牧原股份:半年狂賺百億,下半年怎麼看?

作者 | 格隆匯小編

高估值公司中報業績一地雞毛,反觀豬圈一亮業績都晃花了觀眾的眼!

這幾天豬圈企業上半年業績預告相繼出爐,牧原股份、温氏股份、新希望、正邦科技、天邦股份上半年盈利預增都超過10億元。受益於良好的業績表現,豬圈企業股價也持續上行。

圖:豬肉板塊價格走勢——日K

養豬大佬們上半年是賺得盆滿缽滿,這主要受益於“二師兄”身價的飆升。去年非洲豬瘟告一段落後,豬價在今年上半年短暫調整,然而,在非洲豬瘟和疫情的雙重疊加之下,國內生豬產能恢復不及預期,加之歐美疫情導致進口豬肉受限,供給面偏緊,生豬銷售價格於五月中旬反彈再度上行。

圖:半年生豬價格走勢

豬價上半年經歷短暫回調後,從5月低點至今,已反彈10元/公斤,當前豬價仍處於歷史高位運行。

後續豬價能飛多高,還是要看能繁和存欄等數據以及飼料等進口價格的變化,但就目前的情況而言,下半年國內生豬產能依然受限,豬價很難會出現大跌的情況。

鑑於對豬企下半年業績的明朗預期,下半年豬肉板塊仍是股市投資的主線,而有一家公司無疑是主線中的重點。

那就是——牧原股份。

首先,在豬圈狂歡的背景下,牧原股份是唯一一家半年盈利超過百億的公司。

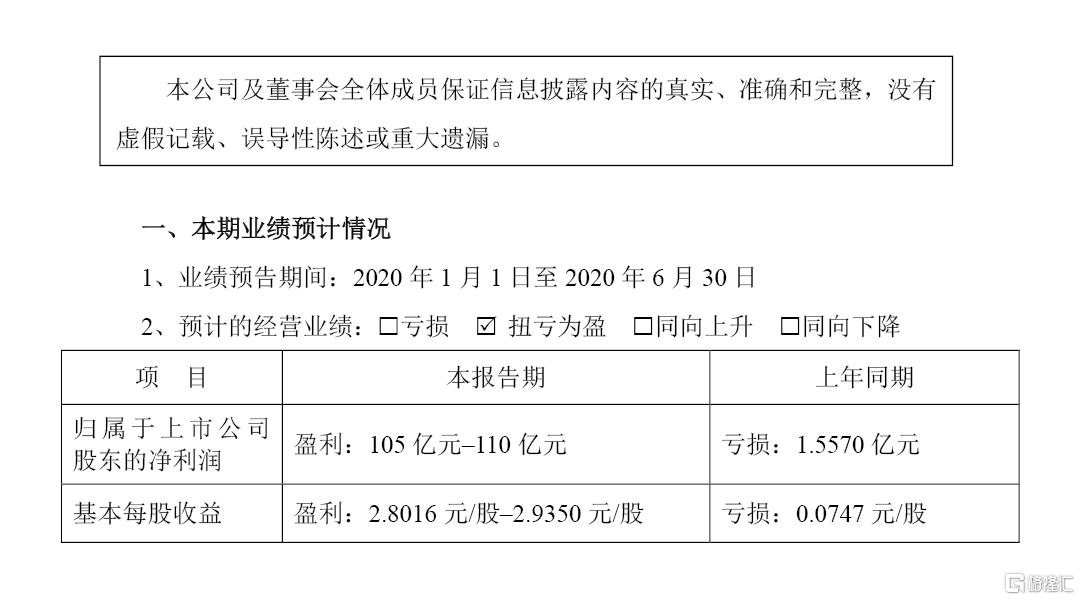

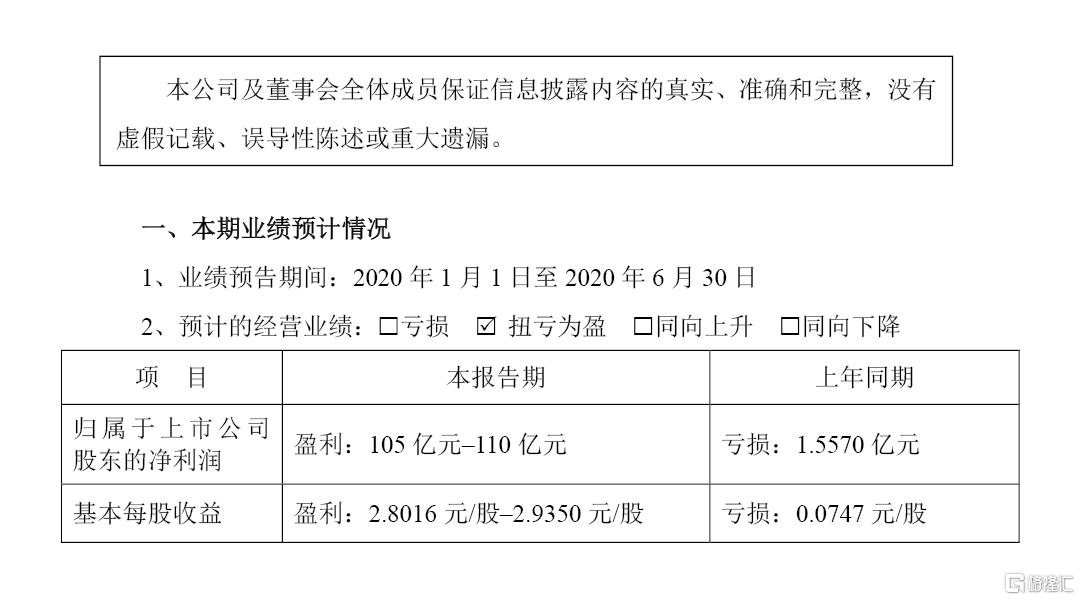

據公司公告,上半年牧原股份預計盈利達105億-110億元,去年同期為虧損1.56億元。公司上半年共銷售生豬678.1萬頭,同比增長16.61%,銷售收入為207.20億元,同比增長202.17%。

圖:牧原股份上半年業績預告

其次,牧原股份在資本市場的表現也完全無愧龍頭企業身份。

圖:牧原股份年初至今股價上漲86%

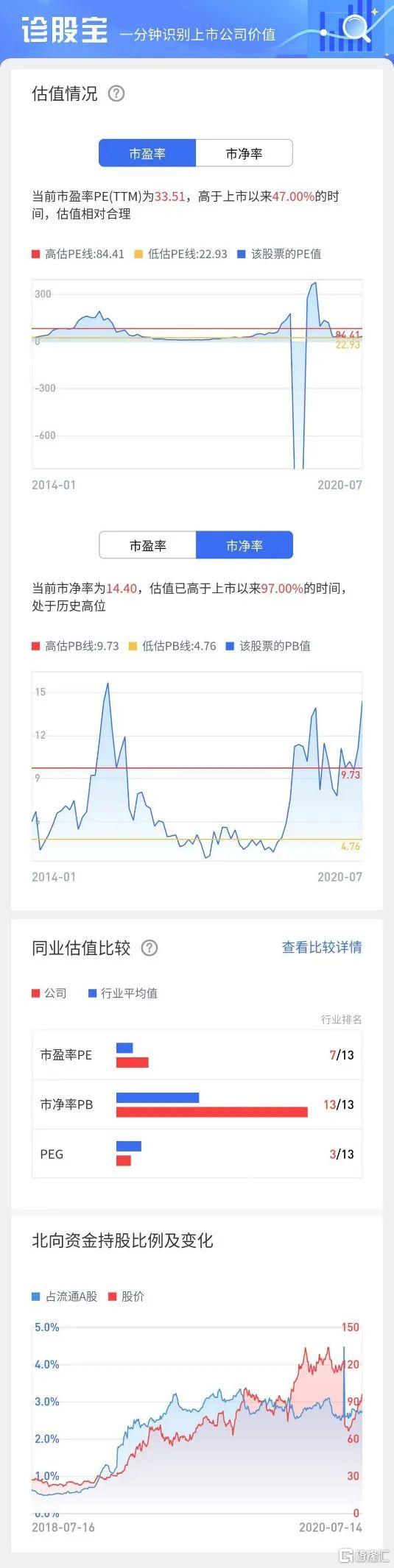

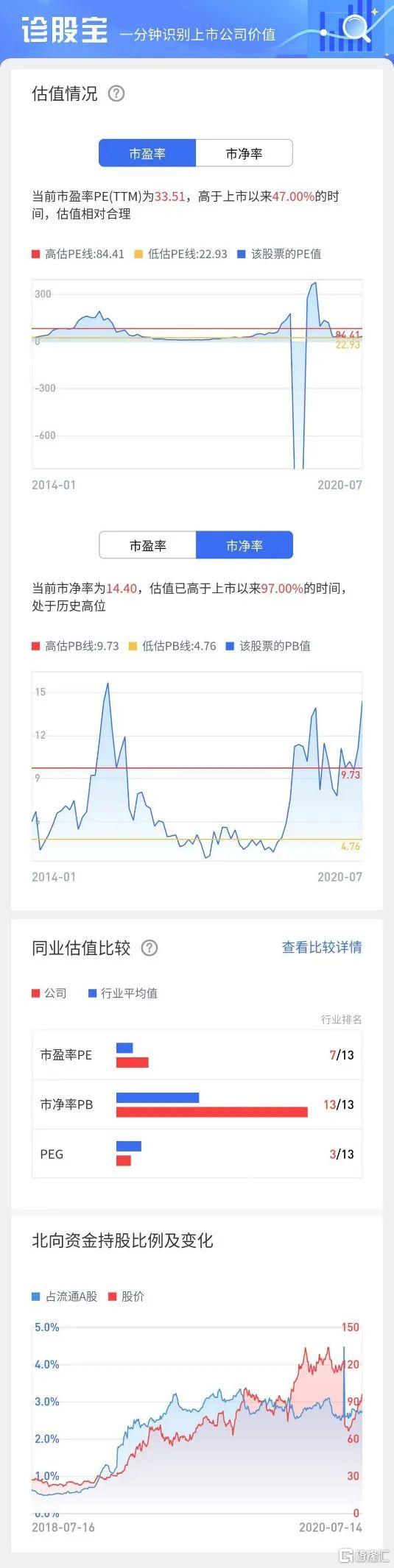

然而,牧原股份領漲板塊的同時,也意味着及較高的估值。當前牧原股份市盈率33.50,高出整個板塊50%;市淨率也來到14.40,更是板塊平均值的兩倍以上。打鐵還需自身硬,牧原股份的體質對得起這個價格嗎?

今天我們從客觀的數據角度看,牧原股份當下的價格是否合理?是否有足夠動能支撐股價繼續上漲?

話不多説,讓我們開始解讀牧原股份的現狀。

總結

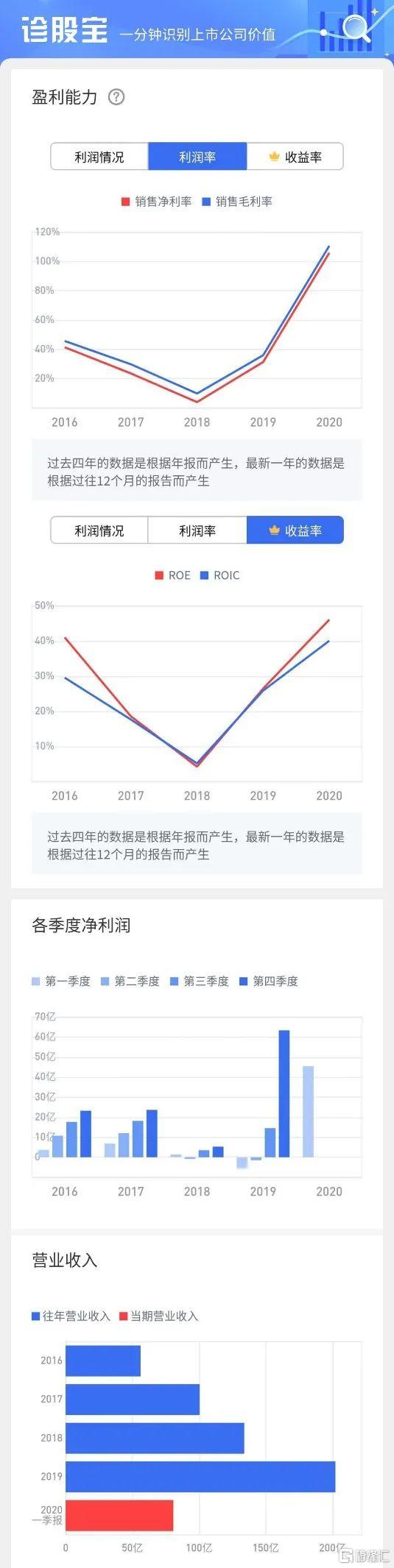

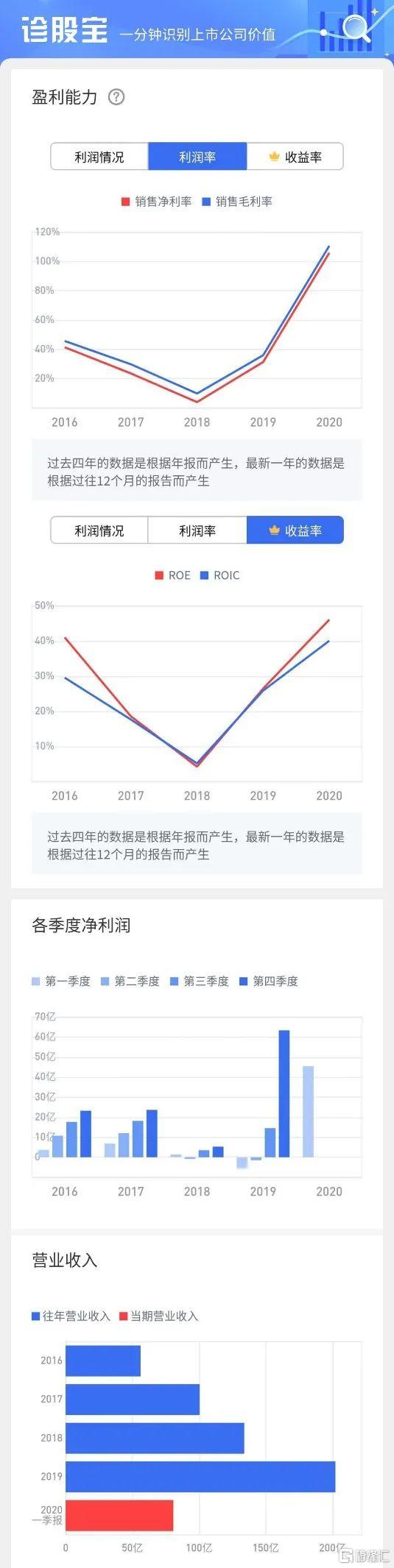

牧原股份ROIC高達40.06%,盈利能力極強。另外市淨率雖高於上市以來97%時間,處於歷史高位,需警惕風險。近兩年利潤快速上漲帶動市盈率,目前市盈率僅高於上市以來47%時間。

資金面,北向資金自進入六月份後保持3%左右流通佔比,目前佔總流通A股2.76%,另有基金持股3.68%、社保持股0.42%,頗受機構青睞。

免費診斷更多股票?認準格隆匯-診股寶

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.