網龍(00777.HK):遊戲強勁,在線教育迎風起航,維持“買入”評級

機構:廣發證券

評級:買入

核心觀點:

遊戲強勁增長。核心IP《魔域》系列遊戲19H1收入同比+56.5%,預計端遊(含互通版)19H2到目前流水維持穩定略增,12月新資料片“御劍天下”上線及王力宏代言驅動用户活躍度提升。儲備多款有版號手遊,《終焉誓約》由B站獨代,預計20H1上線,《魔域傳説》H5、《英魂王座》、《英魂之刃戰略版》預計於20H2上線;另外,《魔域2》、《決戰巨神峯》等手遊在版號審批中。

教育:蓄勢多年,國內+海外、產品+內容+平台多方佈局、多點推進,疊加疫情驅動在線教育需求激增,預計2020年國內、海外教育業務均有不錯增長。海外:普米在歐美等發達國家收入保持增長,新興市場如埃及、俄羅斯、土耳其有項目在落地中或有招標機會,預計19H2收入好於上半年,2020年收入回升。國內2020年收入有望提速:SaaS業務落地教育部學校規建中心項目,與北師大簽約智慧校園建設項目,福州智慧教育項目累計中標近6千萬元人民幣。疫情驅動需求增長,旗下網教通、101PPT、Edmodo加快落地。?近期貝斯特教育融資、上市公司融資,旨在為教育板塊新項目落地及潛在收購投資提供彈藥;向副董事長樑念堅博士授出購股權,旨在激勵高管並推動教育板塊增長。

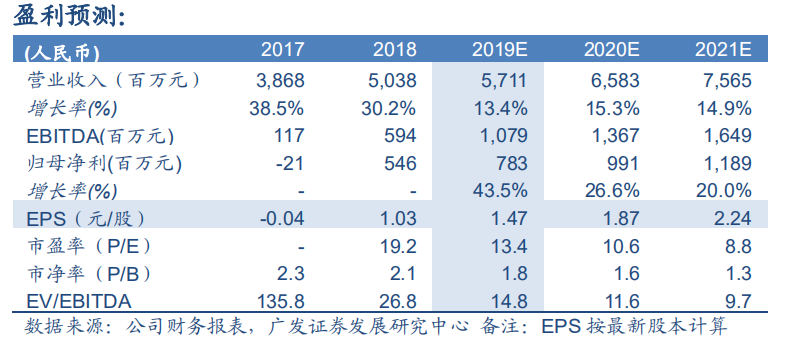

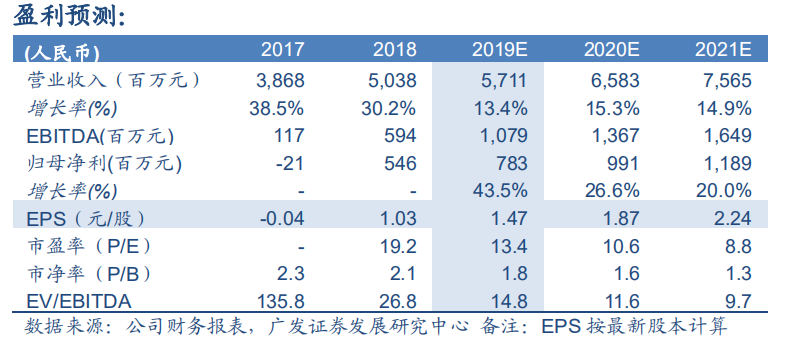

維持“買入”評級。預計19~20年歸母淨利分別為人民幣7.83億元、9.91億元,當前股價對應PE分別為13.4倍、10.6倍。根據SoTP,遊戲業務給予20年10倍PE,國內教育給予2020年10倍PE,普米給予2020年15倍PE,Edmodo按此前收購估值,得到合理價值36.9港元/股。核心遊戲仍增長,多款新遊待上線,在線教育行業需求激增,公司教育開始多點變現,融資為新項目落地及潛在投資併購提供彈藥。

風險提示:老遊戲收入增長放緩,新遊表現不達預期;普米新項目落地及收入確認時間導致收入波動,國內教育業務進展不達預期,虧損擴大。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.