On Monday, local time, Tesla CEO Musk said that if he could not gain 25 per cent voting control of Tesla, he would rather develop artificial intelligence products in companies other than Tesla.

This shows that Musk wants to increase his control over Tesla.

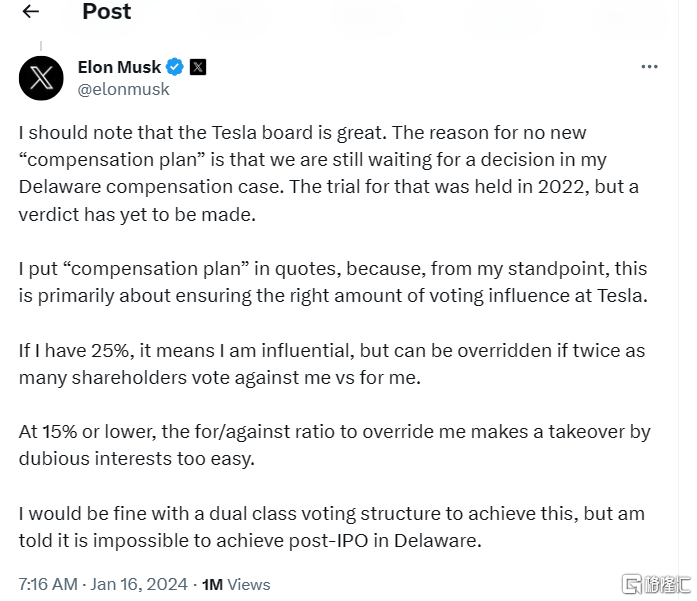

In the X post, Mr Musk said: "I do not want to develop Tesla into a leader in artificial intelligence and robotics without 25 per cent of the voting rights." I need to have enough influence, but not to make it impossible to overthrow me. If not in this case, I would rather produce AI products outside Tesla. "

He also said that if he had 25 per cent of the vote, it meant he was influential, but that his influence could be overturned if there were twice as many shareholders who opposed it as those who supported it. If his voting rights were 15 per cent or less, it would be easy to overturn and Tesla would be taken over by suspicious interest groups.

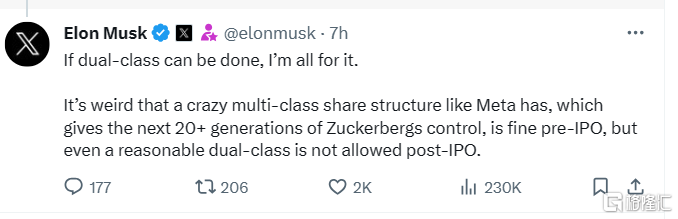

Musk said he is willing to use a dual shareholding structure to achieve this, but this is impossible in Delaware after Tesla's IPO.

Dual equity institutions refer to stocks in which companies have different voting rights, usually one has more voting rights for founders or early investors, and the other has less voting rights for other shareholders.

He also mentioned Zuckerberg's control of Meta. "the strange thing is that a crazy multi-level shareholding structure like Meta makes it possible for Zuckerberg to have control before IPO, but after IPO, even a reasonable dual shareholding structure is not allowed," Musk said.

Tesla fell 2% before the day's trading.

Musk had sold billions of dollars worth of Tesla shares in 2022 to buy X.

At present, Musk is Tesla's single largest shareholder, holding about 13% of Tesla's shares. In other words, Mr Musk demands almost twice as much voting rights as he currently holds.

For Tesla, the future value potential of the company lies in the development of AI and robots.

Prior to this, Musk also said that Tesla is not only an electric car manufacturer, "can be said to be the leader of artificial intelligence in the real world."

Since the beginning of this year, Tesla's share price has continued to fall, falling 12%, wiping out more than $94 billion in market value, while the stock more than doubled last year.

Tesla shares fell 2 per cent to $214.19 a share before the US market opened today.

Mr Musk is currently facing a lawsuit over his pay package.

Tesla shareholders sued Mr Musk and the board in 2018, accusing Mr Musk of using his dominance of the board to earn huge salaries without having to work full-time. & nbsp

In response, Mr Musk said he had no "dispute" with the board over the new pay package and said the pending verdict hindered the discussion.