A股收評:滬指跌0.9%,白酒、軍工、新能源抱團板塊大跌

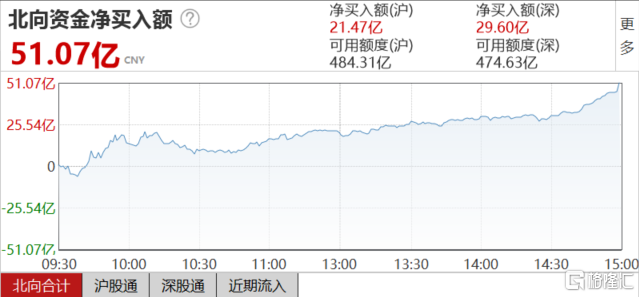

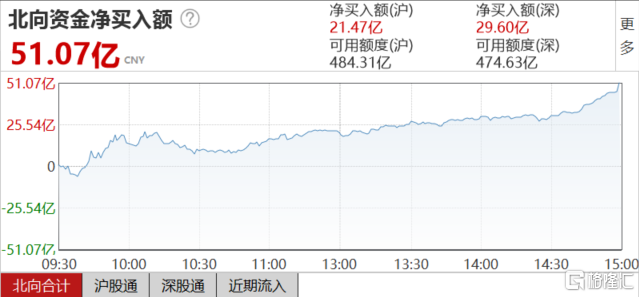

今日兩市主要指數早盤跳水隨後回升,午後再度下跌,滬指全天收跌0.9%報3565.9點,深成指跌1.92%報15070點,創業板指跌1.31%報3089.18點;科創50指數午後一度漲逾5%,現漲幅縮至2.8%。兩市總成交額1.1萬億為連續第九個交易日破萬億,北上資金淨買入51億元。

數據來源:Wind

整體來看,市場情緒表現一般,兩市個股漲多跌少。2487只個股上漲,其中88股漲停;1512只個股下跌,其中46股漲跌停。

盤面上看,軍工、白酒、新能源車等抱團板塊大跌,光伏股走勢分化,隆基等大市值光伏概念跌幅較大,短線資金流向科技股及中字頭股。光刻機概念大漲,晶方科技等多股漲停;中字頭股多數上漲,中國中車兩連板,年內已累計漲逾40%;物管股近乎全線上漲,深深房A漲停;國產軟件、雲計算、鐵路基建、芯片等概念活躍。軍工、鋰電池、種業、白酒股大跌。

具體來看:

白酒股繼續全線回調,貴州茅台收跌1.39%,五糧液跌超5%,瀘州老窖、山西汾酒、洋河股份盤中均一度跌超5%。酒鬼酒、巨力索具、豫園股份跌停,大湖股份、口子窖、大豪科技等集體大跌。

數據來源:同花順

軍工板塊大跌居前,航發動力、中航沈飛、中航西飛跌停,晨曦航空、航天電子、航發控制等跟跌。

數據來源:同花順

農業種植板塊繼續走弱,大北農、登海種業、豐樂種業跌停,荃銀高科、振東製藥跌超14%,農發種業、萬向德農、隆平高科等跟跌。

數據來源:同花順

新能源車板塊整體收跌,比亞迪跌超6%,寧德時代跌4%,長城汽車、斯達半導等多股跌停,博俊科技、天齊鋰業、江淮汽車等跟跌。昨日,中汽協公佈了去年的產銷數據,國內新能源汽車累計產銷量分別為136.6萬輛和136.7萬輛,並預計2021年新能源汽車銷量180萬輛,同比增長40%。

數據來源:同花順

光伏概念早盤跳水後大幅回升,個股走勢分化,隆基股份一度跌超7%,通威股份跌近4%,上機數控跌停,東方日升、豫能控股、中天火箭等集體下跌。

數據來源:同花順

光刻膠板塊漲幅居前,晶方科技、京華激光漲停,芯源微漲15%,賽微電子、揚帆新材、安吉科技均漲超10%,容大感光、南大光電、華特氣體等跟漲。

數據來源:同花順

物管股逆勢走強,深深房、南國置業先後漲停,深物業、深振業、特力A等跟漲。近期該概念整體表現活躍,主要受益於政策面的消息,1月5日住建部、發展改革委、銀保監會等十部委發佈《關於加強和改進住宅物業管理工作的通知》,加快發展物業服務業發展,推動物業服務向高品質和多樣化升級。

數據來源:同花順

半導體板塊早盤衝高,午後有所回落。截至收盤,中芯國際漲2.36%,滬硅產業漲近14%,中晶科技、晶方科技漲停,清溢光電、芯原股份、思瑞浦等跟漲。

數據來源:同花順

資金流入方面,半導體、工業機械、建築淨流入居前;航天軍工資金流出近50億元,券商、酒類、農業淨流出居前。

數據來源:Wind

北向資金今日合計淨流入51.07億元,其中滬股通淨流入21.47億元,深股通淨流入29.6億元。

數據來源:Wind

國君策略團隊發文稱,A股首次藍籌股泡沫已至,是風險偏好低位、宏觀流動性不急轉彎、微觀交易流動性超預期三維共振的結果。短期抱團難瓦解,但伴隨流動性拐點的出現泡沫將消散。前市場龍頭行情已脱離預期環節走向交易維度,且行情在“廣度”與“深度”均有表現,從好賽道龍頭轉向普通賽道龍頭。這並非基本面預期維度能夠左右,而是交易維度進一步強化的結果。預計短期繼續享受泡沫的可能性較大,春節前出現拐點的概率極低。但只要是泡沫,終將會消散。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.