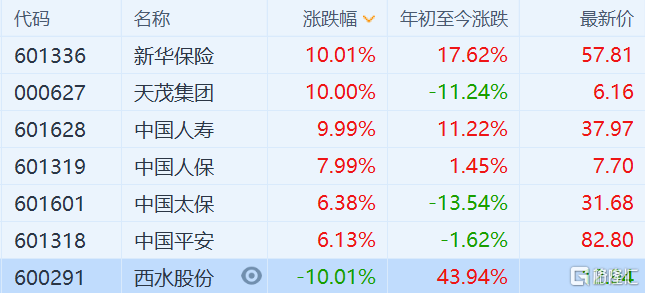

險企權益類投資空間釋放 保險股全線大漲 3股漲停 中國平安漲超6%

格隆匯 07-20 15:17

格隆匯7月20日丨新華保險、天茂集團、中國人壽漲停,中國人保漲近8%,中國太保和中國平安漲超6%;西水股份因“暴雷”跌停。近日,險資權益類投資迎來重要舉措:7月15日李克強在國務院常務會議上提出“取消保險資金開展財務性股權投資行業限制,在區域性股權市場開展股權投資和創業投資份額轉讓試點”;7月17日銀保監會發布《關於優化保險公司權益類資產配置監管有關事項的通知》,明確八檔權益類資產監管比例,最高可到占上季末總資產的45%。大中型保險公司投資權益類資產的比例上限,由原來的30%提高到35%。長城證券數據顯示,根據2019年各上市保險公司償付能力充足率,估算出主要上市險企將有逾萬億元權益配置空間可逐步釋放。上市險企中,權益配置空間比例由大到小依次為中國太保>新華保險>中國平安>中國人壽>中國人保>中國太平。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.