农林牧渔行业月度报告:政策驱动+需求改善,建议关注动保、种子板块,维持“同步大市”评级

机构:财富证券

评级:同步大市

投资要点:

市场行情回顾:11月份,农林牧渔(申万)指数上涨 12.49%,跑赢上证综指、深证成指、创业板指、中小板指、沪深 300指数 5.68、6.97、10.57、8.58、5.29个百分点,在申万 28个一级行业指数中排名第 3位。截止 2020年 12月初,农林牧渔板块 PB(MRQ,整体法)为 3.97倍,高于全 A 市净率水平(1.90倍),位于历史后62.50%分位数。

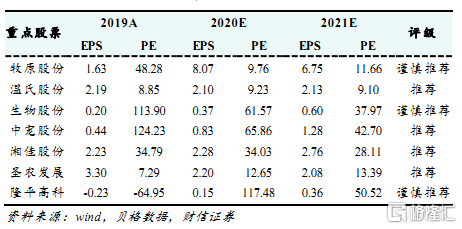

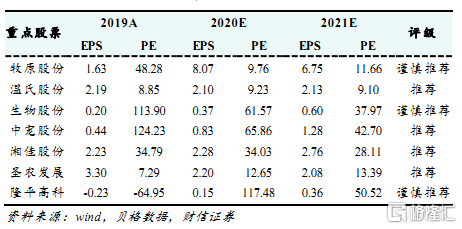

推荐关注长期赛道优质、消费属性强、成长空间大的个股。我国宠物食品行业处于快速发展阶段,同欧美、日本等发达国家相比,我国宠物食品的市场渗透率、单只消费金额仍具有较大增长空间,建议关注宠物食品龙头中宠股份(002891)和佩蒂股份(300673);国家大力推动冷鲜肉品流通和配送体系建设,逐步实现“集中屠宰、品牌经营、冷链流通、冷鲜上市”。同时消费升级、冷链运输、餐饮连锁化等也将推动冰鲜行业的快速增长,建议关注较早布局屠宰加工、冷鲜销售的生猪养殖龙头温氏股份(300498)、区域黄羽鸡冰鲜龙头湘佳股份(002982)和鸡肉制品龙头圣农发展(002299)。

下游需求恢复+行业格局优化,建议关注动保龙头。农业农村部监测数据显示,截止 2020年 10月底,生猪产能已经恢复到 2017年年末的88%左右,预计明年二季度,全国生猪存栏将基本恢复到正常年份水平。动物疫苗市场化进程加快,产品、技术、渠道、服务能力强的企业将获得更高的市场份额,建议关注生物股份(600201)、普莱柯(603566)、中牧股份(600195)。

政策催化+库存降低+需求增加,建议关注种子龙头企业。国务院办公厅印发《关于防止耕地“非粮化”稳定粮食生产的意见》。《意见》指出,要采取有力举措防止耕地“非粮化”。当前我国玉米、大豆库消比处于较低水平,而下游饲用需求增加,建议关注种子龙头隆平高科(000998)、大北农(002385)、荃银高科(300087)、登海种业(002041)。

风险提示:农产品价格风险、自然灾害、疫情风险、行业政策风险。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.