小米集團-W(1810.HK):發佈MI10/10Pro衝擊高端市場,雙品牌戰略愈發清晰,維持“買入”評級

機構:太平洋證券

評級:買入

事件:小米集團今天在線上發佈年度旗艦手機MI10/MI10Pro。同時在發佈會上,公司宣佈2019年Q4手機銷量增長31.1%,市佔率8.9%,2019年全年同比增長5.5%,市場份額為9.2%(IDC數據)。

點評:我們認為從產品本身來説,我們認為完全對得起“旗艦”這兩個字,全系標配的驍龍8655GSOC(CPU,GPU,AI算力等方面均顯著提升),LPDDR5,UFS3.0,90Hz屏幕,主攝更是高達1億像素(並搭配高通Spectra480ISP),支持OIS光學防抖。Pro版本中更是在攝像、屏幕調教、音質等諸多方面進行進一步的升級,其中10Pro在DXOMARK榜單中相機總分、視頻、音質三項測試均位於全球第一。

對於價格方面,MI10和10Pro最低版本分別3999和4999起,略高於之前的市場預期,但我們覺得也在合理之中,一方面相比於一年前定價2999起的MI9,MI10的成本提升顯著,另外考慮到小米計劃2020年在線下渠道中有所發力,在渠道端留一些利潤也是情理之中的事情,但是我們認為更重要的一點是公司自從Redmi品牌獨立之後,2019年作為過渡的一年,且是4G向5G切換的一年,本身在小米產品的發佈上比較保守,某種意義上可以説是靠紅米“戰鬥”了一整年,而19年Redmi優秀的戰績也讓小米在往高端市場進軍有了更足的底氣,這次的定價也顯示出了公司向高端市場發力的信心和在雙品牌戰略落地實施方面的決心。當然退一步來説,我們認為即便定價略高於市場預期,但我們依然不得不承認,在當下的市場,同價位手機或者同配置手機裏面,米10和10Pro性價比的優勢依舊沒有喪失。

這次米10銷量怎麼給預期?説實話我們認為比較難給,但是從首日的預售情況來看,我們判斷銷量不會差,當然在目前的疫情下,工廠的復工存在一些不確定性,之後供應鏈是否更跟上目前還不得而知。但我們建議投資者不妨以更加開放的心態去看待這次小米的旗艦產品發佈會。因為此次發佈的產品價格帶從4000~6000,這是一個小米歷史上幾乎沒有涉足過的領域,因此每賣出一台可以説在某種程度上都是收穫了一個之前並不屬於小米的客户,因此都算是一種成功,但是高端之路難度一定是大的,小米還有很長的路要走,米10只是一個開始。但是不管如何Redmi紮實的基本盤完全有可能接過之前小米+Redmi的所有客户,這就是安全墊。

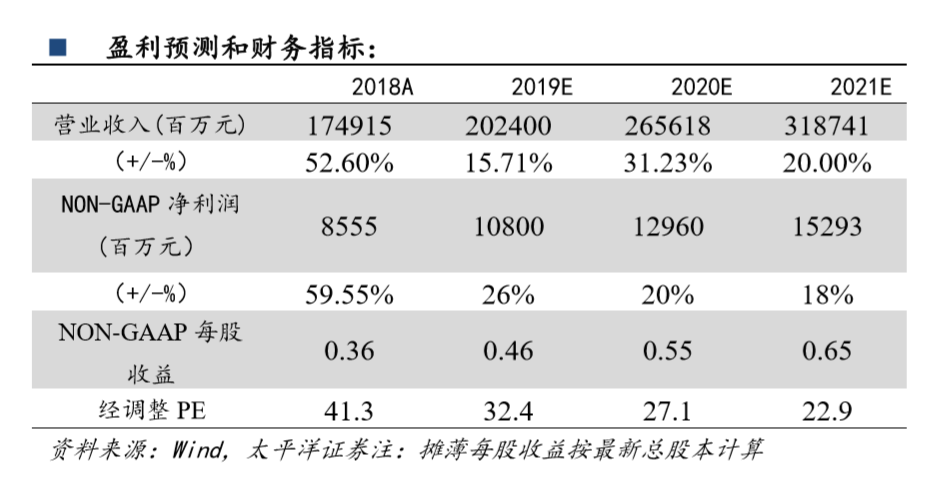

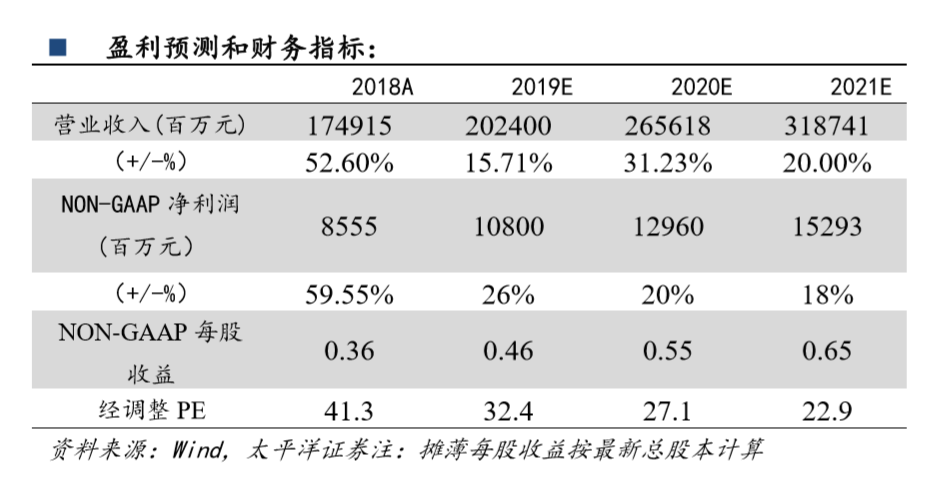

我們看好公司在IoT領域的先發優勢,“手機+AIoT”戰略的持續發力,以及實施雙品牌戰略之後智能手機業務有望實現份額穩步上升,公司在19Q3增速觸底後反彈趨勢確立,我們預計公司2019-2021年NON-GAAP每股收益分別為0.46、0.55、0.65元,對應2019-2020年經調整PE分別為32、27倍,維持“買入”評級。

風險提示:用户活躍度下降風險、業務發展不及預期等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.