美股反彈穩了?

uSMART盈立智投 11-02 20:26

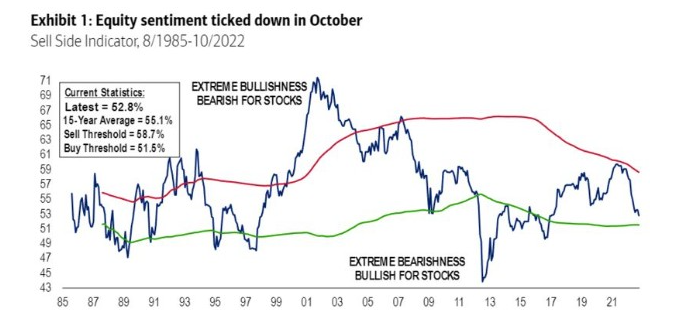

根據美國銀行的一項衡量股市看漲程度的指標——美銀賣方一致性指標(Sell Side Indicator),已接近歷史上預示市場將上升的水平。包括股票與量化策略師Savita Subramanian在內的美銀團隊表示,該指標評估賣方策略師對股票的平均建議配置,表現出5年多來最接近觸發買入信號的水平。

包括Subramanian在內的策略師寫道:“該指標是2017年初以來最接近‘買入’信號的一次;而且相比於‘賣出’信號,該指標已連續第六個月更加接近於‘買入’信號。長期以來,華爾街的股票配置共識一直是一個可靠的反向指標。”

雖然賣方一致性指標不能反映股市的每一次上漲或下跌,但從歷史上看,該指標對標普500指數隨後12個月的總回報具有一定的預測能力。過去,華爾街的共識股票配置一直能夠發出與策略師建議相反的信號,這意味着當分析師看漲時,它是一個看跌指標,反之亦然。現在,美銀的賣方一致性指標在今年上半年一直徘徊在“中性”區域,但在最近的下跌之後,現在正慢慢接近“買入”區域。

他們寫道,賣方一致性指標是美銀將今年標普500指數目標水平定在3600點的依據之一,該指標還預示着標普500指數可能在未來12個月升至4500點。這些策略師還表示,只要該指標處於當前水平或更低水平,美國股市指數隨後12個月的回報率在94%的情況下爲正,漲幅中值爲22%。

在美聯儲將於本週公佈利率決議之前,對美聯儲政策轉向鴿派的呼聲越來越高。這種樂觀情緒幫助標普500指數自10月12日以來反彈了約8%,10月12日該指數收於2020年11月以來的最低水平。

Subramanian及其團隊稱,今年華爾街分析師對股票的平均建議配置水平已下降逾6個百分點,而對債券的建議配置比例則增加了約5個百分點。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.