業績預吿點燃整個板塊!這波行情還能持續多久?

儘管今日指數大跌,但豬肉股集體走高。截至今日收盤,天邦股份漲停,立華股份大漲12.47%,牧原股份大漲7.29%,新希望、正邦科技、唐人神等集體拉昇。

兩家頭部豬企今天公佈了2020年度業績預吿。

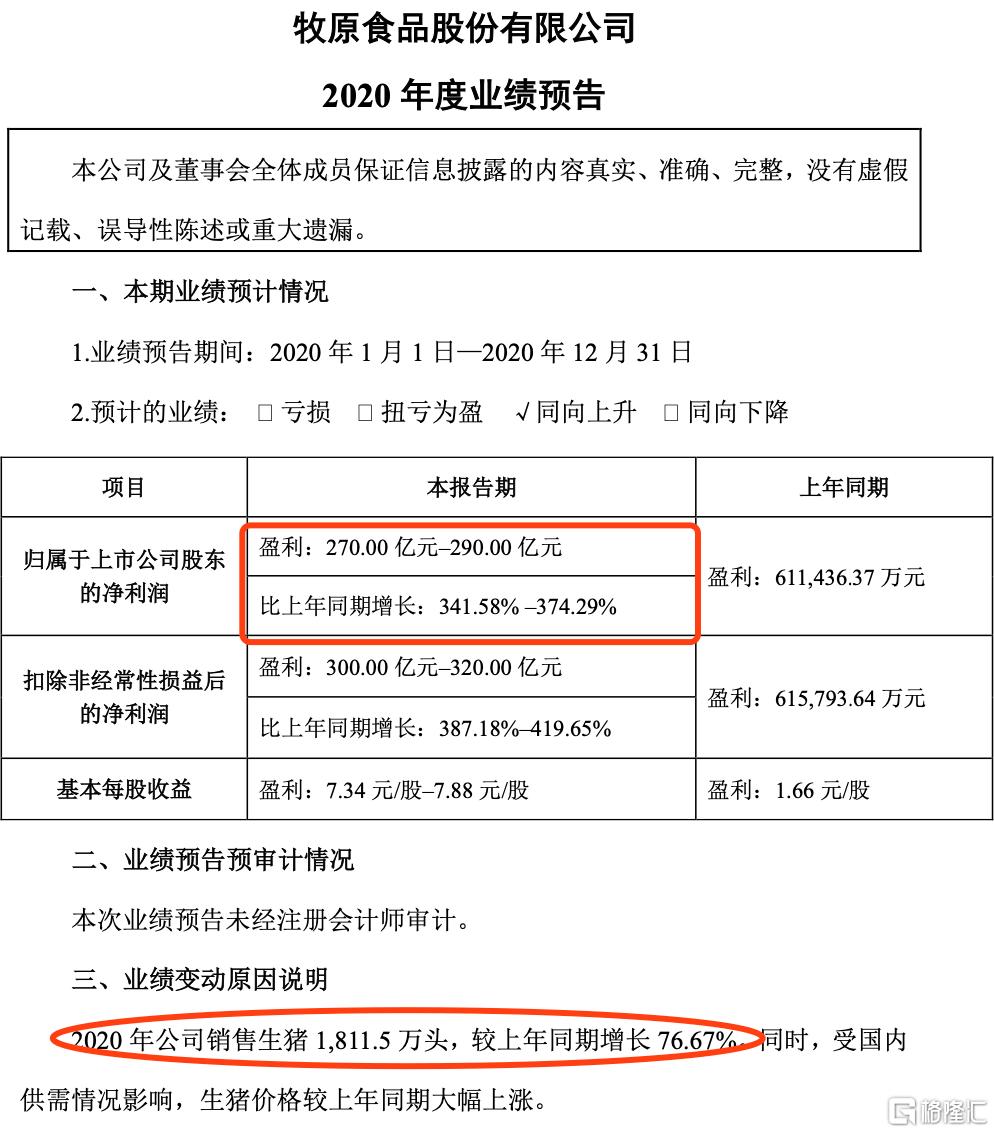

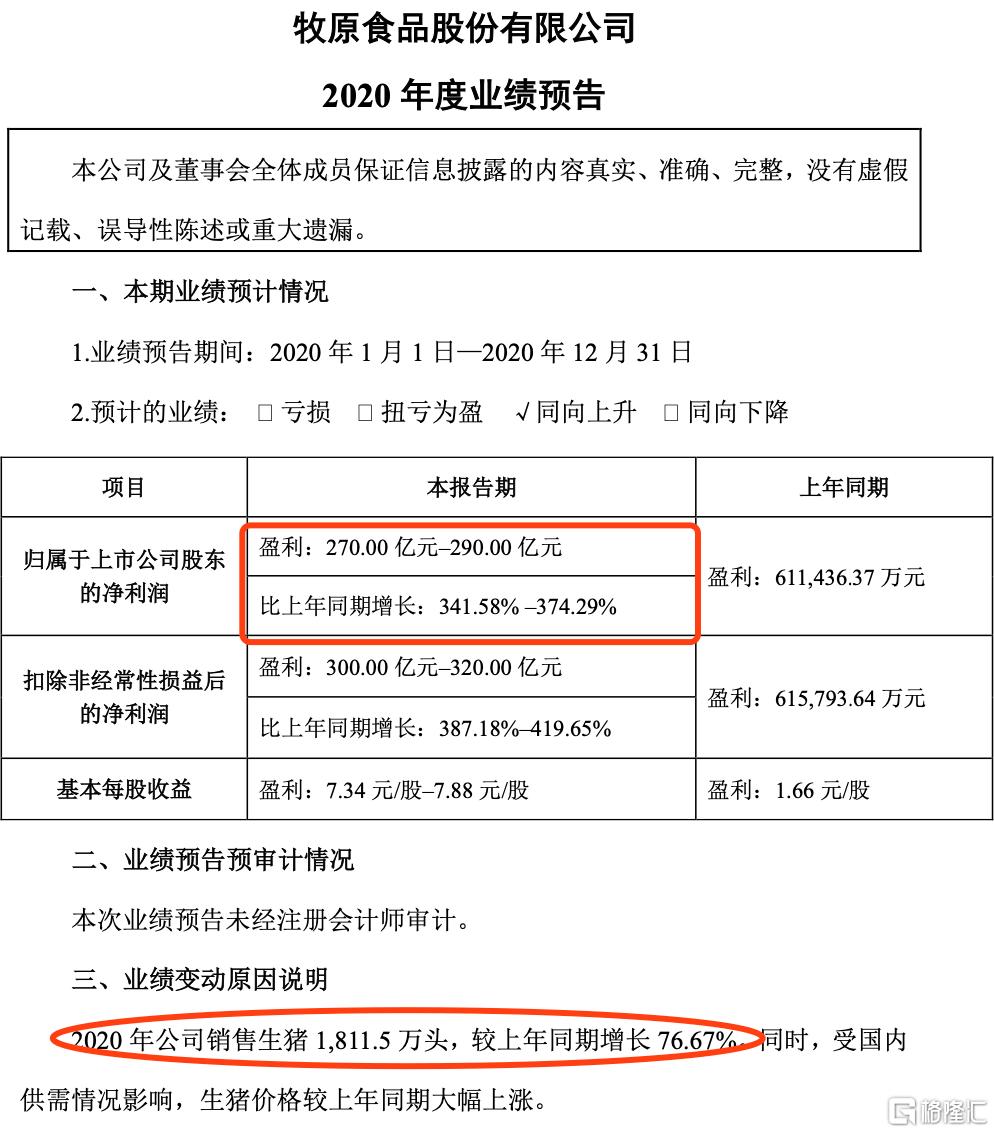

據公吿,有“豬中茅台”之稱的牧原股份預計2020年盈利270億元~290億元,同比增加341.58%~374.29%,扣非淨利潤預計達300億元~320億元。

根據上述數據估算,牧原股份在2020年平均每天大概能賣5萬頭豬,一頭豬的盈利超過1600元。

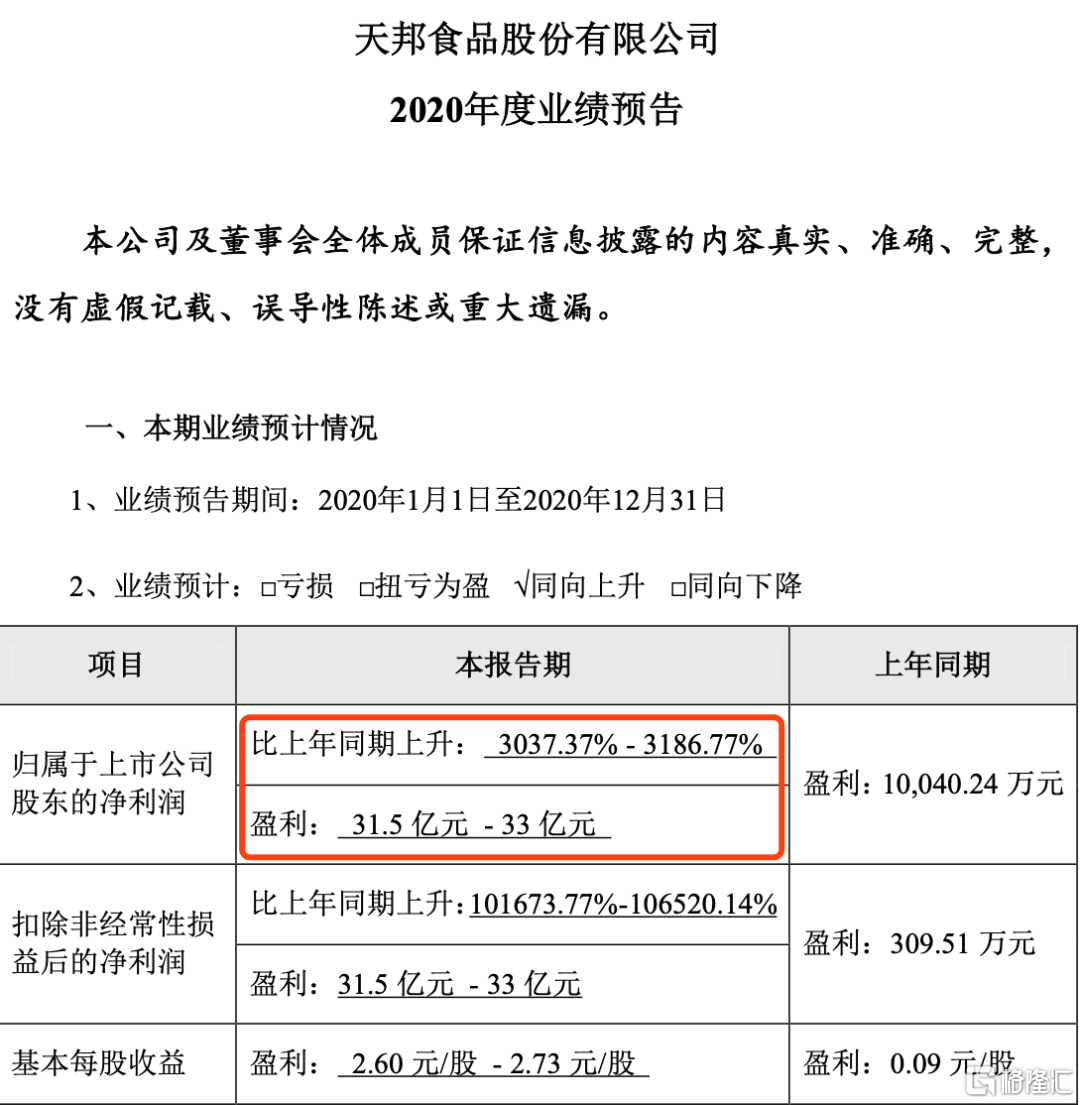

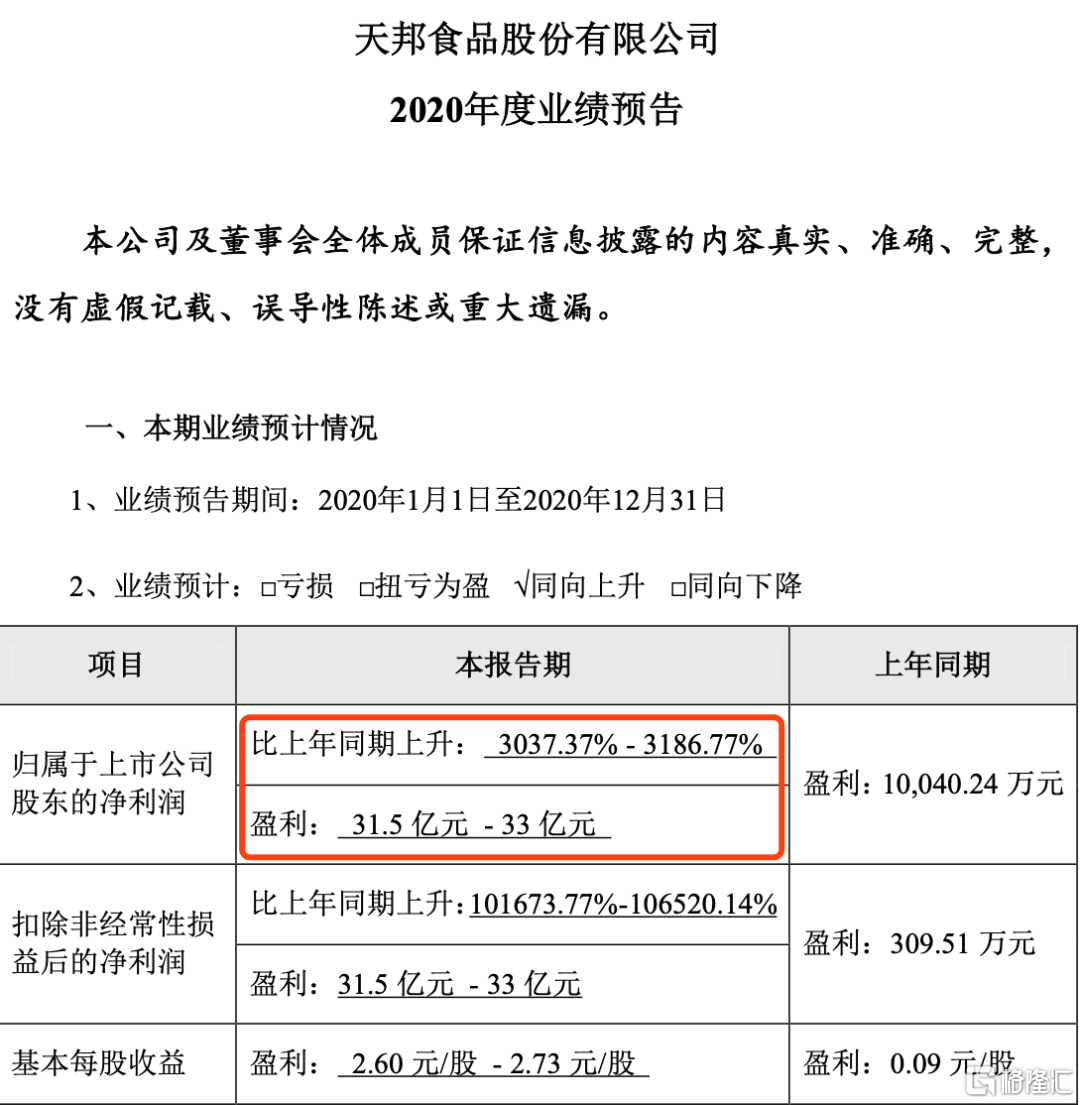

另一龍頭天邦股份的業績增速更是氣勢如虹。公吿顯示,公司預計2020年淨利潤為31.5億元~33億元,同比增長3037.37%~3186.77%;預計扣非淨利潤為31.5億元~33億元,同比增長101673.77%~106520.14%,即增幅超過1000倍。

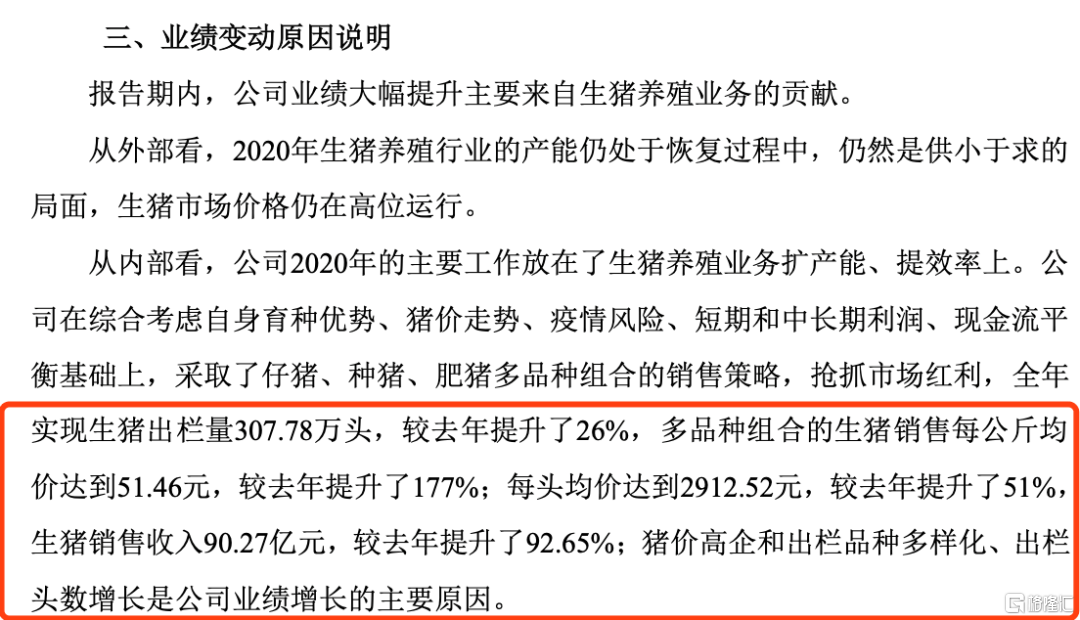

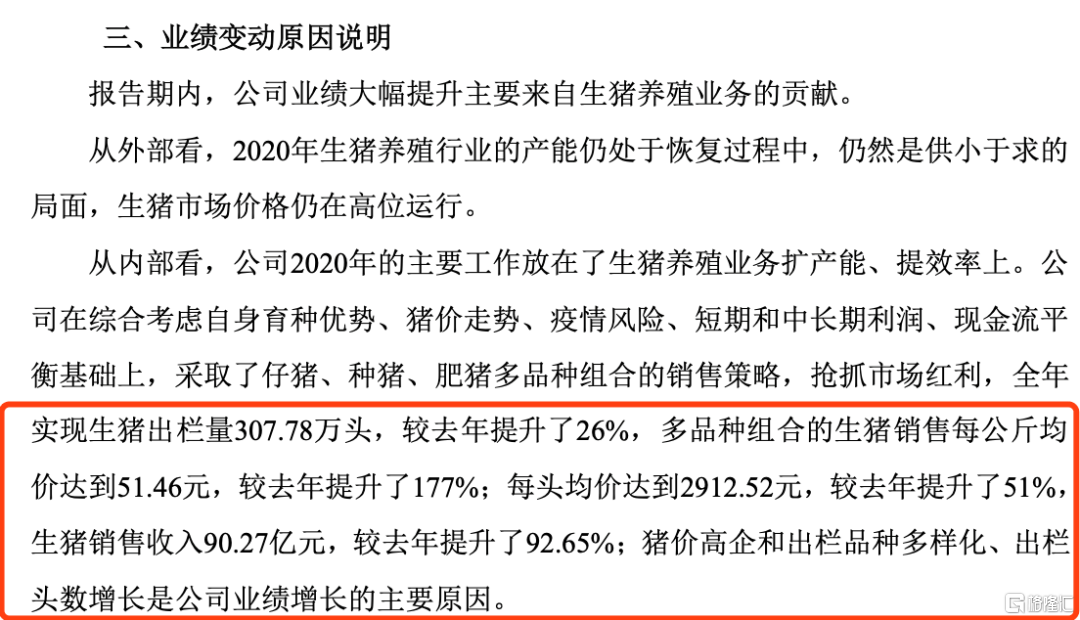

天邦股份表示,公司業績大幅提升主要來自生豬養殖業務的貢獻。

從多家養豬企業已披露的2020業績預吿來看,業績翻倍增長已是主流。

上述企業均明確提及,利潤暴增主要是豬肉價格高位運行,且部分企業出欄量大幅增長。

養豬企業業績高增長還能持續多久?投資者現在還能“上車”嗎?

豬企業績高增長的動力來自豬價的高位運行。從2020年三季度開始,隨着生豬存欄數、出欄量的恢復和增加,豬肉價格出現了明顯的下跌,但這種下跌並沒有持續多久,從11月份開始又一次進入了上漲的通道。

有行業分析師認為,目前正處於豬肉消費的旺季,春節到來使得市場當中的豬肉需求量明顯提升。此外,進口冷凍肉的收緊、國內豬肉運輸成本增加等都是助推豬肉價格上漲的因素。

太平洋證券研報表示,隨着近期疫情防控加強,凍肉進口和銷售將繼續受限,生豬供給緊張格局沒有改觀,春節前豬價仍有望繼續反彈。節後,豬價或有所下行,但對2021年全年豬價持樂觀預期,預計全年均價25元/公斤。

中國銀河證券分析師謝芝優、白雪妍在研報中表示,當前生豬養殖行業處於下行大週期,成本控制在此階段將重新成為行業核心競爭力,完善的育種、育肥體系將優於外購仔豬/種豬模式。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.