重磅政策利好落地,风电股集体爆发!

在今日A股主要指数下跌,市场表现平淡的情况下,风电概念逆势上涨,全天维持强势。截至收盘,泰胜风能、双一科技、大金重工、东方电缆、金风科技、天顺风能、吉鑫科技等7股涨停,金雷股份大涨逾17%,神力股份、永福股份等涨逾8%;日月股份、禾望电气等多股跟涨。

数据来源:同花顺(下同)

数据来源:同花顺(下同)

港股风电板块亦涨势较好,金风科技大涨逾22%,协合新能源涨近9%,龙源电力涨6.2%,大唐新能源涨4.2%。

风电股今天集体爆发,还要从早间一则重磅消息的刺激说起。今日,2020年国际风能大会在北京举行,会上发布了《风能北京宣言》。宣言提出,为达到与碳中和目标实现起步衔接的目的,在“十四五”规划中,须为风电设定与碳中和国家战略相适应的发展空间。

具体数据上,一是保证年均新增装机5000万千瓦以上;二是2025年后,中国风电年均新增装机容量应不低于6000万千瓦,2030年至少达到8亿千瓦,2060年30亿千瓦。

光伏、风电等新能源板块近期一直是市场关注的热点,风电板块今日主力资金净流入达13.6亿元。除今日领涨两市之外,从9月底至今,A股风电指数已多日连涨近60%。

政策利好不断是板块大热的主要驱动因素。近期各种信号表明,“十四五”将加强环境建设,有可能对光伏、风电等可再生能源领域提供政策支持。在这一政策基调下,地方政府纷纷响应:

广东省战略性产业集群行动计划推动形成集海上风电研发、制造、运维一体的海上风电的全产业体系;广西强调2022 年初步构建海上风电装备产业园,力争年产风电装备装机容量100万千瓦以上;云南提出800万千瓦风电规划装机目标;河北省要求到2020 年,全省风电装机达到2080万千瓦,2025年达到2600万千瓦以上。

政策不只是一串数字,还传达着强烈的市场信号。政策面的利好会引发市场憧憬,但除此之外,风电板块内部公司的业绩情况亦表现不俗。

近期,A股上市公司三季报披露大幕缓缓拉开。截至今日,已有近900家上市公司公布了三季度业绩预告,风电行业多家代表企业三季度业绩预计大幅增长。

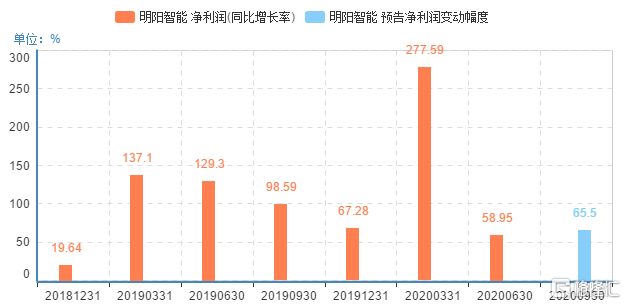

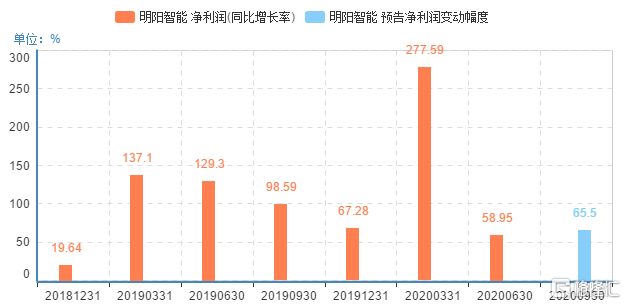

其中明阳智能三季度预告净利润8.5亿,较上年同期的5.1亿元同比升65%。净利润增加的2020年1-9月我国风电行业整体保持快速发展态势,公司在手订单维持高位及供应链整合能力增强,使得公司风机交付规模上升导致营业收入增加;

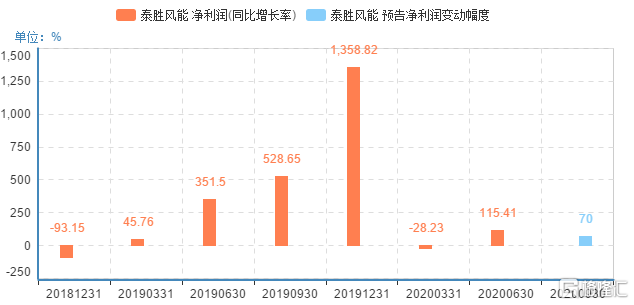

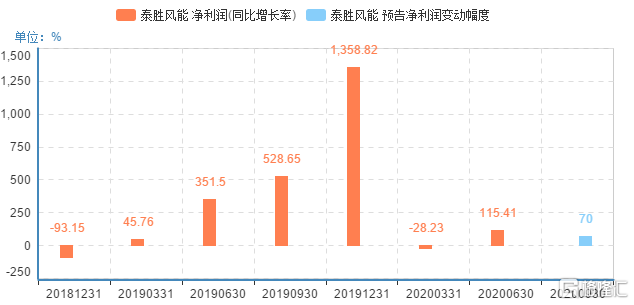

泰胜风能三季度预告净利润2.3亿,较上年同期1.3亿元,同比大幅上升70%。业绩变化的主要原因是三季度海上风电装备业务收入较去年同期有超过60%的增长;

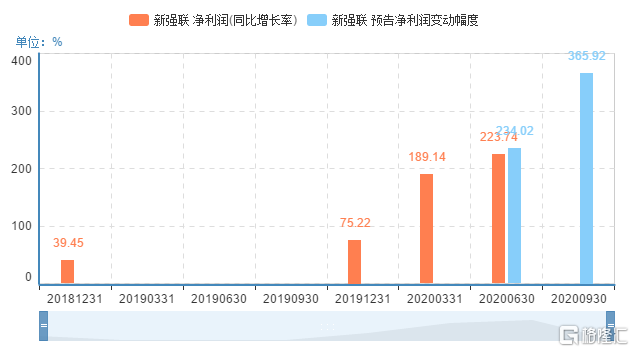

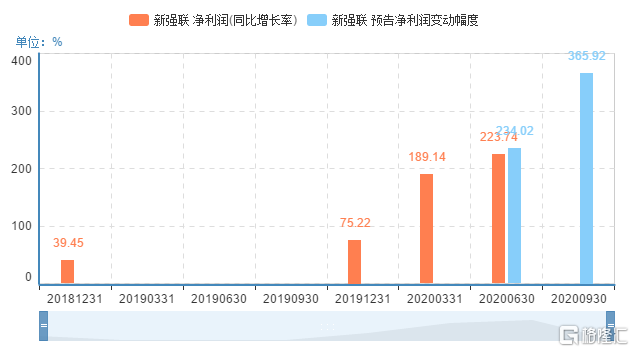

金雷股份三季度预告净利润3.4亿,上年同期为1.4亿元,同比大幅上升144%;新强连三季度预告净利润2.6亿,上年同期为5634万,同比上升366%。

以上风电行业代表性公司三季度业绩预告表现突出,基本都与下游产业景气度持续向好,市场需求旺盛相关。

业内人士预计,国内风电需求或在2021年达到30GW;能源研究机构伍德麦肯兹发布的报告指出,2019年到2023年,全球风电每年平均新增装机量将达到71GW,未来五年全球海上风电新增装机量将达到129GW,年复合增长率将达到26%。

与风机仅供应国内不同,零部件可以全球供应。国内外市场皆处于高速成长周期,一定程度上平衡了单一市场的波动风险。叠加目前A股风电板块估值整体处于较低水平,未来板块成长性值得关注。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.

数据来源:同花顺(下同)

数据来源:同花顺(下同)