中國生物製藥(01177.HK):腫瘤板塊強勁,研發投入增加,維持“買入”評級

機構:國信證券

評級:買入

業績符合預期,腫瘤板塊增長強勁

2020 年一季度中國生物製藥實現營收 62.22 億元(+0.2%),歸母淨利潤 8.62 億元(+0.6%),基本歸母淨利潤 8.34 億元(-14.6%) 。在疫情影響下,公司營收端與去年同期基本持平,符合我們的預期。分主要板塊看,抗腫瘤板塊實現營收 19.84 億元(+61.2%) ,增長強勁,佔總營收的比例提升至 31.9%。腫瘤板塊的主要增長動力來自於安羅替尼、雷替曲塞等大品種的持續放量,阿比特龍、伊馬替尼、吉非替尼等受益於帶量採購的品種的增長。

研發投入保持增長,重磅品種持續收穫

公司一季度研發投入 9.94 億元,其中費用化 9.74 億元(+12.6%),研發費用率上升至 15.7%(+1.7pp) 。公司多年來大力投入研發已經進入收穫期,未來三年,公司預計每年將獲得超過 30個藥品批件,其中不乏峯值銷售在 10 億元以上的大單品。今年 5 月,與康方合作的 PD-1單抗的上市申請獲受理,重組 VIII 因子的上市申請也已獲得受理。公司重點打造的腫瘤領域和呼吸領域已進入收穫期,對生物藥領域的長期佈局也將見到成果。

風險提示:

帶量採購影響超出預期、在研品種上市時間不及預期

投資建議:轉型創新關鍵期的龍頭公司,維持“買入”評級

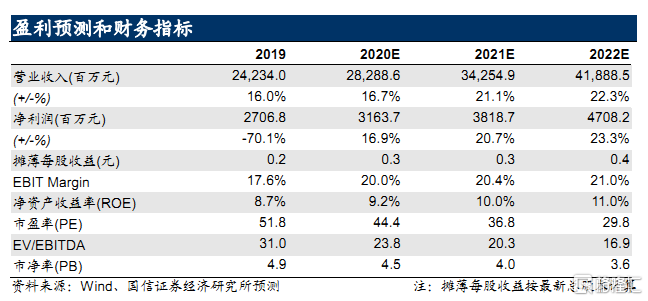

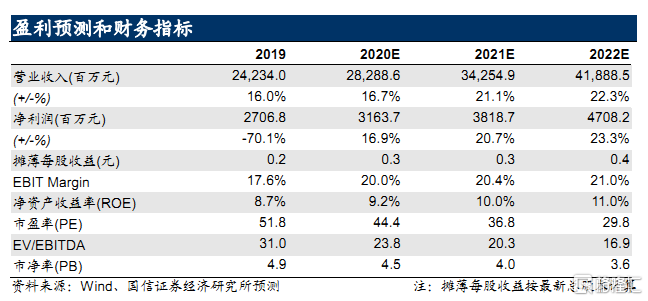

中國生物製藥是具備長期投資價值的醫藥龍頭公司,在腫瘤、呼吸、生物藥三大戰略領域的佈局已進入收穫期:腫瘤領域已成為營收佔比最大的中流砥柱,未來將持續驅動公司業績增長;呼吸領域將在重磅單品布地奈德的帶領下實現大幅增長。受到疫情和集採的影響,肝病、心血管和鎮痛板塊有一定壓力,我們預計集採品種在 2020 年大幅下滑後,銷售緩慢萎縮。我們維持對公司的盈利預測,預計 2020~22 年的淨利潤為 31.6/38.2/47.1 億元,同比增長 17%/21%/23%;並維持公司的合理估值區間為 13.1~16.0 港元(對應 22年 PE 32~39x),相對當前股價有 7%~31%增長空間,維持“買入”評級。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.