集體下殺!藥明系重挫8%領跌藍籌,醫藥股也挺不住了

今日,港股生物科技板塊一路下跌,藥明康德、藥明生物以超過7%跌幅領跌藍籌,昊海生物科技、藥明巨諾跌超11%,金斯瑞生物科技、再鼎醫藥、昭衍新藥跌逾6%,雲頂新耀、加科思等個股紛紛跟跌。

其中A股昊海生物科技也跌幅慘烈,昊海生科暴跌14%,是A股4000多隻票中跌幅排名第三。主要下跌的原因在於其昨晚公佈2020年年度業績快報,不及預期。受到疫情影響,公司主要應用於眼科、整形美容門診、骨關節腔注射診療以及非急診外科手術等相關產品和服務均被納入臨時停診範圍,導致2020年公司實現營收13.32億元,同比減少16.95%;歸母淨利潤2.3億元,同比減少37.95%。

在本輪下跌中,藥明生物等龍頭股成為重點下殺的對象。這是因為,近期市場對於流動性收緊的預期,以及估值泡沫破裂的擔憂,疊加債券利率上行,導致隔夜外圍市場出現大幅下跌的局面。而前期醫藥板塊漲幅明顯,高位醫藥股普遍存在估值過高的情況,尤其是細分領域龍頭股,存在明顯的估值泡沫。

以藥明生物為例,公司自去年以來,股價翻了2倍有餘,翻過年頭,其股價繼續上漲20%,並於2月16日創下歷史新高386.7港元。與此同時,其PE-TTM亦水漲創高至325倍,遠高於歷史平均水平。春節之後,藥明生物股價一路下跌,短短9個交易日回調近23%,可謂慘烈。

藥明生物主要以提供生物藥開發、生產服務為主,公司此前預計2020年歸母淨利潤將至少超16.7億元,同比大增至少65%,超於市場預測的約14.9億元。

一方面,其“贏得藥物分子”戰略的推出帶來多個後期項目和短期收入貢獻;另一方面,2020下半年COVID-19項目超預期,藥明生物管理層此前表示,下半年公司接獲大量新冠相關項目,包括中和抗體與疫苗等。預計新冠項目於2021-2022年將共計帶來約7億美元收入。

藥明生物早期深耕生物藥研發外包服務,自2015年藥明康德剝離及2017年上市後,公司主要發力後端生物藥CDMO能力。2019年藥明生物在全球的市佔率達到5.1%,位列第三;在國內生物藥CDMO中,公司一家獨大,2018年市場份額為75.6%。

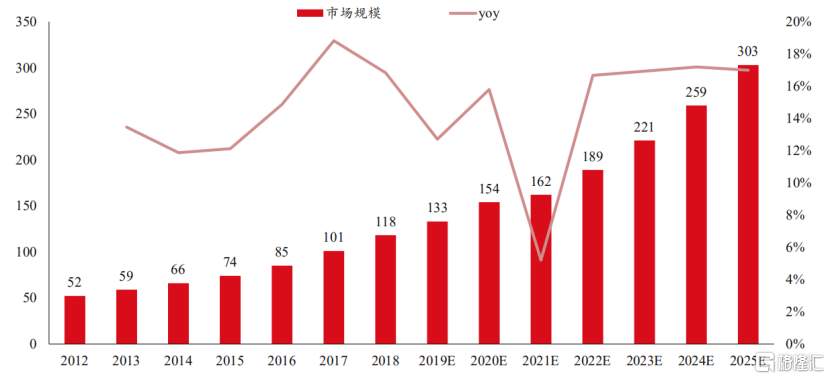

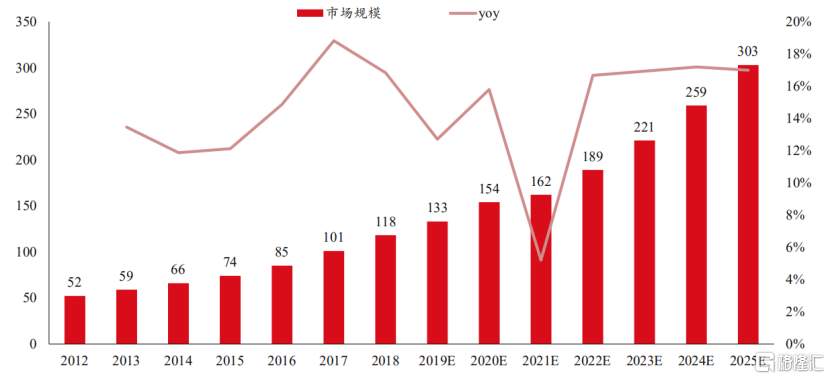

業績增長的背後離不開行業的快速發展。根據BournePartners的測算,2019年全球生物藥CDMO市場規模為133億美元,同比增長17.7%,預計2025年將達到303億美元,2019-2025年CAGR為14.7%;預計全球生物藥生產的外包率將從2019年的15.7%提高到2025年的21.0%。中信證券預測2020-2022年公司實現歸母淨利潤分別為16.75億元、25.15億元和35.32億元,分別同比增長65.19%、50.17%和40.45%。

(全球生物藥市場CDMO市場規模(億美元),來源:國海證券)

不過,站在當前時點來看,儘管藥明生物PE已從高點回落至281倍,但仍處於歷史較高水平,恐怕下殺估值還有一段時間。對於穩健投資者而言,需耐心等待回撤之後的上車機會。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.