權重股止跌!機構:龍頭個股後續波動率還將放大

週五,A股三大股指全天探底回升。截至收盤,上證指數報3696.17點,上漲0.57%;深證成指報15823.11點,上漲0.35%;創業板指報3285.53點,下跌1.04%。

盤面上,貴州茅台、寧德時代等權重股午後止跌回升,有效拉動了指數表現;行業板塊現普漲浪潮,順週期依舊是市場熱點,有色、水泥等板塊表現活躍,網絡遊戲、通信服務、煤炭等板塊同樣漲幅居前。

三大股指午後觸底反彈

本週最後一個交易日,A股三大股指午後拉昇,走出探底回升的趨勢。

同時相對於指數整體表現,個股表現更為活躍,上漲家數超3600家,逾140只個股漲停。滬深兩市合計成交額連續第二日破萬億,市場整體情緒回暖。

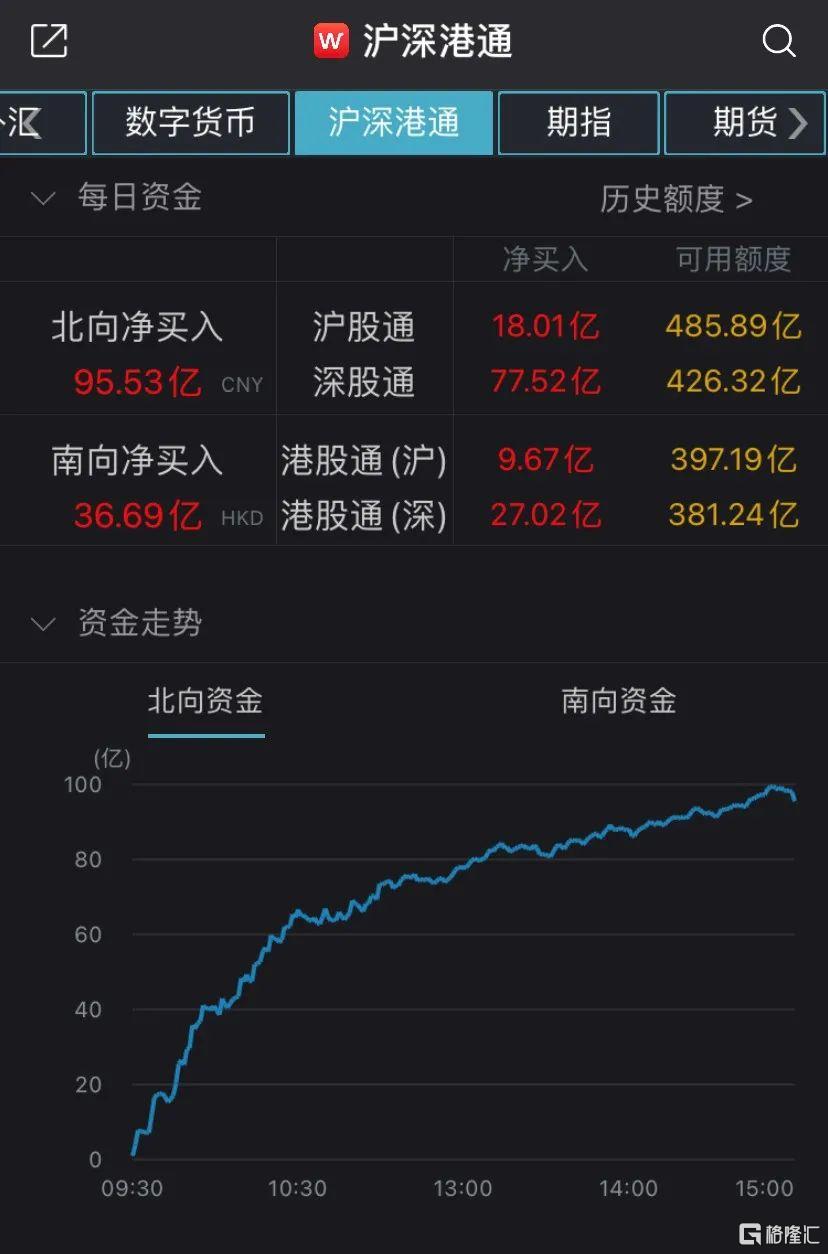

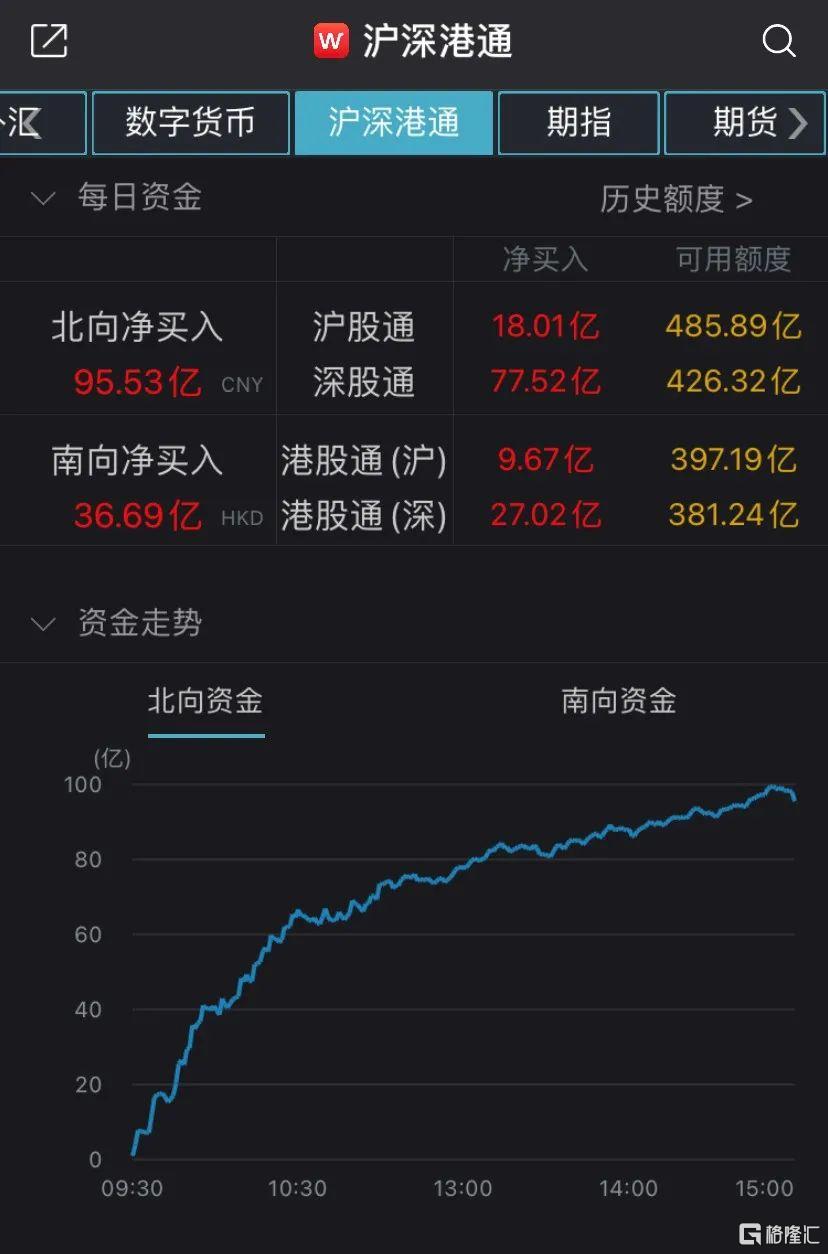

北向資金則延續了持續掃貨的態勢,全天淨買入95.53億元,創1月8日以來新高。其中深股通淨買入77.52億元,滬股通午後則單邊流出,淨買入額收窄至18.01億元。

“茅系”個股止跌回升

週五早盤,白酒龍頭貴州茅台股價盤中一度失守2400元/股,不過截至收盤跌幅收窄至0.45%,全天成交額超145億元。山西汾酒全天收跌7%,水井坊跌逾3%。

作為標杆型個股的貴州茅台近兩日回撤幅度超5%,也使得諸多“茅系”個股股價出現高位波動:Wind茅指數今日早盤整體跌達1.69%,但午後跌幅收窄至0.53%。

醫美龍頭愛美客盤中跌幅一度超14%,午後跌幅收窄至7.8%,報收1135.88元/股;機械裝備龍頭三一重工收跌4.62%;億緯鋰能繼昨日收跌逾6%後,今日再度大跌近6%,天齊鋰業盤中更是觸及跌停;恆立液壓、萬華化學等一眾週期股龍頭也未能倖免。

對於近日前期抱團品種的高位波動,有市場觀點認為,抱團個股在年前短期累積的漲幅較大,因此高估值個股對市場流動性的敏感度更高。

天風證券首席策略分析師劉晨明對此表示,考慮到今年國內公募基金爆款發行使得管理規模進一步頭部集中,市場風格從大市值徹底切換到小市值並不太容易。但他強調,A股最頭部的公司後續的波動率可能明顯放大,其預期回報目標也應該下調。劉晨明認為,未來一段時間全球流動性或將出現拐點的預期是前述高估值個股調整的主要誘因。

機構資金仍為市場主導力量

值得注意的是,一方面以貴州茅台為代表的前期“機構抱團”股出現調整,另一方面春節長假過後,公募基金髮行依然維持快節奏,而多隻聚焦於細分行業與主題指數ETF發行較大幅度地帶動了相關板塊近期表現。這或許意味着,在近期公募基金仍然作為邊際最大增量資金的背景下,機構對於當前市場的話語權仍然較高。

例如週五,遊戲板塊逆市走高,艾格拉斯全天大漲7.86%,美盛文化、世紀華通、掌趣科技等跟漲。消息面上,今日市場首隻遊戲動漫ETF發行,其核心標的三七互娛漲超4%,完美世界漲超5%,奧飛娛樂漲超8%。

農林牧漁板塊週五同樣表現活躍,神農科技、雪榕生物、新希望等多隻個股漲幅較前。2月18日,市場首隻畜牧ETF開啟認購。再比如伴隨着化工板塊開年以來的持續火熱,自2月18日至2月22日,陸續有4只化工ETF起始認購。

國盛證券首席策略分析師張啟堯表示,近幾年A股機構化加速,以公募基金、外資、保險為代表的機構資金成為市場主要增量資金來源。機構化、價值化之下,重視基本面景氣驗證、“放長線釣大魚”也逐步成為市場審美的主流。張啟堯認為,以機構資金為主導的增量資金持續、穩定流入的情況下,A股市場流動性將長期維持充裕。無論是A股還是港股的優質資產,在增量資金澆灌下均將持續受益。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.