北上资金连续加码:消费净买入居首,科技白马现分歧

作者: Wind

来源: Wind

本周,北上资金已连续二天净流入,累计净买入60多亿元,大消费依旧是首选,科技白马现分歧,存在一定的抛售压力。

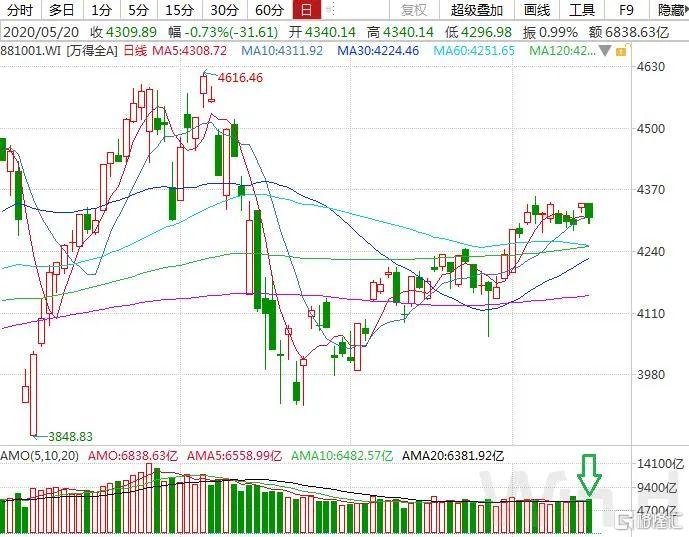

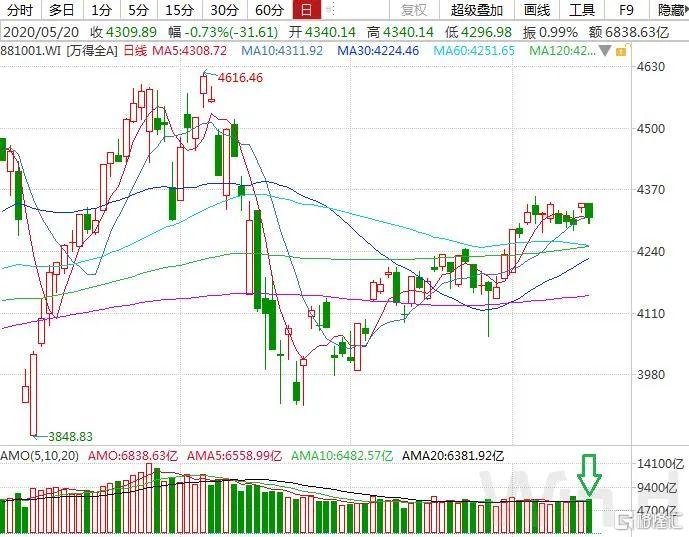

5月26日,沪深两市高开高走,截至收盘,上证指数涨1.01%报收于2846.55点;深成指涨2.10%报收于10815.43点;创业板指涨2.96%报收于2112.97点,万得全A总成交5237亿元,主力净流入额223.73亿元。

(图片来源:Wind金融终端“沪深综合屏”)

市场放量上涨

5月26日,市场延续上涨行情,成交量较前一交易日有所放大。万得全A成交金额近5237亿元,较前一交易日放大约386亿元。

信息技术涨幅居前

5月26日,在沪深两市迎来普涨。其中,信息技术指数涨幅居前,此前该板块连续四个交易日调整。另外,前期表现较好的可选消费、医疗保健再续升势。可见,市场经过短暂后,再次进入整体反弹阶段。

北上资金本月净流入208.99亿元

5月26日,北上资金当天净流入38.87亿元,本月流入208.99亿元。近期北上资金虽偶有波动,但整体维持净买入。

日常消费净买入额居首

本周,北上资金连续二天净买入,累计净买入60多亿元。Wind统计显示,从北上资金持股变动金额行业分布来看,日常消费净买入超过80亿元,位居首位;此外,医疗保健、房地产、可选消费、公用事业等板块买入金额亦较多;工业、金融小幅减仓。

(北上资金5月25日持股与5月23日持股对比,变动市值 = 变动数量 X 5月25日收盘价,下同)

大幅加仓消费,科技白马调仓

Wind统计显示,本周,从北上资金持股变动市值统计来看,对白酒和部分医疗保健公司大幅加仓。其中,有30多家公司本周北上资金净买入超1亿元,其中,贵州茅台、五粮液、海天味业、恒瑞医药、伊利股份、三一重工等公司净买入额均超4亿元。

以下为净买入金额前20名:

北上资金在加仓白酒、医疗保健股的同时,对部分科技白马、消费股进行了调仓。Wind统计显示,有5家公司减仓金额超过1亿元,其中,净卖出金额最多的是海康威视,超12亿元;此外,大华股份、东方日升、先导智能、中际旭创净卖出金额均超1亿元。

以下为净卖出金额前20名:

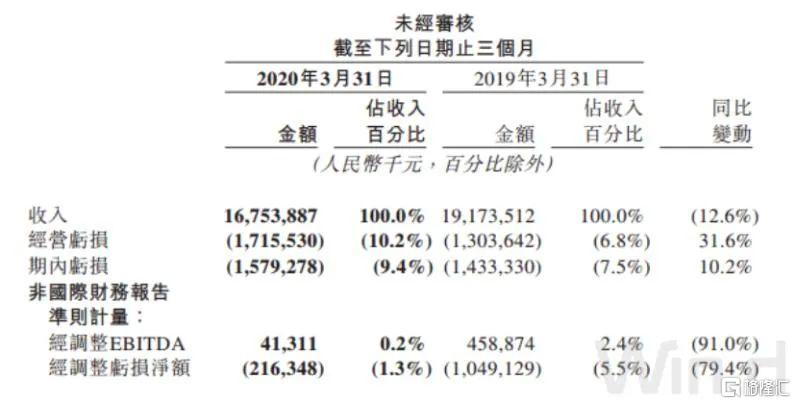

美团业绩超预期

港股美团点评一季报业绩超预期,5月26日大涨10.41%,以全天最高价138.9港元收盘,创上市新高,市值达8093亿港元,位居港股市场第11位港股美团点评一季报业绩超预期,5月26日大涨10.41%,以全天最高价138.9港元收盘,创上市新高,市值达8093亿港元,位居港股市场第11位。

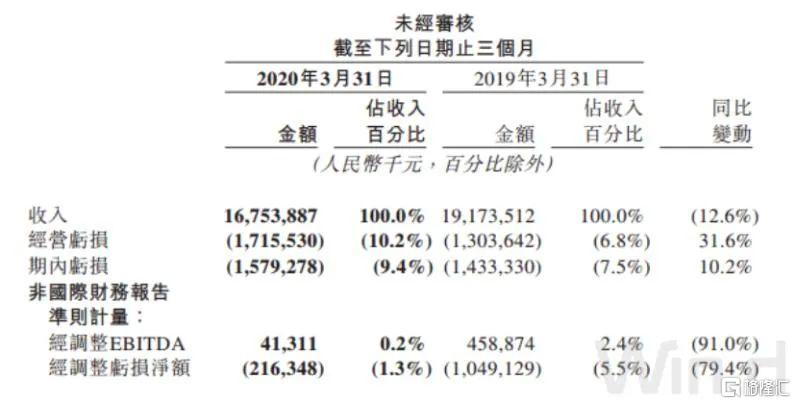

5月25日,美团点评公布2020年第一季度业绩。从主要财务数据来看,2020年第一季度美团点评总收入为167.54亿元,同比下降12.6%,市场预期为161.14亿元,营收超出市场预期;净亏损15.79亿元,市场预期净亏损16.41亿元,去年同期净亏损14.3亿元;第一季度调整后净亏损2.2亿元人民币,去年同期亏损10.5亿元,同比亏损收窄79.4%,本季度美团经调整亏损大幅降低,超出市场预期。

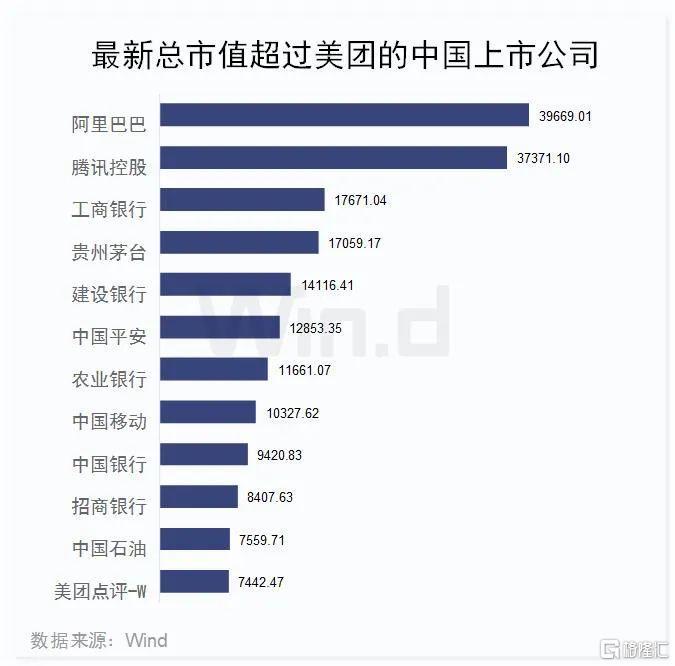

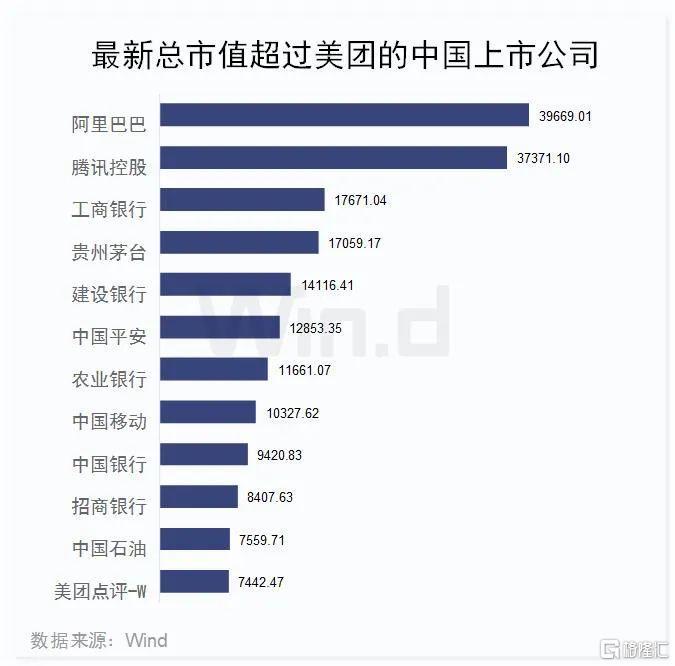

市值超5000亿中国上市公司

以最新收盘总市值来看,Wind数据显示,中国上市企业中,有16家上市公司总市值超过5000亿元(人民币,下同),而美团点评以接近7500亿的市值挤入前12位,且成为国内第三家市值跨过1000亿美元门槛的互联网公司,前两家分别是阿里巴巴和腾讯控股,也是目前中国上市公司中市值规模最大的两家。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.