受一季營收淨利雙降拖累,白酒板塊今日跌幅靠前

近期以來,白酒行業迎來季報期,而受疫情影響,古井貢酒、老白乾酒、迎駕貢酒等白酒企業今年一季度業績表現不佳,均出現了營收淨利雙降的局面。

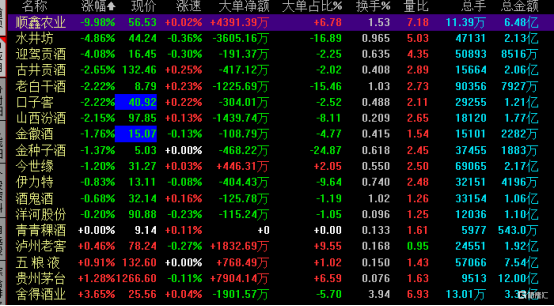

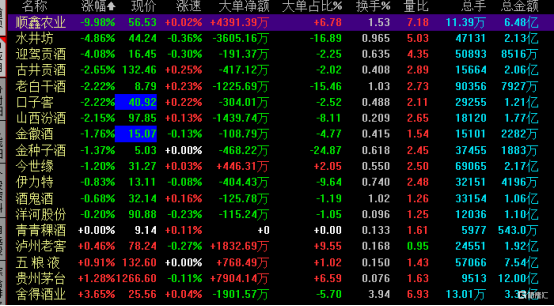

或受一季度業績不佳影響,今日白酒概念股表現較弱。截止發稿,18中白酒股中僅有4只上漲,其中捨得酒業漲近4%領漲,貴州茅台則漲超1%。而順鑫農業則迅速跌停,水井坊、迎駕貢酒均跌超4%。

(行情來源:同花順)

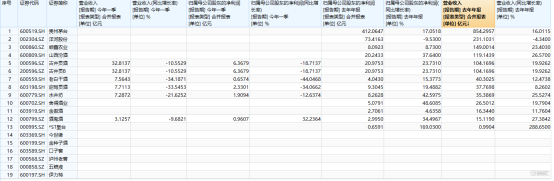

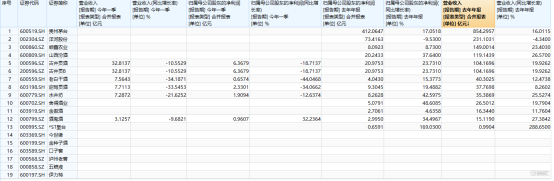

據wind數據顯示,近20只白酒股中已有不少白酒股披露了2019年年度業績和一季度業績報告。其中,2019年絕大多數營收淨利呈同比增長的趨勢,而受疫情的影響,一季度則出現營收、淨利雙降的局面。

(資料來源:wind)

首先,我們來看看白酒股年度業績表現。

2019年,白酒行業營收最高的三家分別有“老大哥”茅台、洋河股份、順鑫農業。其中,茅台實現營業收入854.3億元,同比增長16%;實現淨利潤同比增長412.06億元,同比增長17.05%。而洋河股份實現營業收入231.1億元,同比下降4.34%;實現淨利潤73.41億元,同比下降9.53%。順鑫農業則實現營業收入149億元,同比增長23.4%;實現淨利潤8.73億元,同比增長8.09%。

除此之外,山西汾酒實現營業收入119.43億元,同比增長26.57%;實現淨利潤20.98億元,同比增長23.73%;而古井貢酒實現營業收入104.17億元,同比增長19.93%;實現淨利潤20.98億元,同比增長23.73%。

正如前文所提的那樣,受疫情的影響,相關白酒股今年一季度業績是受到不少衝擊的。

具體而言,今年一季度,古井貢酒實現營業收入32.81億元,同比下降10.55%;歸淨利潤6.36億元,同比下降15.15%;經營活動產生的現金流量淨額16.33億元,同比增長61.54%;而迎駕貢酒實現營業收入7.71億元,同比下降33.55%;歸母淨利潤2.33億元,同比下降34.07%。

此外,據水井坊一季報披露,該公司今年一季度實現營業收入7.29億元,同比減少21.63%;歸母淨利潤1.91億元,同比減少12.64%;老白乾酒則營收淨利同比下降的最為嚴重,今年一季度實現營業收入7.56億元,同比下降34.18%,實現淨利潤0.65億元,同比下降44.04%。

而針對上述一季報業績表現,大部分券商機構都是持積極的建議,皆認為“疫情短期擾動不改白酒長期趨勢”。

其中,川財證券表示,近兩週內白酒行業已迎來季報期,考慮到白酒板塊節後補庫存受影響、國內消費恢復較為緩慢,市場對酒企一季度業績預期應適當放低,預計一季度酒企業績分化將較為明顯,其中高端酒受疫情影響最小,業績確定性較高。

不過,本輪疫情也檢驗了各家酒企的綜合能力,落後產能的加速淘汰將提升行業集中度,而高端酒將受益於其正確、堅定的應對措施,增長確定性更高,短期擾動不改長期趨勢。近期隨着消費逐步復甦,白酒需求開始回暖,板塊迎來估值修復,貴州茅台股價再創新高,優質標的或迎配置良機,繼續看好白酒估值修復行情。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.