美团点评-W(3690.HK)吃喝玩乐全一条龙构建O2O生态闭环予以“买入”评级

机构:东吴证券

评级:买入

目标价:80港元

投资要点:

外卖业务:双寡头格局定,提升“效率”为增长关键。19Q1美团外卖和饿了么两者合计市占率为98%,未来“运营效率”将成为提升平台货币化能力将成为角力重心,Q1为餐饮外卖淡季,美团实现收入107亿(+yoy52%),增长主要依赖于货币化率提升至14.2%,未来预计整体外卖业务货币化率将继续提升:

1)成本端:随着订单密度提升,外卖日均交易笔数由17年的1120万单提升至18年的1750万单;未来配送网络效率提升,骑手成本有望下降,从而自营配送业务实现盈利;

2)提点率:外卖业务有助于商户降低每单成本,同时可增加商户获客量,未来平台对于商户的议价能力将提升;

3)广告营销助力外卖业务:外卖同质化竞争严重,商户未来对于广告需求将逐步增加,高毛利营销业务有望带动外卖业务盈利增强。

到店,酒店及旅游:在线营销服务增长显著,用户粘性逐步养成。美团19Q1到店及酒旅业务收入44.92亿元(+yoy43.2%);GMV为464亿(+yoy15%),收入增速显著高于交易额增速,“营销类”业务对收入的贡献效果逐步提升。预计未来整体到店团购业务将逐步下滑,而高毛利的在线营销业务比重将提升:

1)商户端:流量红利消失,商户获客难度增加,广告投放需求将提升;

2)用户端:大众点评及美团在整体O2O生活服务行业市占率提升,用户数量和粘性均保持行业领先,将成为商户广告投放首选。酒店业务:在发展初期,美团酒店用户以年轻散客为主,未来随着年轻用户成长,消费能力和对于酒旅的消费需求都将提高,叠加其已经养成的使用粘性,有助于美团由低线向高星酒店渗透。

创新业务:出行业务亏损有望降低,ToB业务尚处于培育期。凭借着“大众点评”和“美团”在O2O生活服务市场的高市占率和高用户粘性,美团顺理成章可推进B端的商户衍生服务,包括餐饮管理系统(RMS),快驴进货(供应链),在线商户营销等。出行方面:19年起,随着摩拜单车大规模折旧完成,网约车采用“聚合模式”,小象生鲜门店数量下降,预计新业务亏损将大幅收窄,整体货币化能力将持续提升。

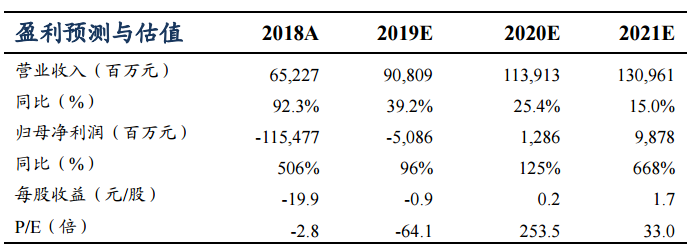

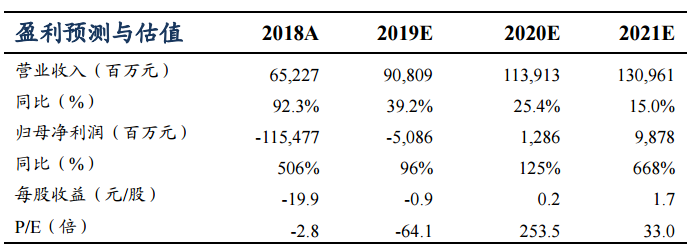

盈利预测与投资评级:采用PS分部估值,预计美团2019年合理估值为4085亿元,约4609亿港币,对应股价为79.6港币。同时,考虑EV/EBITDA估值,外卖业务成长性较好,未来盈利能力提升空间较大;到店及酒旅业务毛利较高,盈利能力可持续,预计公司整体19-21年EBITDA为-32/27/123.6亿,予以21年30xEV/EBITDA,对应市值为3708亿元,约4184亿港币,对应股价约72港币。综合而言,予以美团6个月目标价72--80港币,予以“买入”评级。(1人民币=1.1283港元)

风险提示:外卖骑手成本难以下降,餐饮外卖政策风险,到店旅游等行业竞争激烈,旅游业务等受经济周期影响较大,新业务致使亏损增加。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.