小米集團(1810.HK)漲超2% Q4手機出貨量增長23% 增速排名第一

格隆匯 01-31 11:18

格隆匯1月31日丨小米集團(1810.HK)今日股價走高,盤初一度拉昇漲超3%,現漲幅為2.38%,報12.04港元,暫成交13.14億港元,最新總市值為2890億港元。

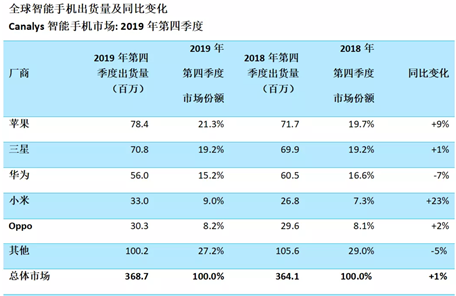

國際市場研究機構Canalys最新發報告指,全球智能手機出貨量在2019年第四季度同比增長1%,實現連續第二個季度增長,市場出貨量達到3.69億部。

其中,在全球前五大手機品牌中,小米實現了最高單季增速。Q4出貨量達3300萬台,增幅高達23%,市場份額增長為9.0%,市佔率繼續居於全球第四。從全年來看,小米市場份額則為9.2%,同比增長4%,穩居全球第四。

小米Q4實現同比最高增速,是向5G時代平穩過渡的信號。

小米在Q3業績發佈會上提出過,集團在第三季度將調整庫存、提升現金流水平作為重要工作,一切為5G時代換機潮競爭做準備。具體策略是,小米在2019年拆分Redmi和小米品牌,逐步推動Redmi開始走量,支撐原有市場份額,而使小米品牌進行技術儲備,執行保守的出貨策略,避免庫存風險。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.