蘋果再發新品AirPods Max,代工廠歌爾大漲7%

蘋果又來清空打工人的錢包了。

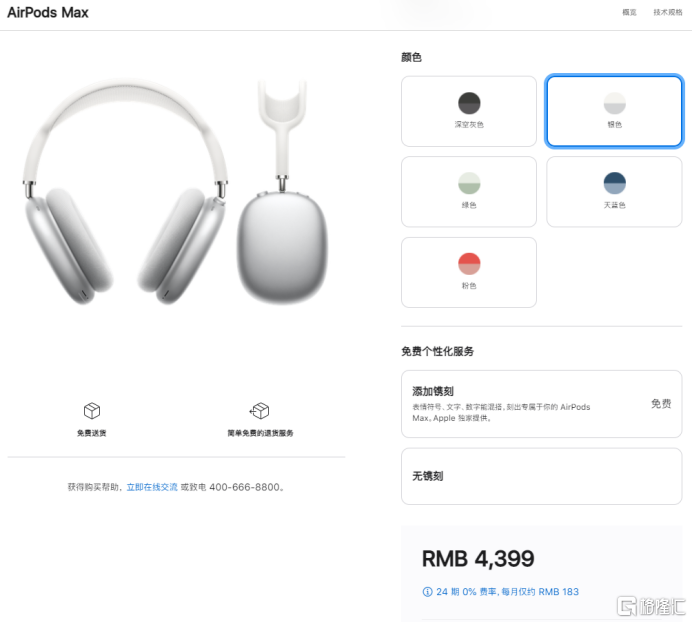

昨晚,蘋果在官方微信公眾號上發佈了新品——頭戴式耳機。蘋果文案:從頭開始,重構設計。

接着就是大家熟悉的環節——商業吹捧:從耳墊到穹網,每一寸設計、用料和工藝,都傾注了我們對頭戴式耳機的重新思考……充電5分鐘,聆聽1.5小時,即使主動降噪和空間音頻功能全開,續航也可最長達20小時。總之,AirPods Max就是各種MaX。

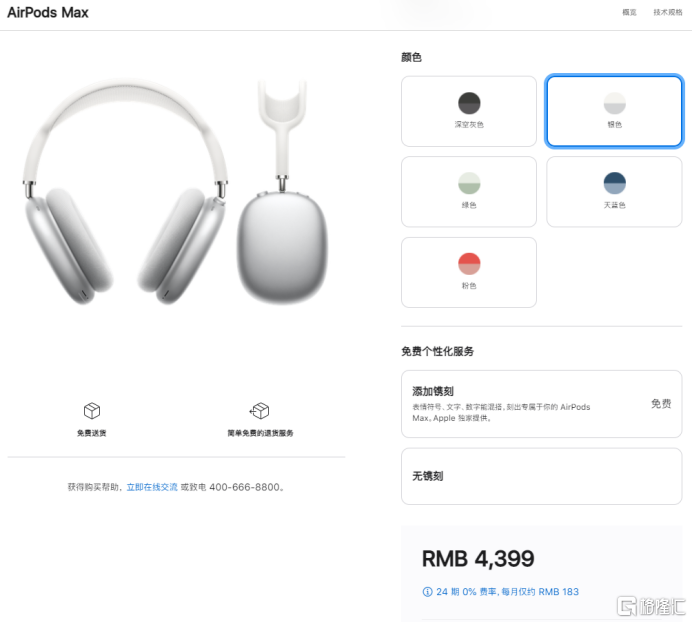

當然,價格也是Max。官網上,AirPods Max售價是4399RMB,預計發貨時間12-14周。

美股方面,蘋果公司無明顯異動,收漲0.51%,盤後下跌0.81%,大概率是因為早有預期。本月以來,蘋果累計漲幅近4.5%。

A股市場上,蘋果概念股今天也爆發了。作為蘋果無線耳機的“金牌”代工廠,歌爾股份自然是繞不開的。此前,有媒體報道,這款耳機是由歌爾股份獨家代工的,上證報記者向接近公司人士求證,也獲得其“默認”。

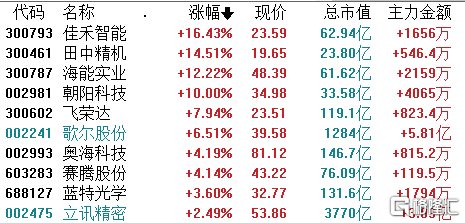

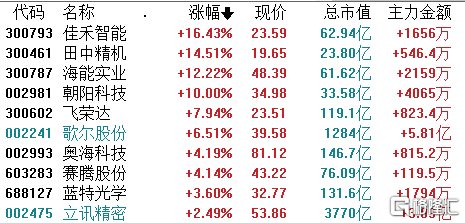

盤面表現上,歌爾股份一度大漲7%,立訊精密也漲超4%,隨後都有所回落。截止目前,朝陽科技漲停,佳禾智能漲16%,田中精機漲近15%,其他個股紛紛跟漲。

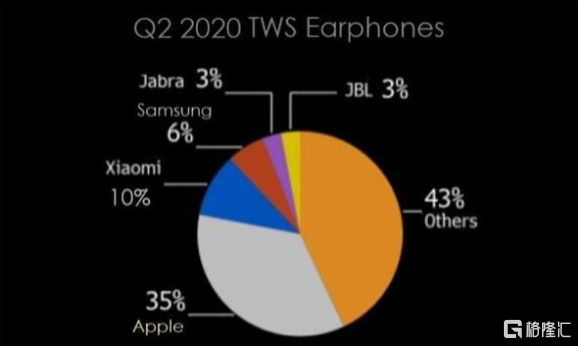

近年來,真無線藍牙(TWS)市場迎來爆發式增長,TWS耳機競爭組逐漸白熱化,就像當年的MP3、MP4一樣。市場研究機構Counterpoint Research數據顯示,過去3年TWS耳機的出貨量增速為118%、130%、183%,2019年真無線藍牙耳機的出貨量超1.2億台,預計到2020年TWS耳機的出貨量將達到1.5億台,市場規模近110億美元。

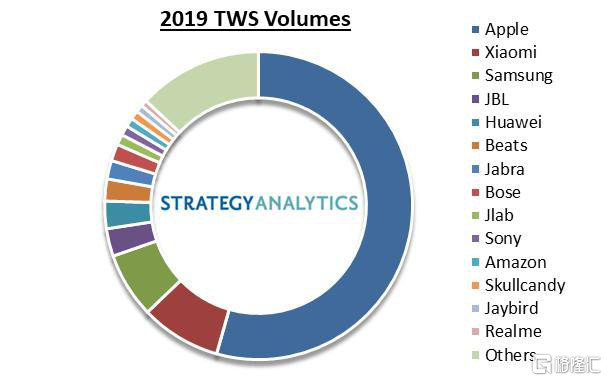

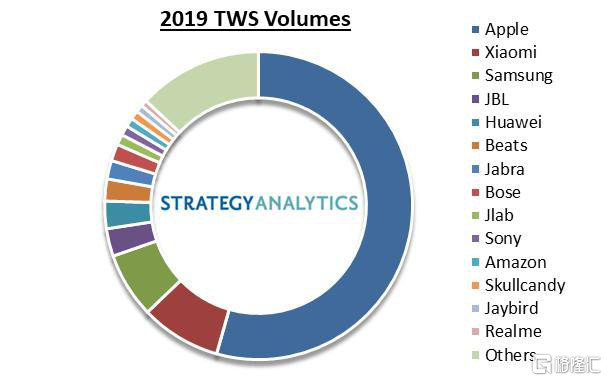

自從AirPods面市以來蘋果就一直引領該市場。2019年,AirPods銷量近6000萬副,同比銷量增長近100%,佔全球TWS耳機份額的50%以上,收入也佔到了全球TWS耳機銷售總額的71%。

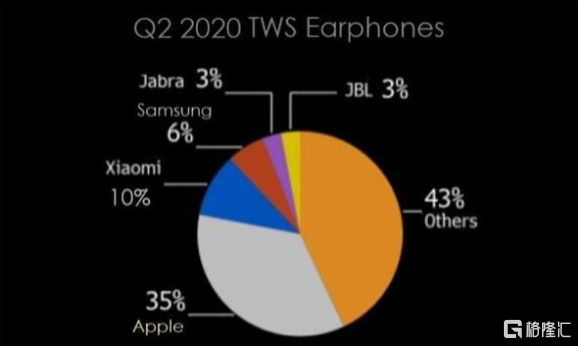

但隨着眾多實力雄厚的大廠相繼入局,不僅在音質、降噪、續航等等方面帶來了更大的升級,而且還在價格上進行了控制,導致蘋果的市場份額不斷被蠶食。今年上半年,蘋果在TWS耳機的市場份額下滑至35%,小米、三星分別以10%、6%的佔比緊隨其後。

儘管市佔率下降,但蘋果的TWS業務隨着整個市場規模的擴大,一樣賺的盆滿缽滿。而作為整機制造商以具備聲學精密組件加工能力的OEM/ODM廠商立訊精密與歌爾股份,是蘋果AirPods系列耳機最大的兩家ODM廠家,受益於蘋果AirPods這趟“快車”,立訊精密與歌爾股份銷售額都同比快速增長,其股價也是水漲船高。

2017年7月,立訊精密取得了蘋果AirPods的代工資格,並憑藉接近100%的良品率獲得蘋果青睞,逐漸成為AirPods主要供應商,佔據60%的代工份額。從2017年至今,立訊精密的市值已經從440億元增長至逾3770億元。

2018年歌爾股份進入AirPods供應鏈,最終成為AirPods的第二大代工廠,佔據30%的代工份額。2019年至今,歌爾的股價上漲了近490%,市值從217億元增長至超1270億元。

2020年前三季度,歌爾股份實現營業收入347.3億元,較上年同期增長43.9%;歸母淨利20.16億元,同比增長104.71%,符合預期增長,且Q3單季度高於前兩季度之和,預計全年累積淨利潤增長115%-125%。三季度歌爾股份業績增長主要是因為智能無線耳機、精密零組件及虛擬現實等相關產品銷售收入增長所致,盈利能力改善。

財報顯示,歌爾股份毛利率從2019年的15%增長至17%,淨利率從2019年的不到4%,增長到1-3Q的5.8%。同時,歌爾越來越重視研發創新,每年營收的6%-8%投入研發,去年超過20億元,近五年來已經超過80億元。

此外,賽騰股份也值得關注,該公司在2016年開發出無線耳機組裝設備,並供貨蘋果。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.