運價漲漲漲!航運投資風口來了?

作者:於祥明

來源: 上海證券報

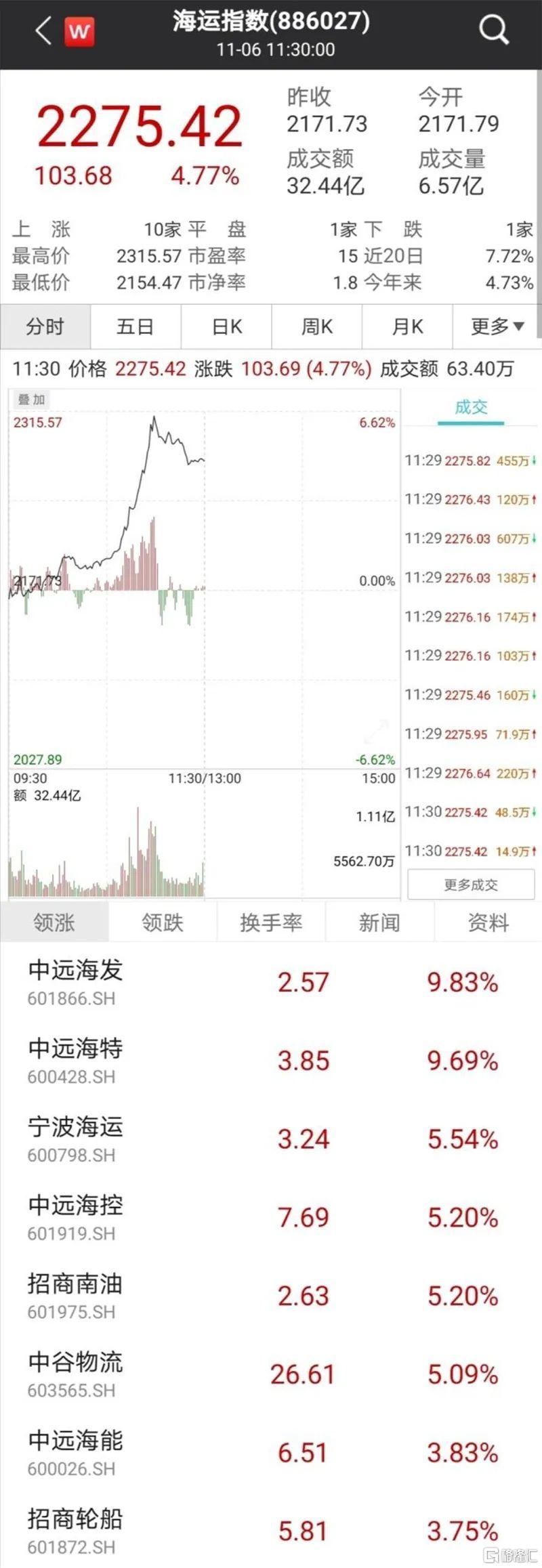

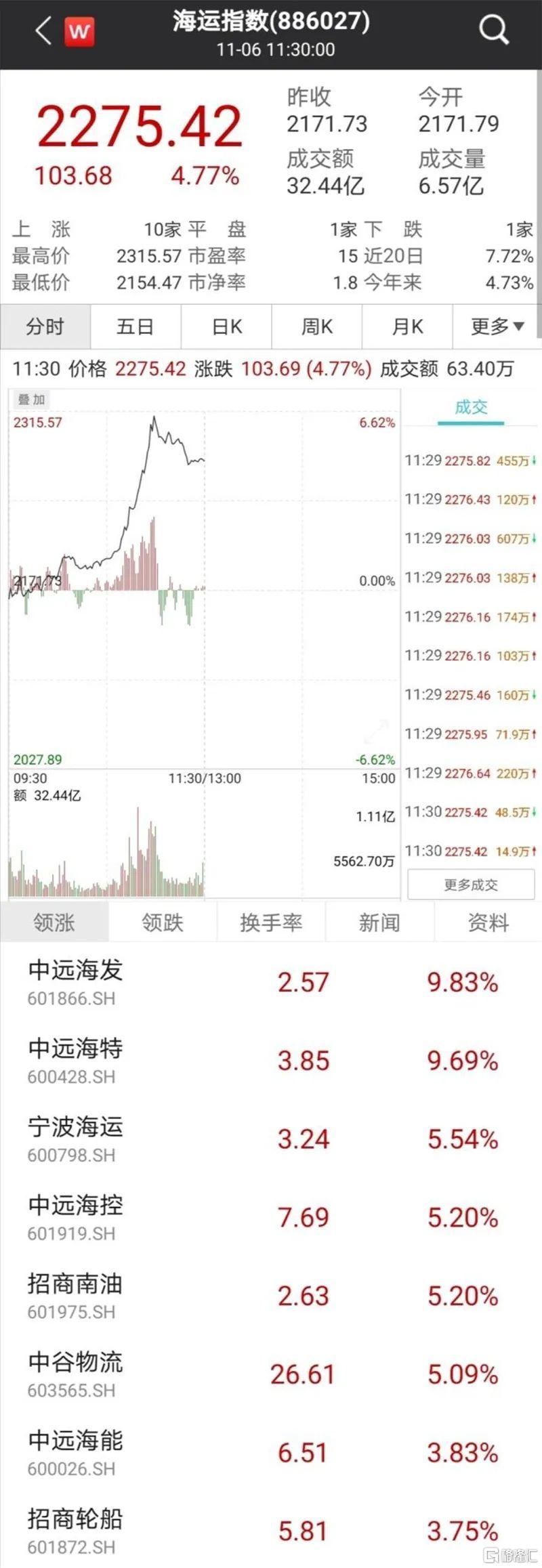

今日早盤,港口航運概念股異動,中遠海發拉昇觸板,中遠海特、中遠海控、寧波海運、招商輪船等紛紛跟漲。

很多人沒想到,航運集裝箱市場在今年的市場環境下還能逆風飛揚。

中國港口協會最新數據顯示,重點監測的沿海港口集裝箱業務進一步提速。10月份,八大樞紐港口集裝箱吞吐量同比增長11.1%,增速創今年新高。其中,外貿增長11.9%,較上月加快3.3個百分點;內貿同比增長9.0%,較上月明顯提速。

隨着,航運業進入傳統旺季,市場樂觀看多的情緒也愈來愈高漲。

航運價格逆風上漲

回想今年年初,受疫情影響,很多人預期全球貿易下滑,首當其衝會殃及航運業。

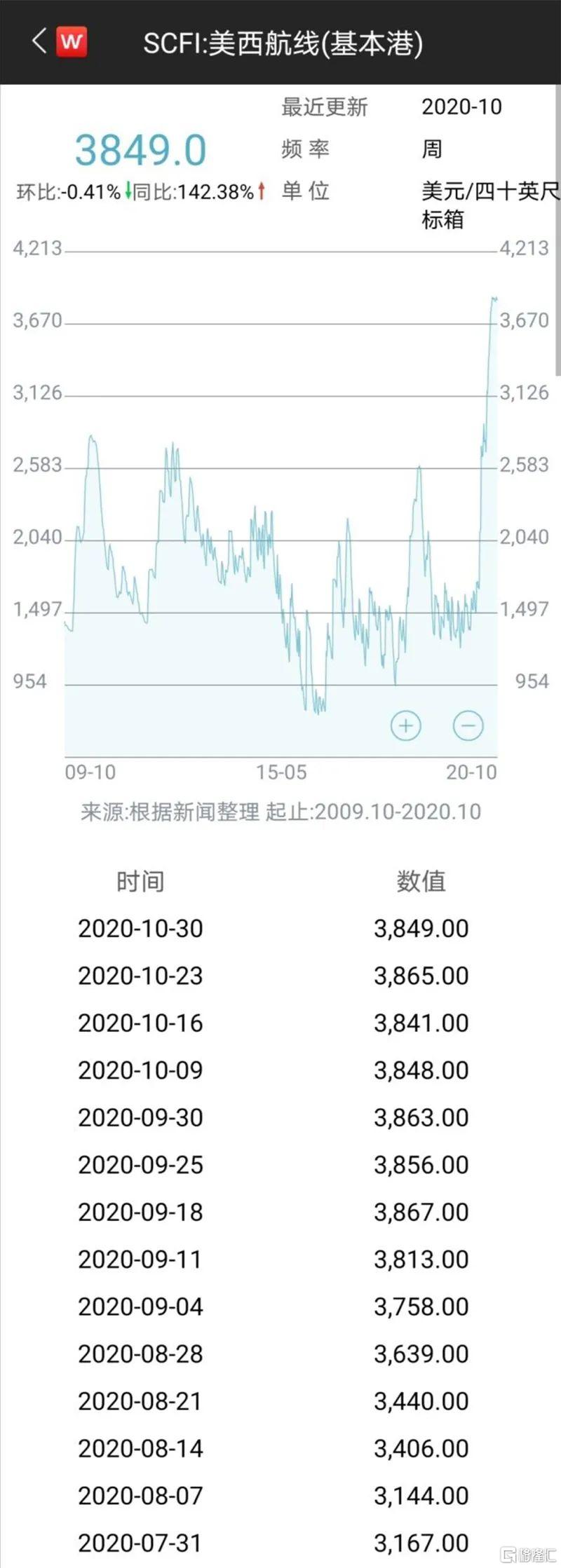

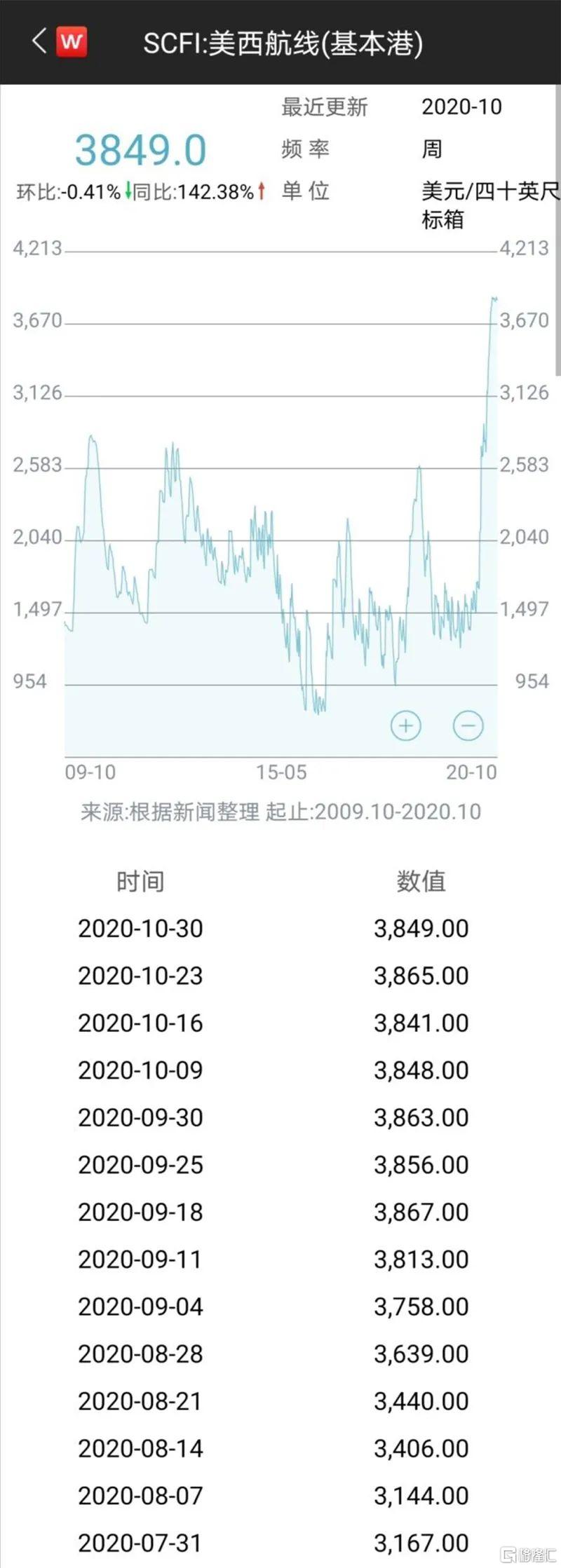

然而,出乎意料,自二季度以來,特別是今年7月份以來,航運價格逆風持續上漲,美西航線運價更是較年初漲了近三倍,最高升至3867美元/FEU(40英尺集裝箱)。

記者跟蹤發現,6個月時間內,中國出口至歐美的國際集裝箱海運價格翻番。受運價持續攀升影響,中國最大的集裝箱運輸企業中遠海控前三季度淨利增超八成,達到38.6億元。其中,第三季度淨利潤27.22億元,同比、環比漲幅均超兩倍。

中信建投分析師認為,歐美及其他海外地區疫情持續發酵使得當地經濟處於冰凍狀態,生產活動大幅受限,而本地製造與本地消費產生供給缺口,客觀上刺激外部貿易需求增加。這一問題並不會在短期內得到有效解決。

明年行情能否持續仍不明朗

“目前我司集裝箱訂單已排至明年春節前後。”中集集團近日回答投資者調研時直言,集裝箱市場近期需求有明顯增長。究其原因,一是受疫情影響,出口的集裝箱散落在全球各地,迴流不暢;二是國外政府出台疫情紓困計劃等財政刺激,導致短期內需求端(例如生活和辦公用品)超強表現,宅經濟火爆。

對於後市判斷,中集集團認為,儘管目前集裝箱需求端增長強勁,但後續仍需視疫情影響和貿易迴流情況而定,同時結合歐美財政刺激對貿易需求拉動的程度。總體看,判斷至少“缺箱”局面會持續一段時間,但明年全年情況並不十分明朗。

記者從各方機構瞭解到,市場對集運市場的樂觀預期有更深層次原因。

中金公司研究部董事總經理、交通運輸及基礎設施研究主管楊鑫認為,中遠海控三季度業績超預期,並且旺季過後的運價支撐水平有望超預期,為明年的長協合同談判奠定基礎。

她認為,基於目前的行業格局(集裝箱航運行業集中度大幅提升,前十大運力的份額佔比已從10年前低於60%,提高到83%),市場從長期角度可期待行業盈利中樞和估值水平的抬升。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.