中石化炼化工程(02386)中期营利双增经营现金流负49.6亿元

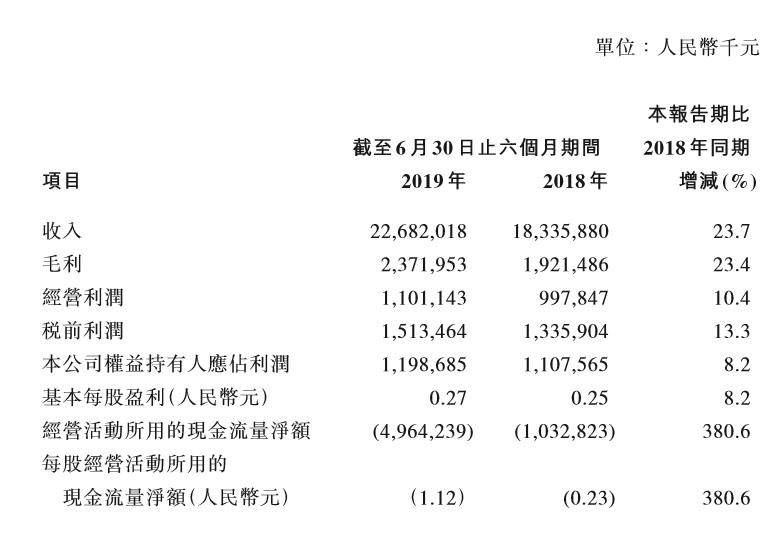

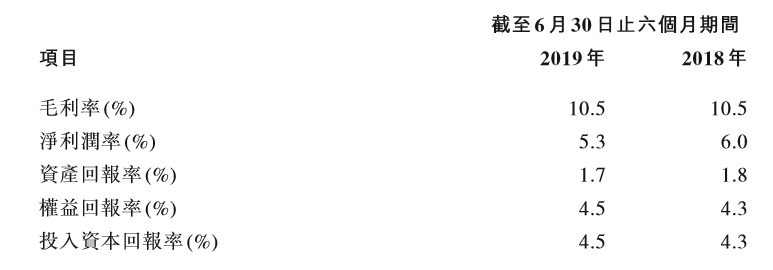

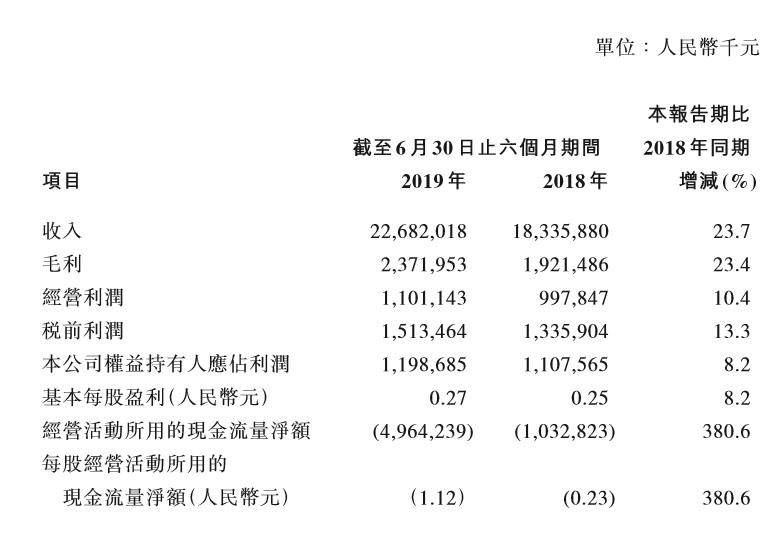

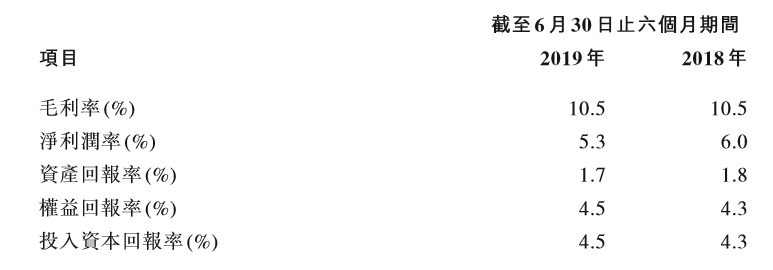

8月19日,中石化炼化工程(02386.HK)公布上半年业绩报告。报告显示,2019年上半年,公司实现收入226.82亿元(人民币,下同),同比增长23.7%;毛利23.72亿元,同比增长23.4%;公司权益持有人应占利润11.99亿元,同比增长8.2%;基本每股盈利0.27元,拟派中期股息每股普通股0.108元。

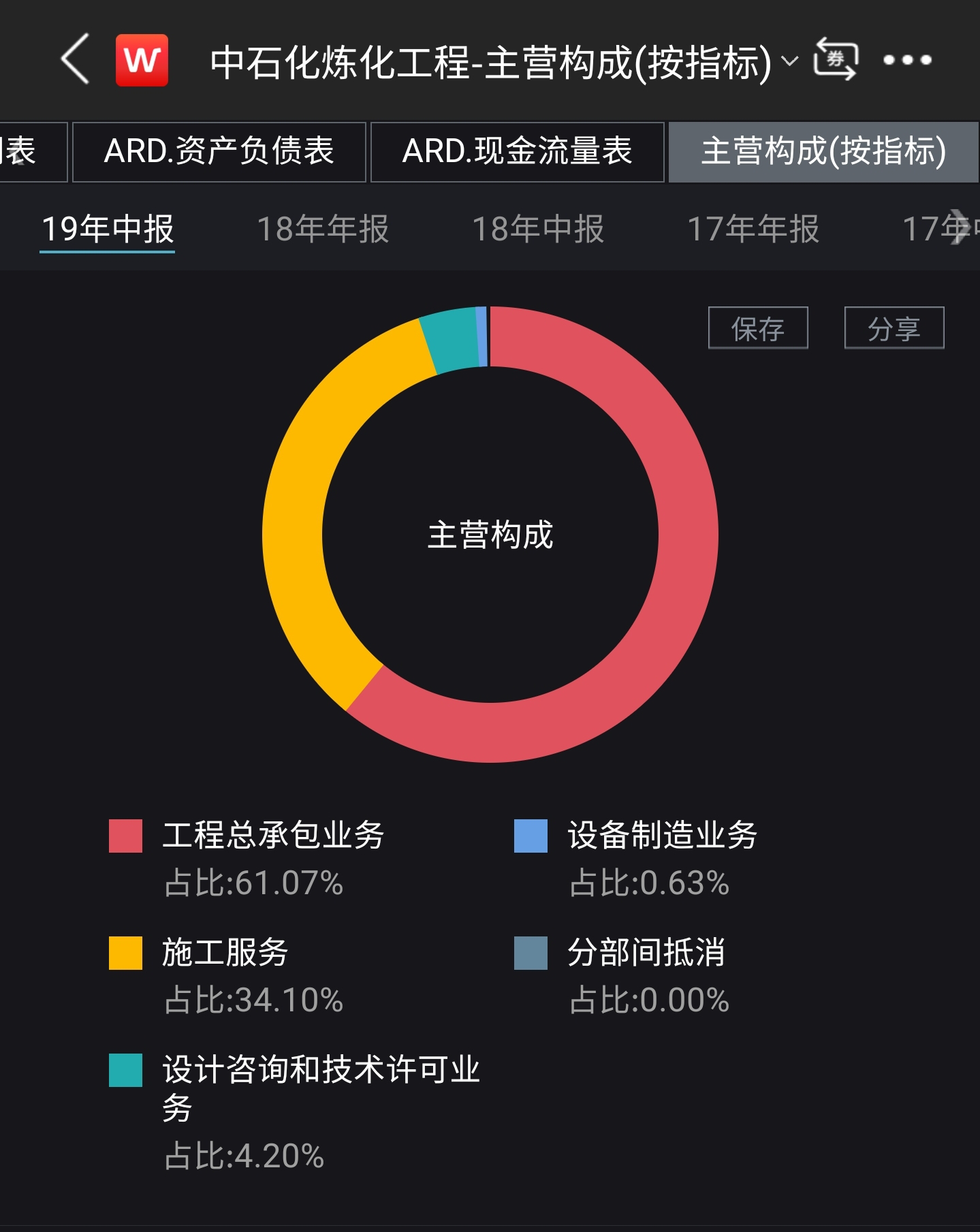

中石化炼化工程称,收入增长主要得益于中科炼化一体化项目、科威特炼油项目、中化泉州乙烯项目等几个大型设计、采购、施工总承包项目进入执行高峰期。然而,尽管其中期业绩在一些指标上颇为靓丽,但是资本市场并不买账,其股价今日开盘即跌。截止收盘,报收5.59港元,与昨日收盘价一致,成交额1085.88万港元,总市值247.525亿港元。

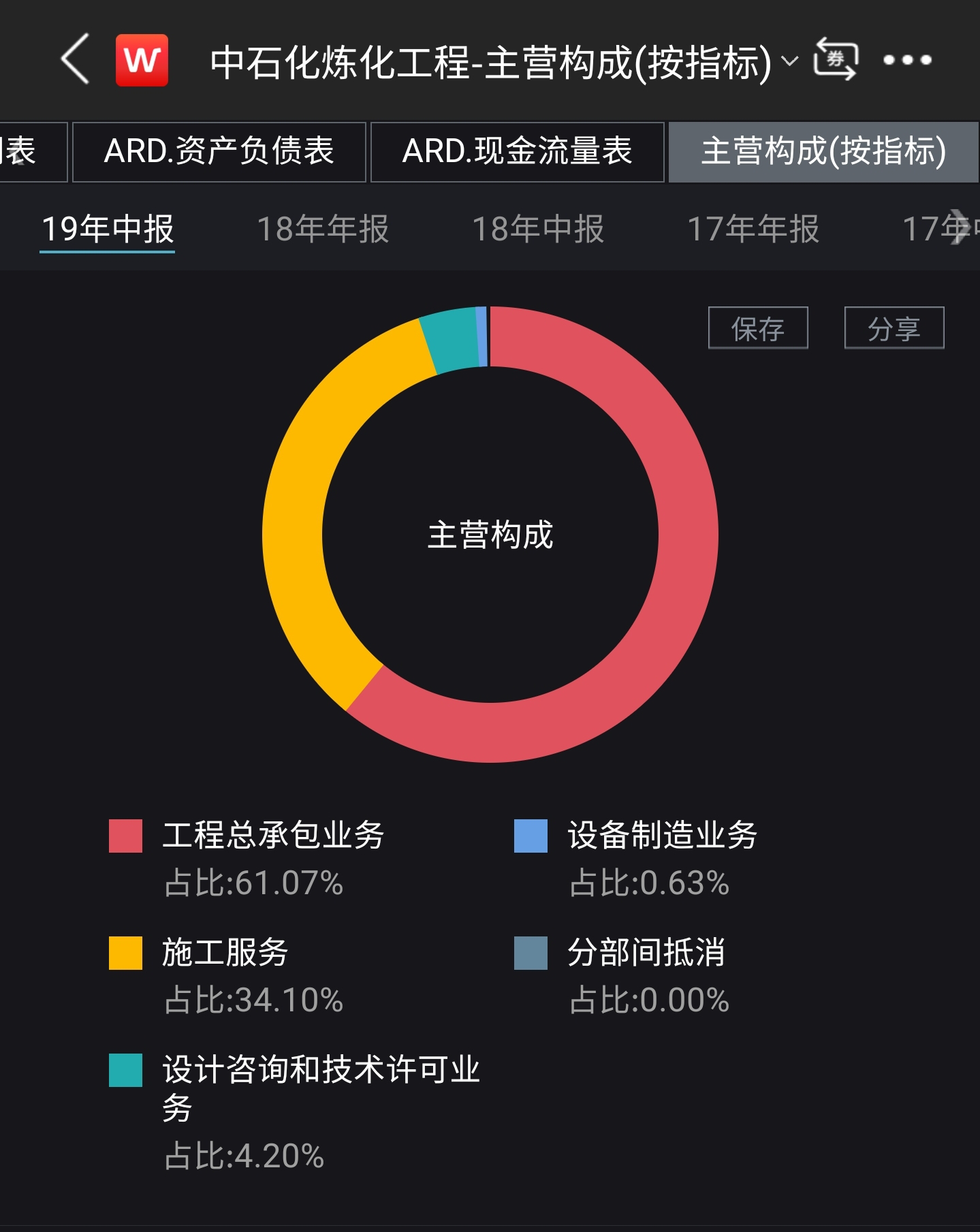

资料显示,中石化炼化工程是中石化旗下工程建设平台,业务以炼油、石化、芳烃、煤化工为主,涵盖 天然气化工、环境工程与公用工程。

(资料来源:Wind )

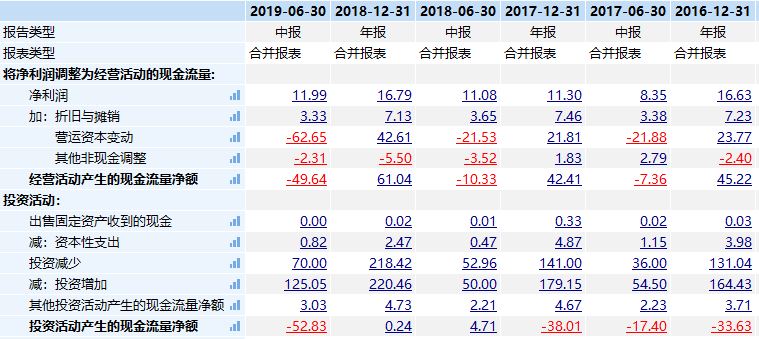

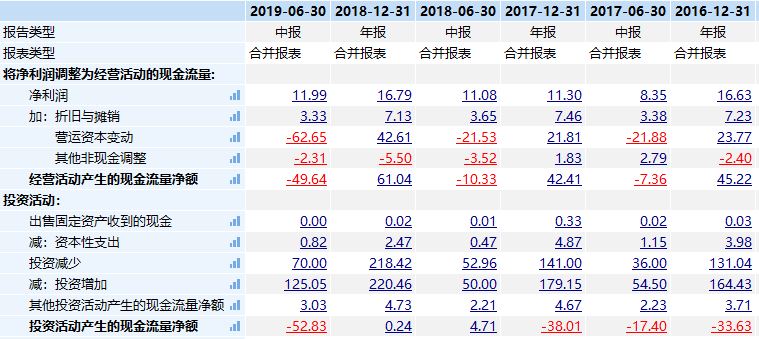

今日中石化炼化工程的股价并没有因其业绩上实现营利双增而有所起色,或与其糟糕的现金流有关。在公司项目进入执行高峰期的情况下,其上半年录得49.64亿元负经营现金流,令人不解。

(资料来源:Wind)

期内,尽管中石化炼化工程实现新签订合同量为332.20亿元,占全年目标550亿元的约60%,但同比却减少6.4%。此外,于本报告期末,其未完成合同量为1054.73亿元,较2018年底增长11.1%。两者叠加,或在一定程度上影响中石化炼化工程的现金流。而在项目处于建设高峰期的情况下,其上半年分包成本亦有较大增加,甚至分包成本在下半年不会有明显下降。

而关于现金流,中石化炼化工程财务总监贾益群指,有部分业主于去年底提早支付约35亿元款项,因此影响了今年上半年的应收款及现金流。他承认大型项目支付较慢对现金流入有影响,但随着项目陆续进行支付,料下半年经营性现金流会有所改善。

此外,期内公司研发开支大幅增加64.9%至7.47亿元,亦是导致其现金流紧张的原因之一。贾益群解释表示,因上半年国內签订新项目较多,劳动力紧缺,为满足工程进度要求,加大工程研发投入,此外公司亦在具有前瞻性的技术领域加大投入,因而令研发投入有较大增幅。研发投入所涵盖的项目包括开拓氢能源方面廉价氢能源获取以及氢储存等,除此之外,研发开支还投入到包括原油识別、烯烃以及天然气化工等多种项目上。

至于现金流下半年能否改善,贾益群表示,从目前情况看,大型项目支付缓慢的情况可在年底前有所缓解,这方面风险不大,相信经营活动现金流下半年有所改善。

2019年下半年,世界经济仍将充满挑战,中国经济运行面临更多不确定因素,国际油价走势依然充满变化,鉴于中石化炼化工程的现金流表现,其后续发展形势令人担忧。

不过,国联证券此前发布研报指,从2016年起,随着原油价格的复苏,全球炼化投资就进入了增长阶段,这意味着在2019年和随后的几年,全球将出现大量新增炼油产能,以亚太地区和中东地区炼厂产能增长最多,分别由需求和一体化发展所拉动。国联证券认为,中石化炼化工程持续受益于近两年不断增长的新签订单,伴随各大在手项目陆续进入执行高峰,业绩或进一步改善。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.