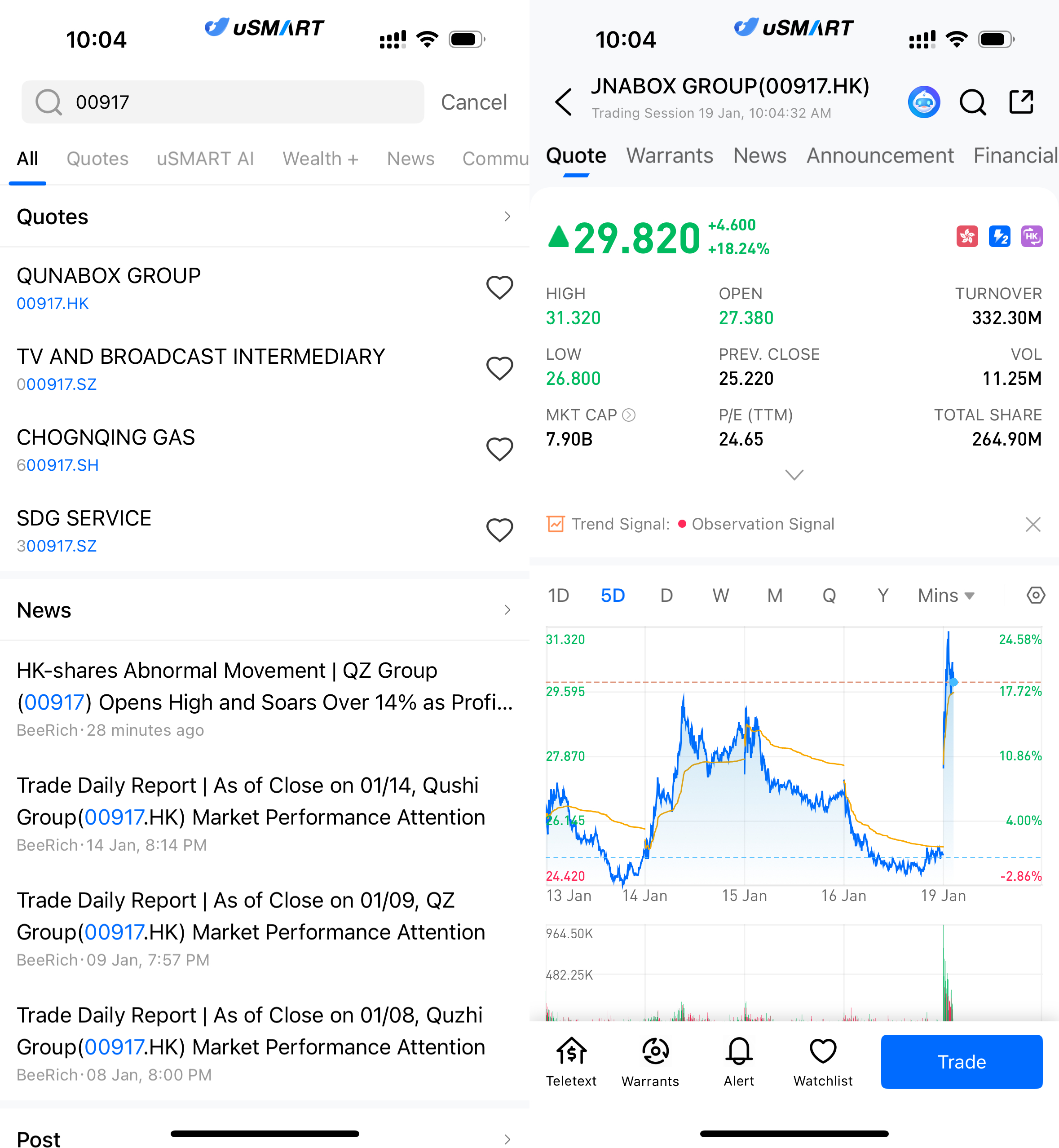

(Image Source: uSMART HK app)

Profit Alert Released, Full-Year Results Swing Back to Profitability

Qutian Group recently issued a profit alert, forecasting a turnaround to profitability for the year ended December 31, 2025. The company expects to record a full-year net profit ranging from RMB 270 million to RMB 330 million. This marks a significant improvement compared with a net loss of approximately RMB 1.663 billion recorded in 2024, and is seen as a key catalyst behind the stock’s strong performance.

AI and Intelligent Interaction Investments Begin to Show Scale Benefits

According to the announcement, the improvement in results was primarily driven by the group’s continued long-term investment in research and development, particularly in AI applications and intelligent interaction technologies. As these technologies mature and are deployed at scale, the company’s AI-powered interactive marketing capabilities at the terminal level have continued to strengthen, leading to simultaneous improvements in delivery efficiency and overall operating efficiency.

Technology Translates Into Revenue Growth, Operating Quality Improves

With its technological capabilities increasingly solidified, Qutian Group has expanded the application of its solutions across a broader range of real-world business scenarios, supporting steady growth in business scale and providing backing for revenue and profit expansion. In addition, the company did not record any fair value losses during the year, further improving its financial performance and resulting in a healthier earnings structure.

Turnaround Boosts Market Sentiment, Sustainability of Growth in Focus

Against a backdrop of improving risk appetite in the Hong Kong equity market, companies with clearly defined earnings inflection points tend to attract greater capital attention. Qutian Group’s profit alert has effectively lifted market sentiment by signaling meaningful operational improvement. Going forward, the market will continue to monitor the commercialization progress of the company’s AI technologies and the sustainability of its profitability growth.

How to Buy TSMC via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (TSM.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)