透視港股通丨中海油獲內資搶籌近44億

北水總結

1月27日港股市場,北水淨流入235.3億,其中港股通(滬)淨流入約84.85億港元,港股通(深)淨流入150.45億港元。

北水淨買入最多的個股是騰訊(00700)、中海油(00883)、中國移動(00941)。北水淨賣出最多的個股是申洲國際(02313)等。

數據來源:盈立智投APP

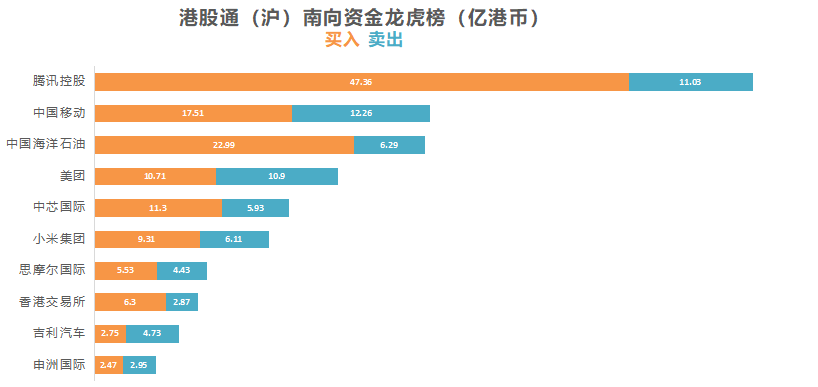

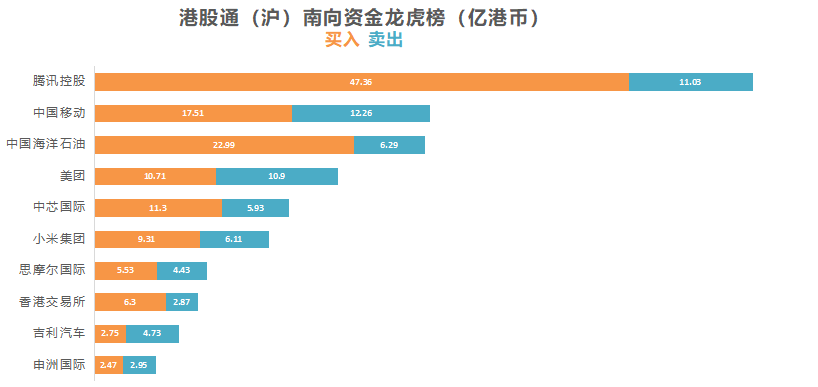

十大成交活躍股

數據來源:盈立智投APP

個股點評

騰訊(00700)再獲淨買入68.72億港元。消息面上,瑞銀近日發佈研報指,騰訊近日舉行了微信會議,聚焦於微信近期的進展及策略,受惠用戶參與度強勁,該行留意到數個未來變現的正面因素,其中微信及朋友圈日活躍用戶分別達11億及7.8億,帶動生態系統上的增長,小程序數目按年升75%,而企業夥伴則按年更升400%,相關用戶交易增加,去年的GMV按年增一倍達到1.6萬億元人民幣。據該行分析,大部分GMV是來自電商及本地服務。公司繼續開放微信的生態系統,並與短片產品等連結,開放影片動態及外部搜尋功能,相信長遠將有廣告、支付、訂閱及打賞等的變現機會,而相關因素未反映在股價上。該行予騰訊“買入”評級,目標價830港元。

中海油(00883)獲淨買入43.75億港元,中金公司表示,MSCI和富時羅素將中海油剔除出部分指數系列的決定1月27日生效,考慮到ETF的潛在調倉,如果股價出現大幅波動,建議長期投資者加倉。此外,小摩發佈研究報告,將中海油目標價由9港元上調5.6%至9.5港元,維持“增持”評級。

中國移動(00941)獲淨買入2.49億港元。消息面上,中國移動公告,公司全資附屬公司中移通信代表其31家省公司與中國廣電簽訂了一系列具體合作協議,這意味着移動、廣電5G共建方案落地,正式啓動700MHz 5G網絡共建共享。多家大行發佈研報唱好。小摩予中國移動評級“增持”,目標價73港元;瑞銀稱中移動(現估值低於歷史平均市盈率,評級“買入”;野村則維持中國移動“買入”評級,目標價65港元。

美團-W(03690)獲淨買入21.69億港元。消息面上,大和資本發表報告,看好美團社區團購服務美團優選可擴大潛在市場範圍、到店酒店及旅遊業務年內具重估機會,大舉調高目標價,由370港元升至500港元,維持“買入”評級。而中金預計美團核心業務穩健增長及看好其優選長線競爭力,升目標價至426港元,予“跑贏行業”評級。

港交所(00388)獲淨買入10.76億港元。消息面上,高盛發佈研究報告稱,預期今年內地投資者在香港股市淨買入規模達創紀錄的950億美元,較該行今年最初預測的500億美元增加近1倍,上調預測因在港股第二上市的股票下半年或加入港股通。不過,該行對港交所評級“沽售”,預計該股在大幅上漲後將面臨較高的回調風險。

思摩爾國際(06969)獲淨買入3.89億港元。消息面上,思摩爾國際此前發佈公告稱,於2020財政年度,集團溢利及全面收益總額預期將同比增加約10%至15%。公司還表示,2020財政年度經調整純利預期將按年增加約70%至75%。中金髮布研究報告,上調思摩爾國際2020-22年經調整每股盈利預測3%/5%/3%至0.66/0.93/1.23元人民幣,維持“跑贏行業”評級,目標價上調23%至93.8港元。此外,大和上調思摩爾國際目標價60.7%至90港元,但降評級至“跑贏大市”。

保利協鑫能源(03800)獲淨買入2.09億港元。消息面上,中銀國際發佈研究報告,將2021年多晶硅均價預測從89元/公斤提升至99元。該行預計全球硅料產出至多支撐172GW硅片和165GW晶硅組件,全球組件出貨可能略超170GW,並將2021年1-4季度多晶硅均價上調1-15%至88/91/106/112元/公斤。

此外,小米集團-W(01810)、中芯國際(00981)分別獲淨買入6.46億、4.27億港元。而申洲國際(02313)遭淨賣出4809萬港元。

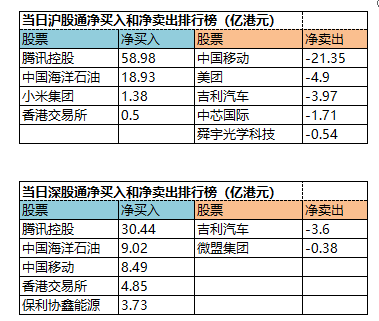

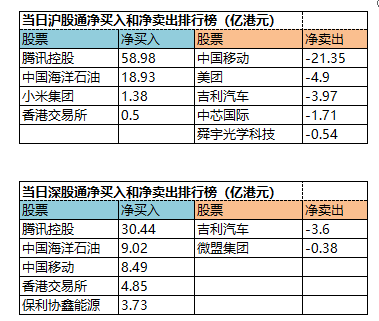

當日港股通淨買入和淨賣出排行榜

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.