JD.com recently released its Q1 2025 financial report, with performance surpassing market expectations. In the first quarter, JD.com achieved total revenue of 301.1 billion RMB, marking a 15.8% year-on-year growth and setting a new high for revenue growth in nearly three years. Net revenue reached 301.08 billion RMB, a 16% increase year-on-year, exceeding the market estimate of 289.44 billion RMB. In terms of profitability, JD.com's operating profit amounted to 10.5 billion RMB (approximately 1.5 billion USD), a significant increase compared to 7.7 billion RMB in the same period last year. Adjusted EBITDA reached 13.7 billion RMB, up 27% year-on-year, also beating the expected 12.64 billion RMB.

Strong Business Performance Boosts Confidence

JD.com's core business, JD Retail, continued to perform strongly with a 16.3% year-on-year revenue growth, accelerating further and becoming the main driver of the company's overall growth. At the same time, JD has made initial progress in expanding into new businesses, with the food delivery service emerging as one of the highlights. Despite a revenue growth of 18.1% year-on-year in the new business segment, the losses from the food delivery service significantly widened to 1.327 billion RMB, with the loss size doubling compared to last year.

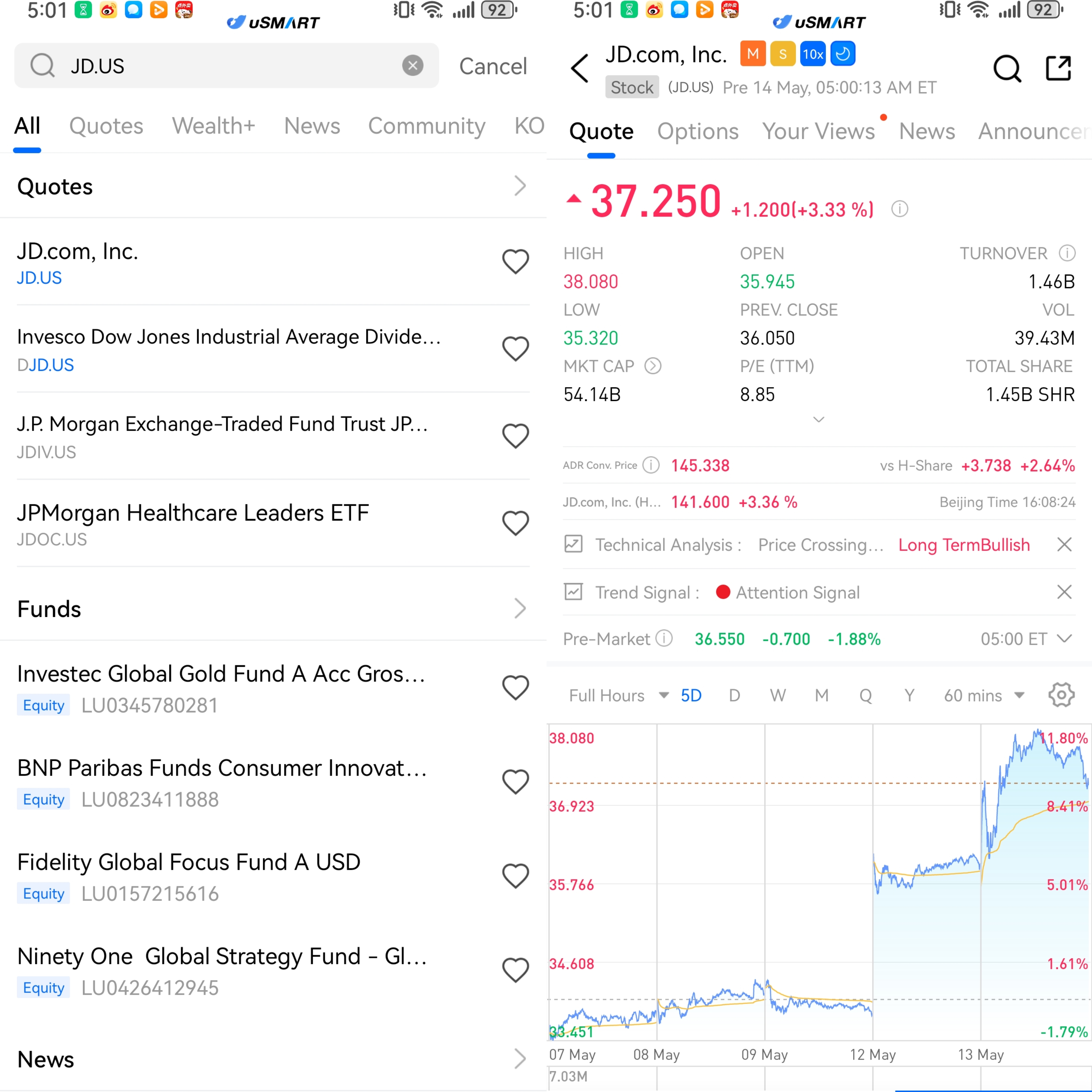

Following the release of the earnings report, JD.com's stock price surged over 4%, reflecting investor confidence in the company's strong performance and future growth potential.

(Image Source: uSMART HK)

Progress in China-US Trade Agreement Boosts Market Confidence

After JD.com released a strong Q1 financial report, its stock price surged by over 4%, reflecting the market’s high recognition of its excellent performance and future growth prospects. In addition to the company's impressive internal results, the recent positive developments in China-US trade negotiations have also added more confidence to the market. In recent months, both sides have reached consensus on several key issues.

The United States had previously raised tariffs on Chinese goods to as high as 125%, but now the US has agreed to significantly reduce the tariff rate to 10%. In response, China has also agreed to lower retaliatory tariffs on US goods from 125% to 10%. This substantial tariff reduction exceeded market expectations, making investors optimistic about the improvement in trade relations between the two countries.

Following the announcement, US stock futures surged sharply, the US dollar rose, and Treasury yields increased, signaling a clear boost in market confidence in the global economic outlook. This drove a significant rise in the S&P 500 index.

How to Buy JD.com on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image Source: uSMART HK)