兩大主力出逃250億!但這些股被逆勢增持

來源:東方財富網

進入9月,A股整體回調,本月滬指下跌3.29%,深成指下跌5.43%,創業板指下跌6.36%。作為投資者關注的兩路資金,北向資金和融資客也均在“出逃”,北向資金淨流出139億元,融資餘額減少115億元。這樣的背景下,誰正在被逆市加倉呢?

01

本月融資餘額減少115億

對融資客來説,9月前兩個交易日,融資餘額是連續增加的,此後融資餘額出現7連降,9月10日更是下降110億元,14、15日兩天又是連續增加,融資餘額累計減少115億元。

數據來源:東方財富Choice數據

02

融資客瘋買黃金ETF

從個券交易看,本月以來融資客對75只個股或ETF基金淨買入過億,淨買入金額前三位均為黃金ETF,其中華安黃金易ETF淨買入9.21億元,博時黃金ETF淨買入8.8億元,易方達黃金ETF淨買入8.65億元。而個股方面,中芯國際本月被融資客淨買入最多,為7.99億元。

相反,融資客本月淨賣出過億的個券有96只,其中融資淨賣出最多的三隻個股是中國平安、中興通訊和沃森生物,淨賣出金額分別是9.49億元、4.79億元和4.39億元。

03

北向資金淨流出139億元

和融資客一樣,北向資金本月以來,也呈淨流出狀態,累計淨流出139億元。具體看交易日,前一半主流出,而後一半主流入。前5個交易日,北向資金天天淨流出,而9月8日以來的7個交易日,則只有2天是淨流出。

數據來源:東方財富Choice數據

04

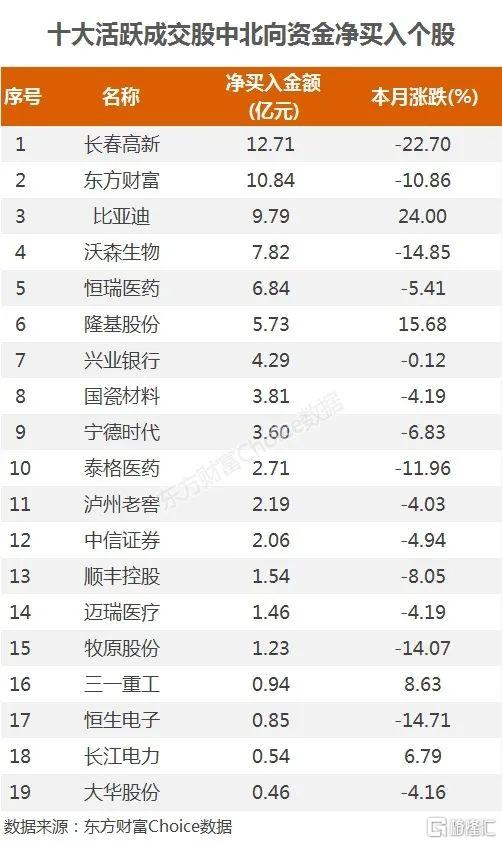

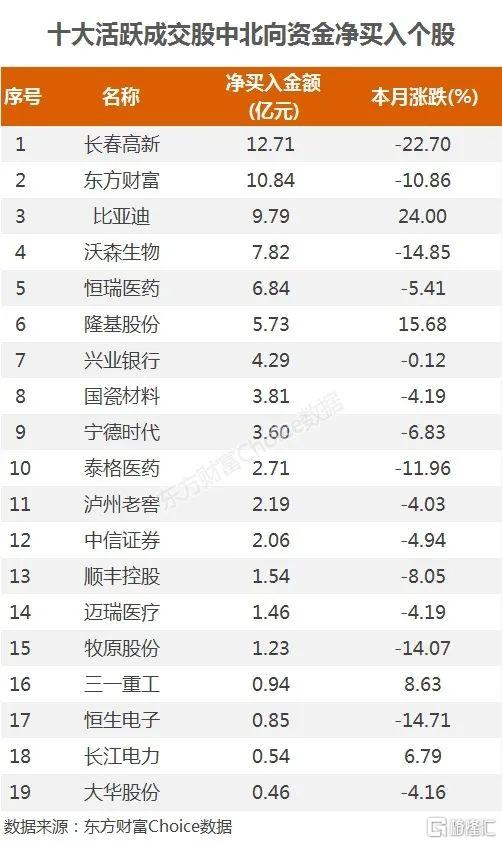

19只十大活躍成交股被淨買入

從上榜十大活躍成交股來看,本月至今有19股被陸股通淨買入15股被淨買入過億,長春高新被淨買入最多,為12.71億元。東方財富緊隨其後,淨買入金額10.84億元。

相反,本月上榜十大活躍成交股的公司中,陸股通淨賣出最多的三家公司是中國平安、京東方A和藥明康德,分別被淨賣出12.31億元、11.88億元和10.98億元。

05

7股被融資客、北向爭相買入

除了上述這些融資客和北向資金分別搶籌的公司外,統計發現,其中有7只個股是融資客和北向資金爭相買入的(北向資金淨買入金額按區間持股量增加乘以個股區間成交均價進行計算),本月均被融資客和北向資金淨買入過億。

比亞迪是本月融資客和北向資金合計淨買入最多的公司,淨買入金額為16.43億元。牧原股份和隆基股份緊隨其後,本月被融資客和北向資金合計淨買入13.78億元和11.33億元。此外,永輝超市、橫店東磁、索菲亞和樂普醫療也是融資客和北向資金爭相買入的個股。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.