A股 | 疫情財務大洗澡,“鑽石一哥”玩業績大變臉

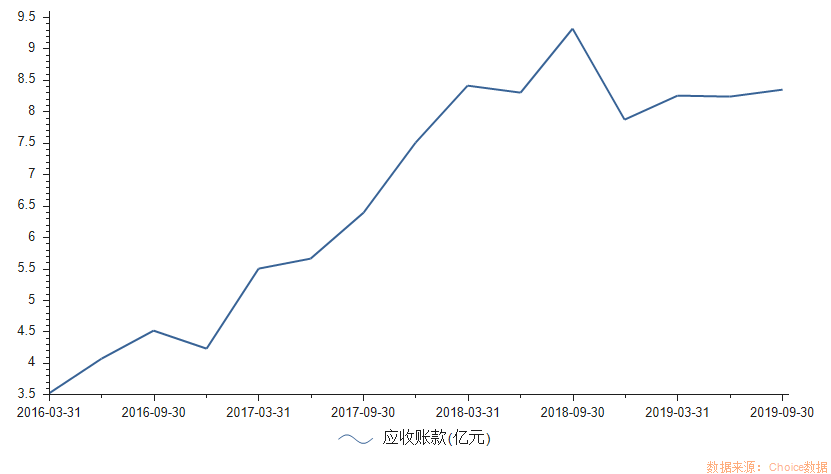

在2019年年報披露的前一刻,國內最大的人工鑽石生產的企業在4月3日晚間披露《2019年度業績預告及業績快報修正案》,淨利潤鉅虧51億元。

相較於2月29日公司發佈的業績快報公佈的歸屬上市公司股東的淨利潤8040.43萬元,直接由盈利轉為鉅虧,堪比瑞幸之後的又一響雷。

一、驚天巨雷早有伏筆,多項財務數據明顯存在貓膩。

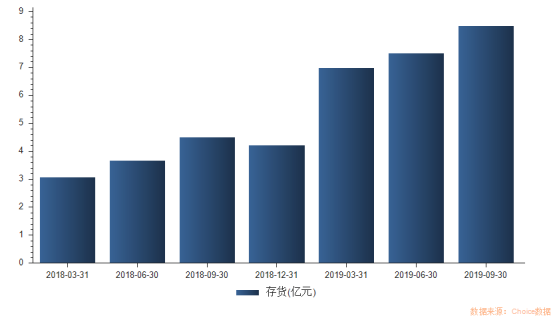

1、存貨計提跌價準備約10億元

公司方稱受新冠肺炎疫情及經濟下行影響,環境變化對鑽石的變現價值產生較大影響,進而重新修正了存貨計提跌價準備。

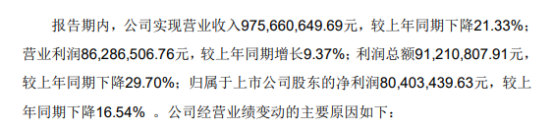

但根據公司過往公開資料顯示,公司一直在增加庫存,截至一季度末,公司的存貨為6.97億元,較2018年末的4.21億元增長66%。2019年6月30日存貨達到8.48億元,較18年末增長更是高達100%以上。存貨週轉率雖然自13年開始逐步好轉,但17年開始至今,下跌幅度逐步擴大。以申萬三級行業為標準,公司19年三季報存貨週轉率顯著低於行業平均值1.89與中位數1.63,並且在行業中處於末尾水平。

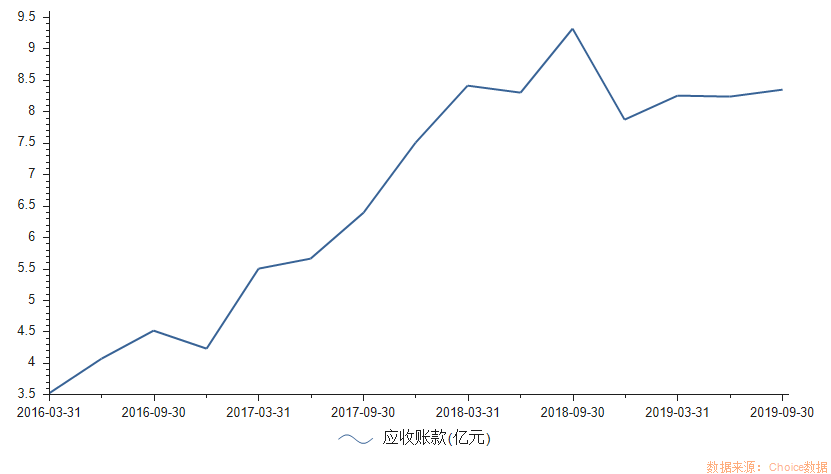

2、計提壞賬計提10.3億元

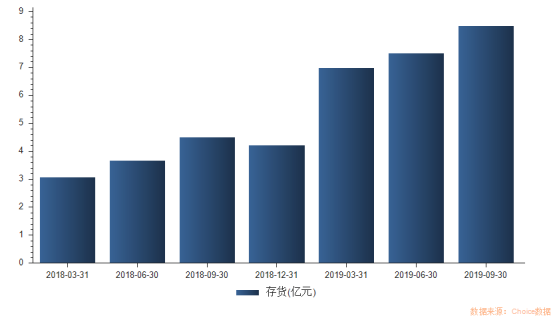

公司應收賬款雖然在18年有所減少,但在19開始緩慢提升,0.9%的應收賬款週轉率遠低於行業(申萬三級)均值2.56。從2019年中報觀察,公司9億的應收賬款,賬齡主要集中在1年,1-2年,合計佔比高達96%,兩年內的應收賬款大幅增加並且直接被計為壞賬,實在不得不讓人有所聯想。

暫且不看其他財務數據,光是預計負債、固定資產、存貨計提等財務數據就能明顯的感覺到豫金剛石披露陳述與真實事實不符。

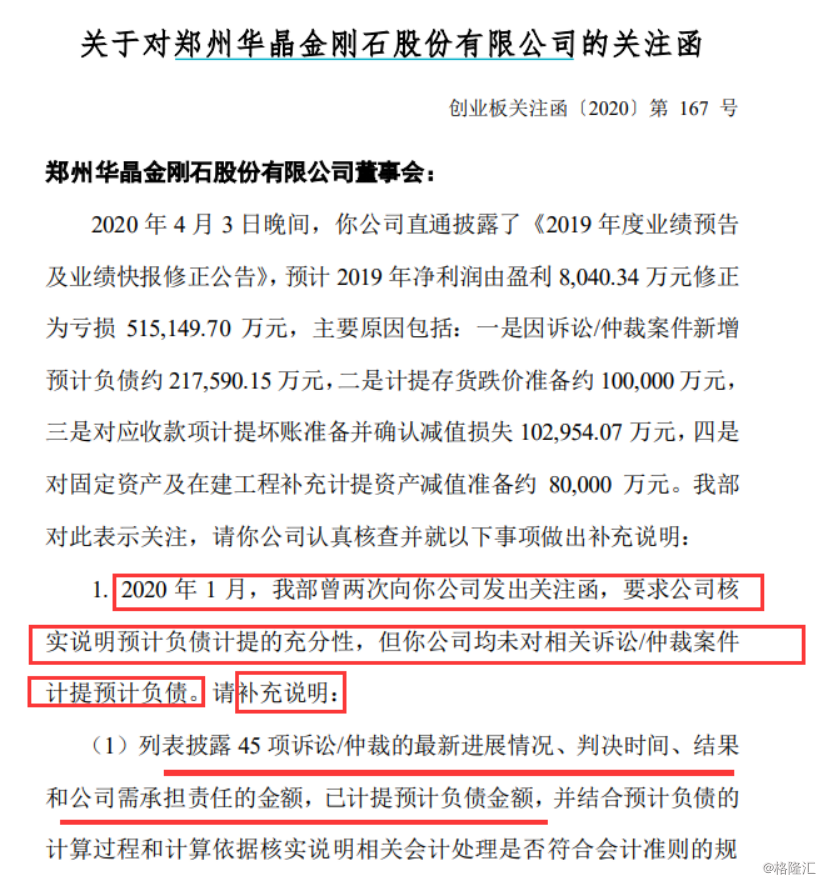

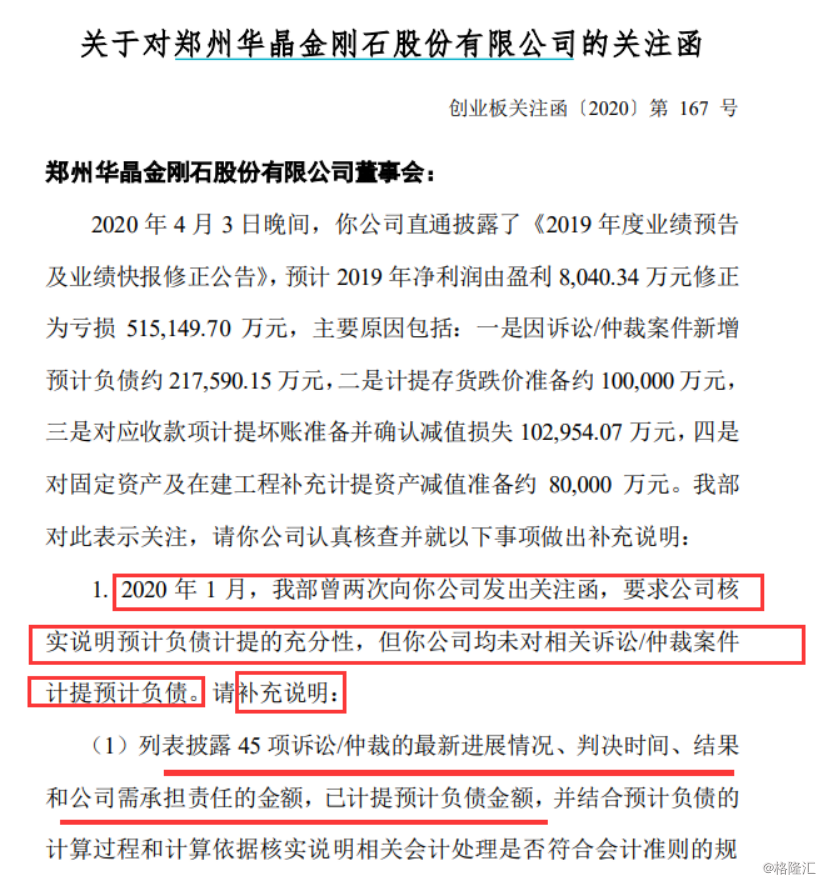

二、深交所火速下發關注函

深交所1月曾兩次向豫金剛石發出關注函,要求核實説明預計負債的充分性。面對業績修正,深交所再一次要求公司於4月7日前有關書面材料報送該部並對外披露,同時抄送河南上市公司監管處,且看公司後續如何給監管機構、給市場一個答覆。

附:格隆匯深度豫金剛石財務解析

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.