新能源車11月銷量亮眼,比亞迪漢月銷首度破萬

截至2020年12月4日,已有多家車企先後發佈了上個月汽車銷售數據。從數據上看,其新能源業務取得了不錯的成績,部分個股也在績後迎來上漲甚至一波爆發。但從多日走勢上看,板塊估值處於高位,相關個股向上突破明顯遇阻。

此前推出爆款B級新旗艦車型“漢”、改款刀片形磷酸鐵鋰電池而迎來“戴維斯雙擊”的比亞迪,在11月繼續表現強勢。

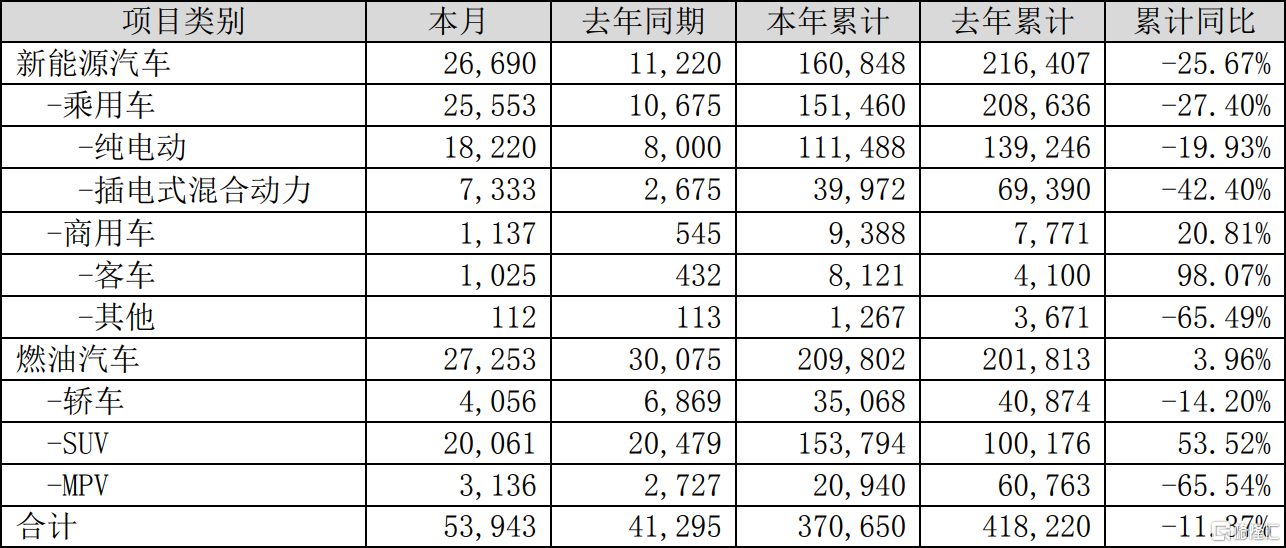

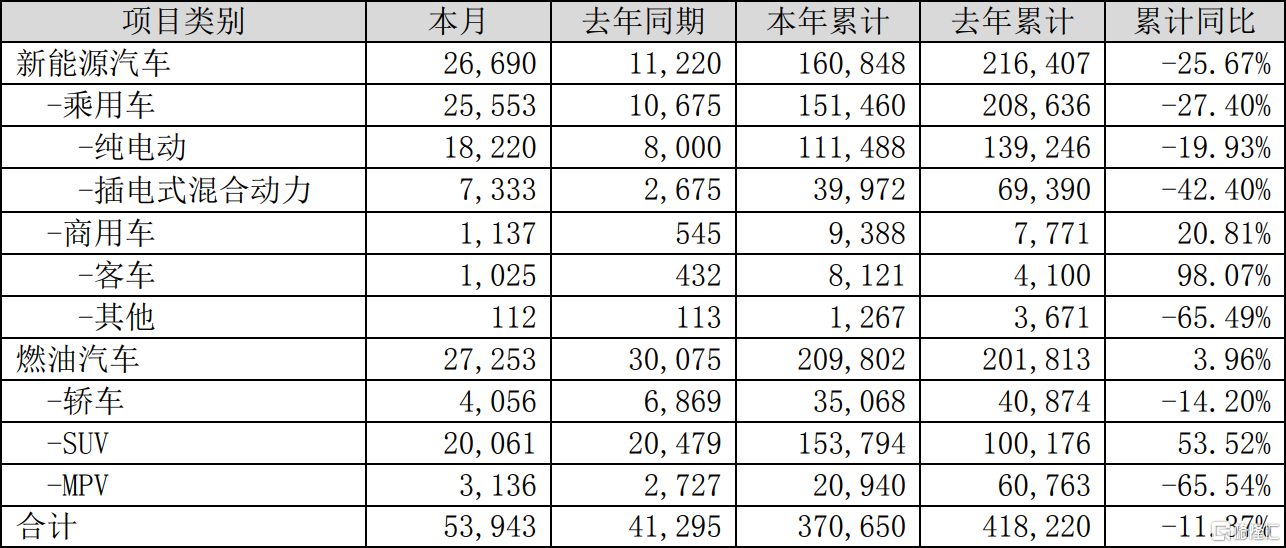

新能源汽車銷量26690輛,去年同期為11220輛,估算同比增長138%。其中,比亞迪漢11月銷售10105輛,再創新高,連續4個月銷量攀升,累計銷售28467輛。

業績發佈次日,比亞迪一改多日陰跌的趨勢低開後震盪爬坡,今日早盤漲幅超過4%後回落,後續維持在2%以內。但從多日股價走勢上看,自11月6日達到198.85元高位之後,比亞迪A股已下跌超過8%。

在A00汽車賽道上,五菱宏光MINI EV同樣延續了前幾個月的強勁銷售業績。

該車型單月累計銷售33094輛,環比增長60.4%,經連續兩月蟬聯國內新能源零售榜單銷冠;單日銷量最高突破2000輛,截至目前成為今年國內新能源市場中唯一單月銷量破三萬的車型。

與比亞迪股價走勢相似,公佈業績當天年實現小幅反彈,但自11月19日達到1.26港元的高位後,其股價至今已跌去超過11%。

中概股造車“三巨頭”最近發佈的業績也很亮眼。

蔚來汽車公佈的數據顯示,11月份蔚來汽車交付新車5291輛,繼10月份交付量再次突破5000輛,連續第四個月創蔚來品牌單月交付數新高,自今年4月以來連續八個月實現同比翻倍增長。

11月份理想汽車交付量為4646輛,環比增長25.8%,同時也是創下單月交付量紀錄。

小鵬汽車11月交付量是4224台,同比勁增342%,創下2020年內新高。

但三家公司隔夜美股走勢插水,蔚來、理想、小鵬分別下跌5.48%、7.02%、7.46%。而三家企業的對手特斯拉則上漲4.32%,截止收盤市值達到5624.65億美元

其中小鵬汽車遭到瑞銀集團下調評級指“中性”,理由是股價上漲太多,但仍看好小鵬的發展前景。截至最近一個報告期,小鵬汽車仍然處於虧損狀態,而PS固執為71.72倍,遠超特斯拉的20.8倍估值。

事實上,自中國市場受到新冠肺炎疫情衝擊減退以來,新能源汽車銷量出現報復性回彈,帶來資本市場對相關板塊的追捧。

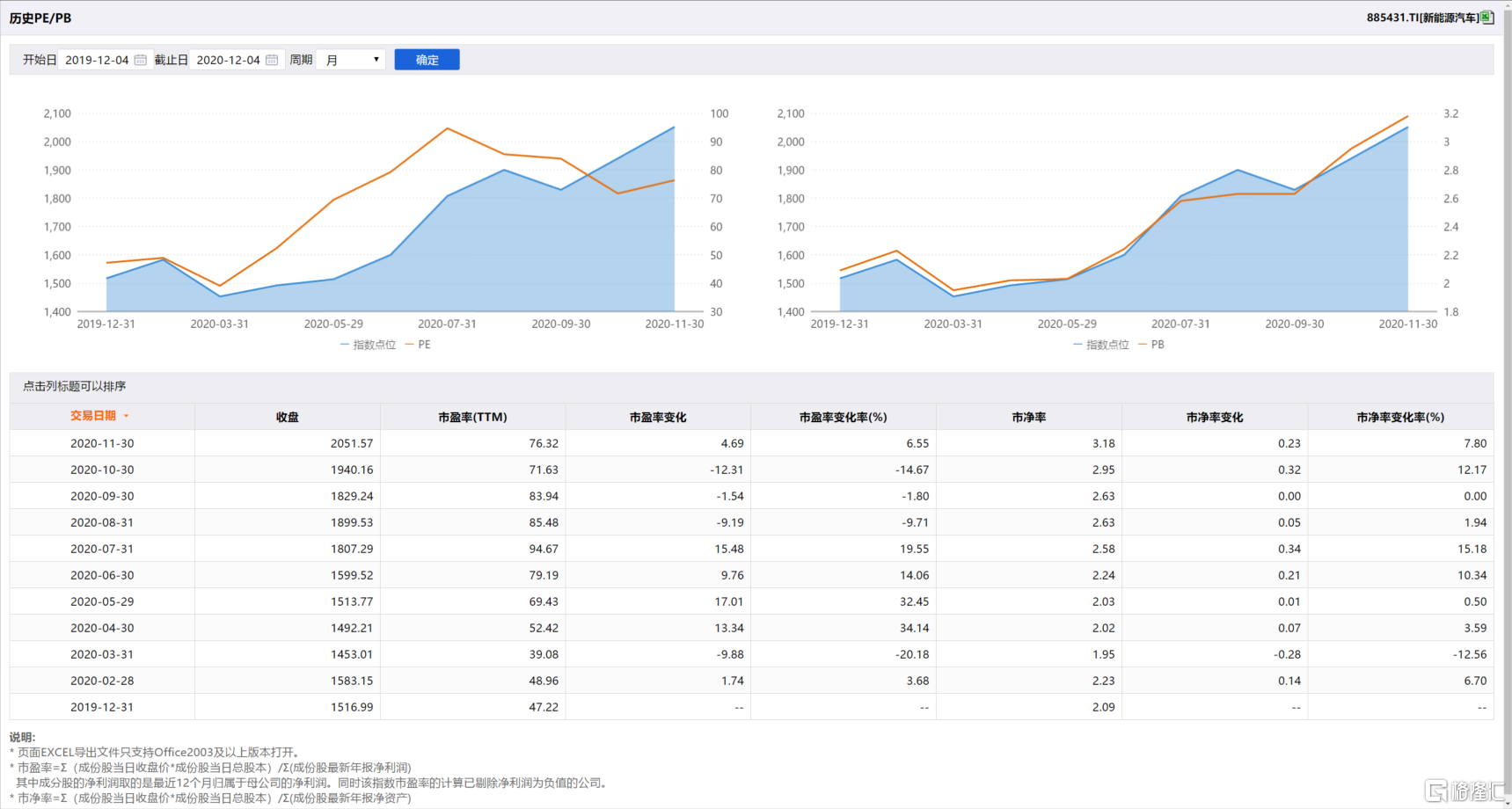

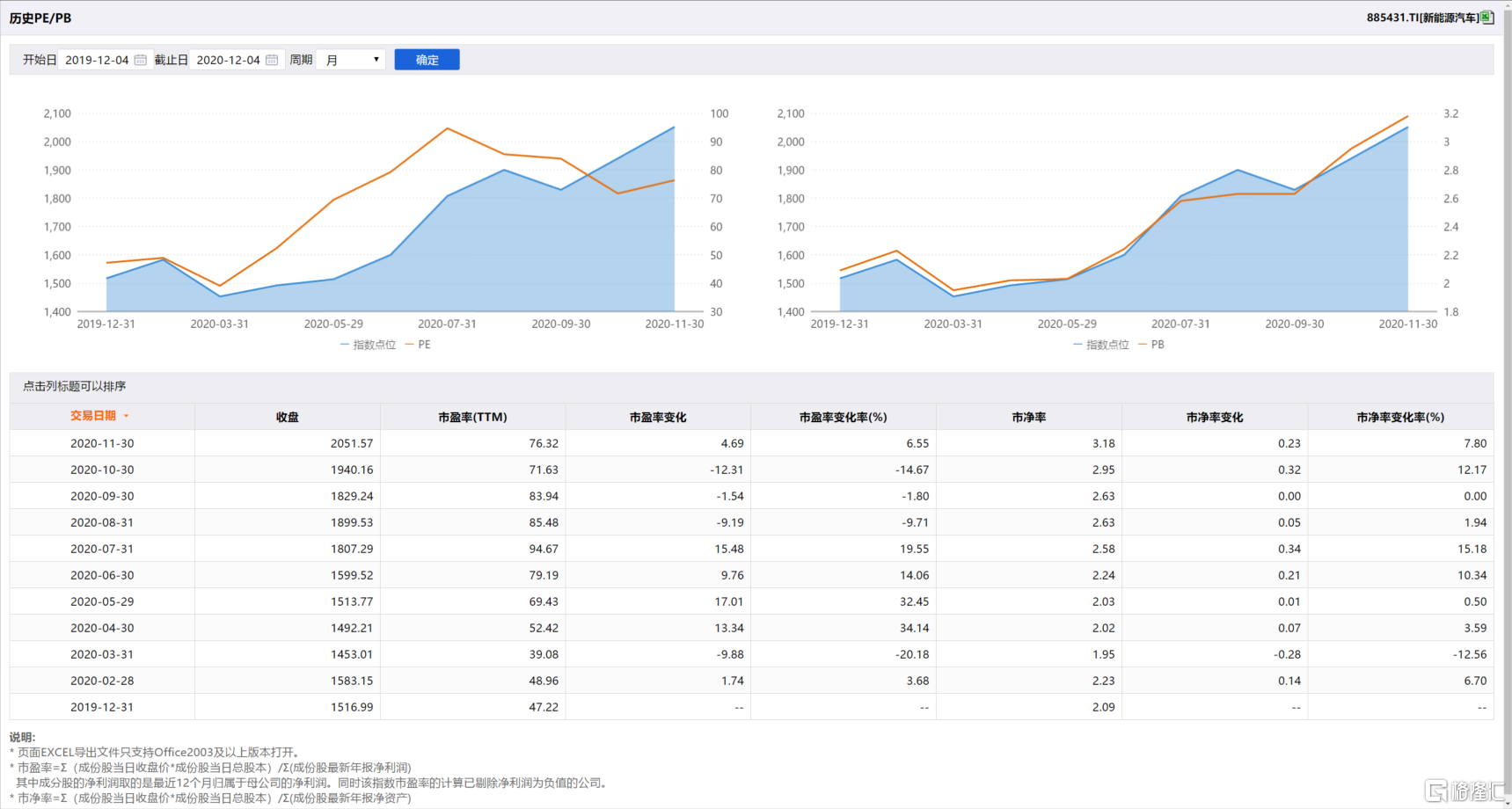

新能源汽車指數(885431.TI)自2020年2月錄得1389.51點的低位,至今已上漲近48%;相關PE和PB估值也已處於歷史高位。

但11月下旬隨着新能源汽車題材熱度退潮,資金輪換趨勢下,新能源車板塊多家公司陸續衝高回落,交易量也出現一定程度的收縮。

但值得投資者關注的是,結合個股利好消息,個別公司偶有反彈起爆,如長安汽車在公佈於華為、寧德時代的合作項目後,10天內連續錄得3個漲停板。

因此11月中國車企新能源車銷量走強,有望在中短期拉昇板塊估值,為投資者帶來操作的機會。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.