疫情带火抗疫股,上市公司业绩大幅预喜,然抗感冒药却遭“另一重天”

作者:徐红

来源:科创版日报

随着上市公司进入上半年业绩披露季,A股也随即迎来一波波的半年报行情。

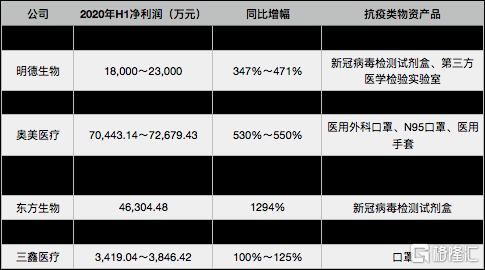

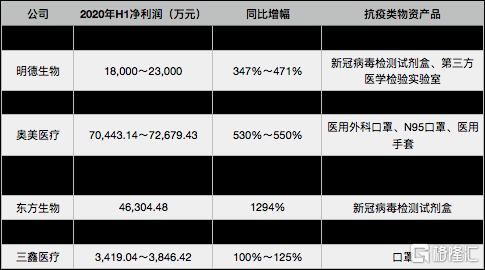

上周(6日-11日),振德医疗(603301.SH)、明德生物(002932.SZ)、英科医疗(300677.SZ)、奥美医疗(002950.SZ)、东方生物(688298.SH)、万孚生物(300482.SZ)等上市公司披露的业绩预告显示,2019年上半年的业绩均大幅预喜。受此利好消息刺激,整个医疗器械板块亦持续上涨。

图|业绩大幅预喜抗疫个股

值得注意的是,以上这些公司业绩大幅预增的原因皆与新冠疫情有关。受上半年的新冠疫情影响,口罩、防护服、防护手套等防疫类防护用品,以及新冠检测试剂、呼吸机等抗疫医疗设备和检测产品的需求都出现剧增,带动企业业绩增厚。

不过,疫情对于其他很多产品及企业来说仍是利空,而首当其冲的可能就是抗感冒药这一品类。中国医药工业信息中心PDB药物综合数据库数据显示,2020年第一季度,国内样本医院感冒用药销售金额为8331.85万元,同比下降了24.83%。

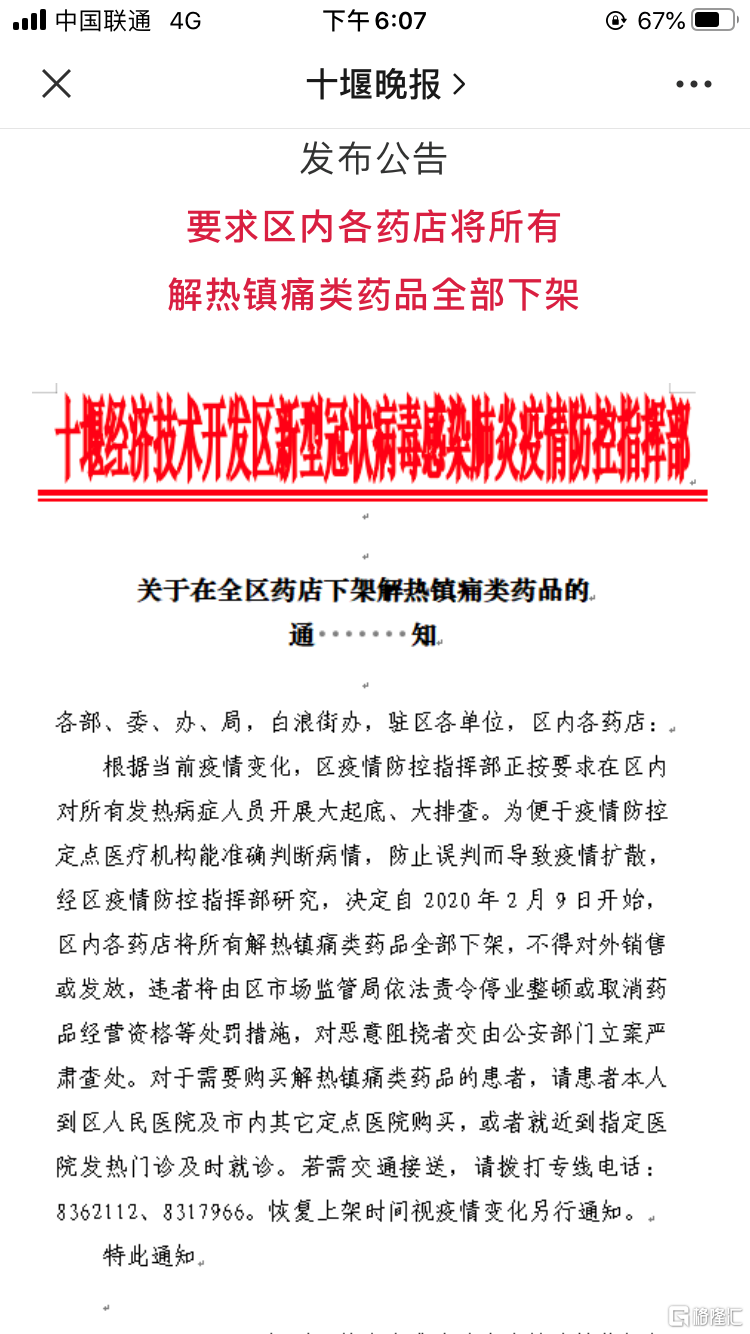

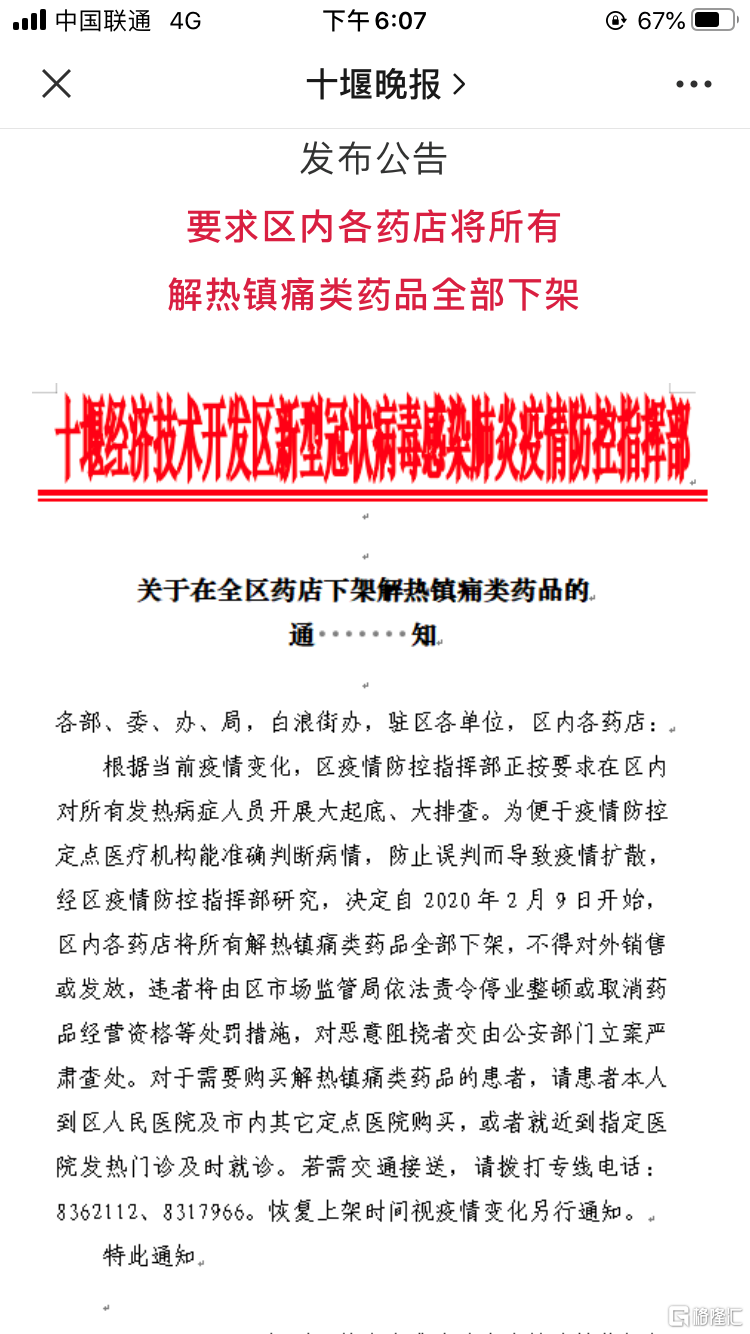

“今年上半年,一方面因为疫情的原因,零售药店应各地政府要求严格限制解热镇痛药品的销售,导致相关药物销售下滑明显。另一方面,新冠疫情期间由于民众呼吸道疾病防护意识增强,积极佩戴口罩,流感发病率也有所降低,这同样会影响药物的销售。”一位业内人士向《科创板日报》记者表示。

这样的情况也在某连锁药店上市公司处得到了证实,对方并向记者表示,目前,除个别地区外,很多地区已经解除限售令,不过购药要求登记的指令对药品的销售仍有一定负面影响。

公开资料显示,解热镇痛类药物一直是医药市场上一大类重要品种,同时在OTC非处方药物中的比重也比较大,达到了三分之一左右。迄今为止,已上市的解热镇痛药物约有数十个,核心品种则有扑热息痛(对乙酰氨基酚 )、阿司匹林、布洛芬等,涉及的上市公司分别对应有葵花药业(002737.SZ)、人福药业(600079.SH)、辰欣药业(603367.SH)、新华制药(000756.SZ)等,不过由于这些公司产品线较为丰富,因此个别产品销售下滑或对公司整体盈利影响有限。

除了解热镇痛类药物以外,由于民众养成佩戴口罩使得发病率及药品销量双双下降的还有抗过敏药。以A股抗过敏药龙头我武生物(300357.SZ)业绩来看,今年一季度,因疫情影响新患增加,公司净利润同比下滑37.45%至4136.87万元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.