市場被捶老實了,反彈就來了?短期有什麼好選擇?

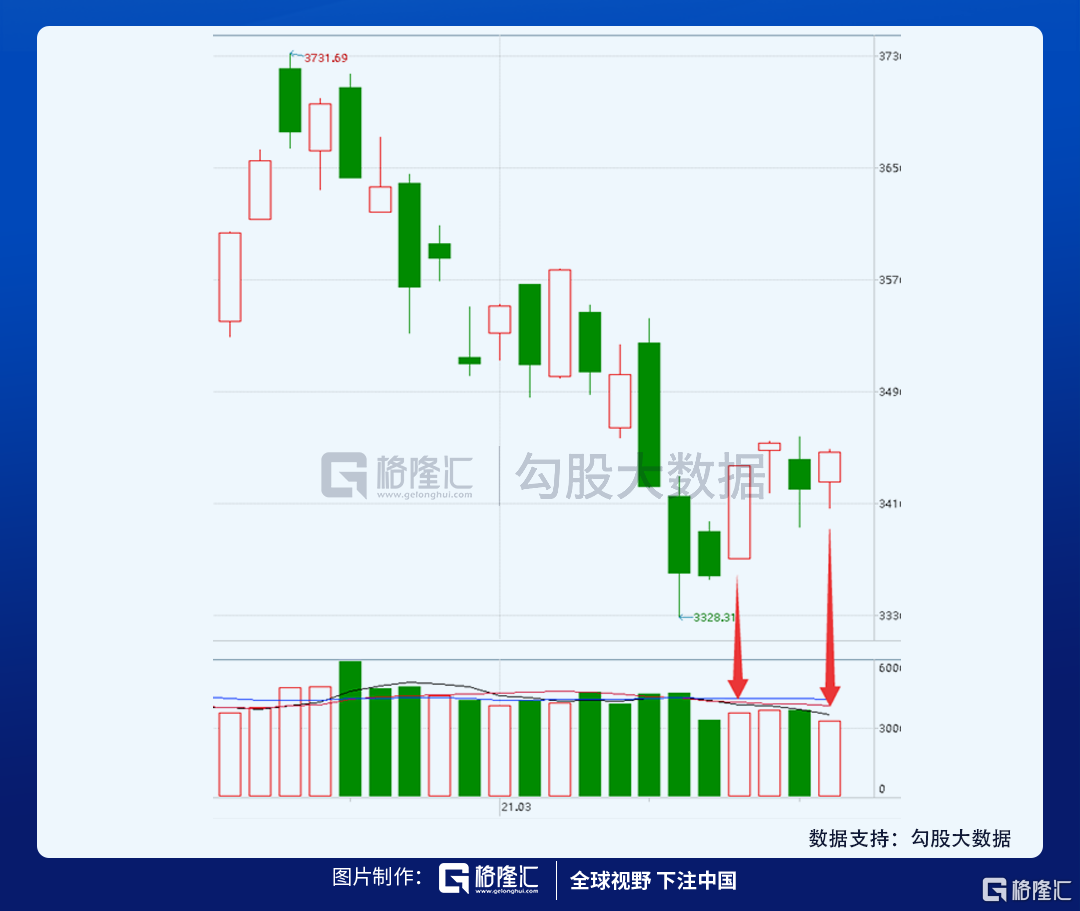

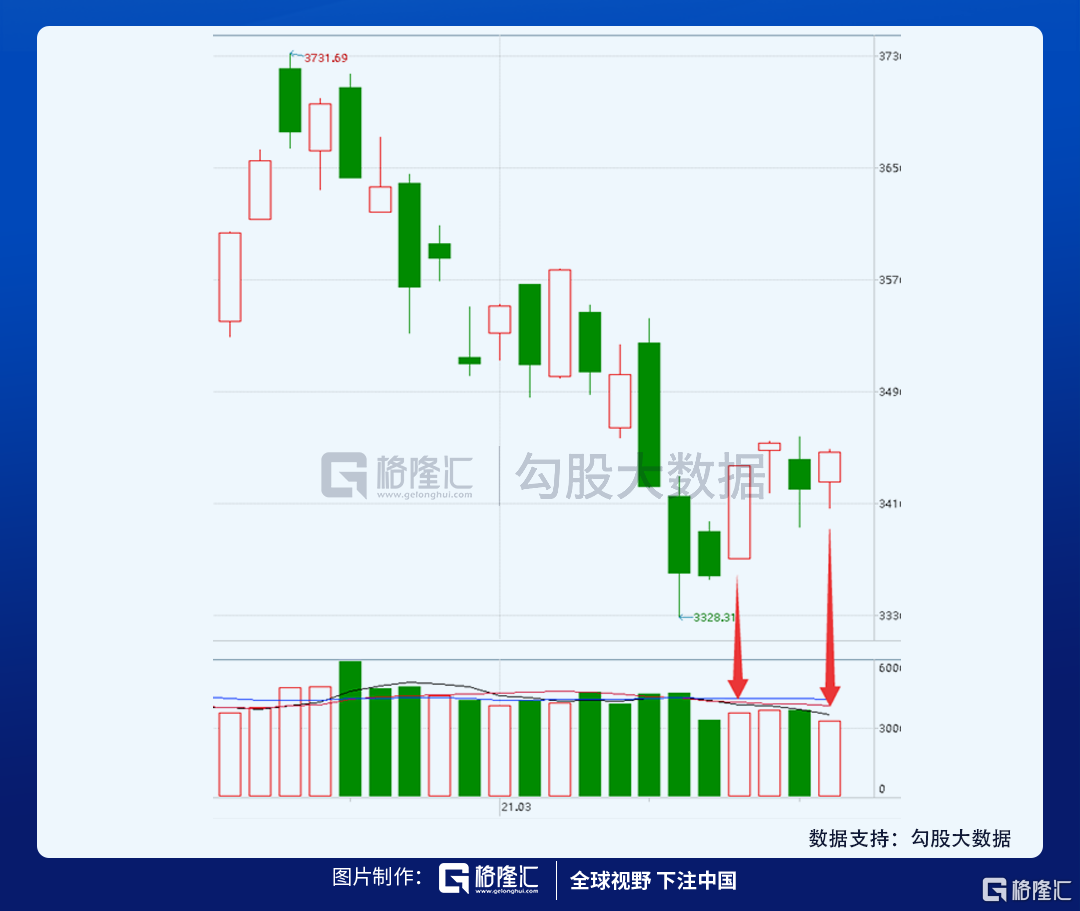

最近大家的心情肯定是起起伏伏,經歷了上週的反彈,又經歷了週一的大跌,今天又是反彈。只能説最近市場波動非常劇烈。上週説過,在3450這個位置會磨一會,今天看也的確是這樣,但好處是,今天反彈的量比之前要小——這是好事,説明大家上週反彈被錘之後,已經不願意抄底了。

要知道,在股市我們永遠無法改變的一點就是市場整體永遠處於在頂部貪婪,在底部恐懼的狀態。所以指數越高量越多越危險,底部越低量越少越安全。往後,3450這個位置還是會磨,但是越磨量越小,越安全,如果短期快速上漲,之前的套牢盤解套壓力也是很大的。

看圖説話到此結束,下面還是和大家討論下最近的機會,其實是狠多的。最近這個半個月,是業績的高發期,所以主線應該就是多關注公司業績。

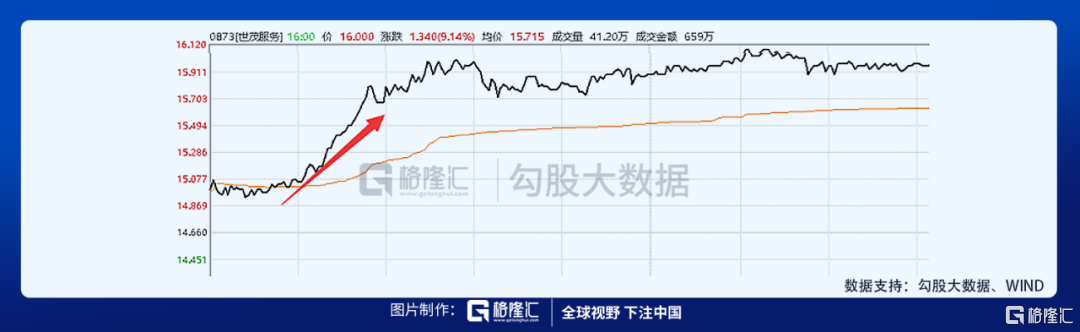

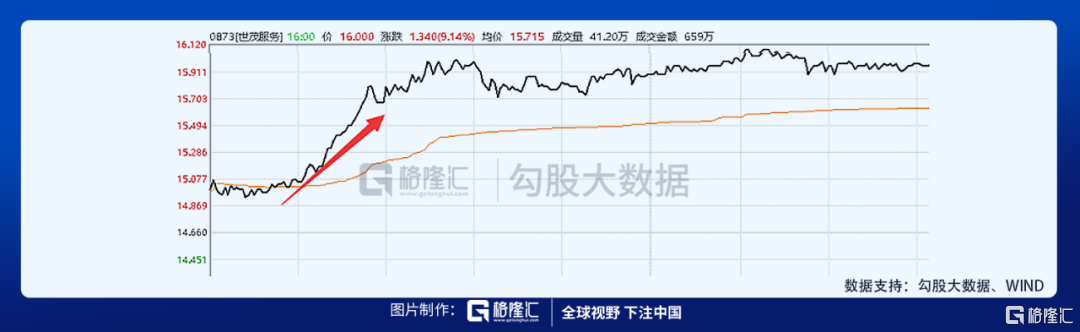

早上我看到這麼一個走勢,就是昨天發了業績,收入增長101%,利潤增長80%,對應估值42倍。

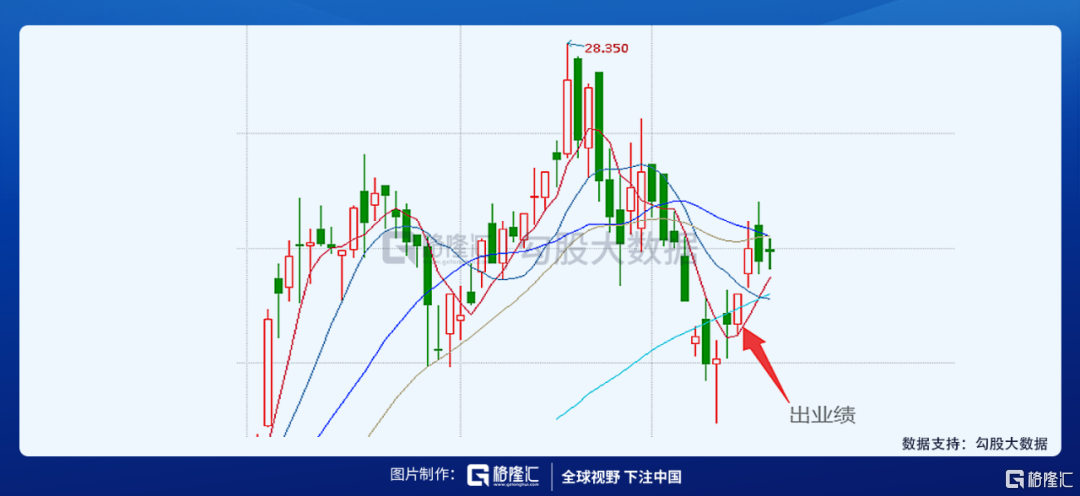

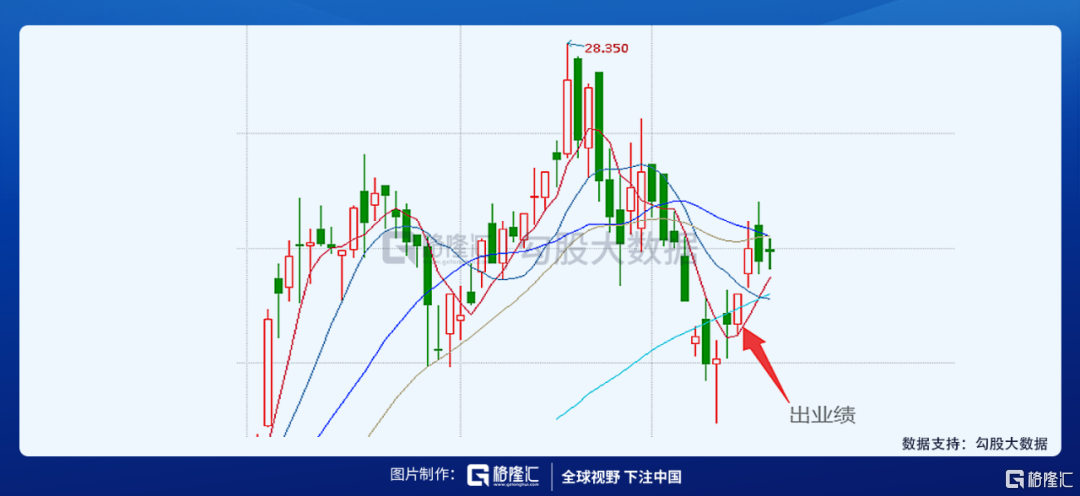

從之前股價走勢看,也不是抱團的那種,所以説,業績出來就有一個預期差在這邊,反而出業績會漲。對於那種抱團的,的確業績增長也很高,但是大家預期更高,所以你懂的。

包括融創服務也是如此,業績出來之後也是一路上漲,還抗住了週一的大跌。

由此去關注了一下物業板塊,除了個別龍頭,其他物業股都在低位。原因之一是去年物業股扎堆上市,把稀缺性給打沒了,行業整體殺了一波估值。但是行業本身沒問題,全國百強物業的收入增速也能在20%左右,頭部公司,依靠母公司的竣工增速,以及外延併購,利潤增速都可以保持在40%左右。而且物業股的這個現金流和利潤比例,比茅台都好,只要你住進了這個小區,物業服務對你來説就是個Saas服務,終身現金流。

大家想知道物業股最近確定性的邏輯在哪裏,以及未來物業股業績發佈日期和預估增速的,添加我們的SVIP小助理回覆“物業”領取。我們會把報吿發給您,還有兩個確定性較高的標的。

這邊也順便總結下,還有哪些值得關注的標的的業績發佈日期,可能都有機會。

3.16 恆大物業

3.16 康哲藥業

3.17 耐世特

3.17 遠大醫藥

3.18 佳兆業美好

3.19 中升控股

3.22 康師傅

3.23 永升生活

3.25 中移動

3.29 天工國際

3.29 達利食品

3.29 華潤置地

3.30 中遠海能

3.30 先健科技

3.31 洛陽玻璃

格隆匯聲明:文中觀點均來自原作者,不代表格隆匯觀點及立場。特別提醒,投資決策需建立在獨立思考之上,本文內容僅供參考,不作為實際操作建議,交易風險自擔。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.