騰訊控股Q2營收1340億,淨利潤同比下降56%

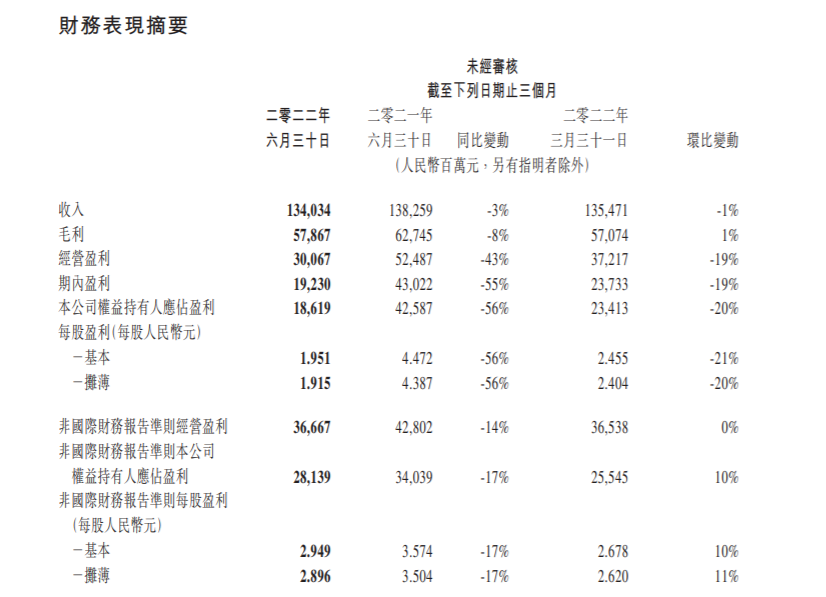

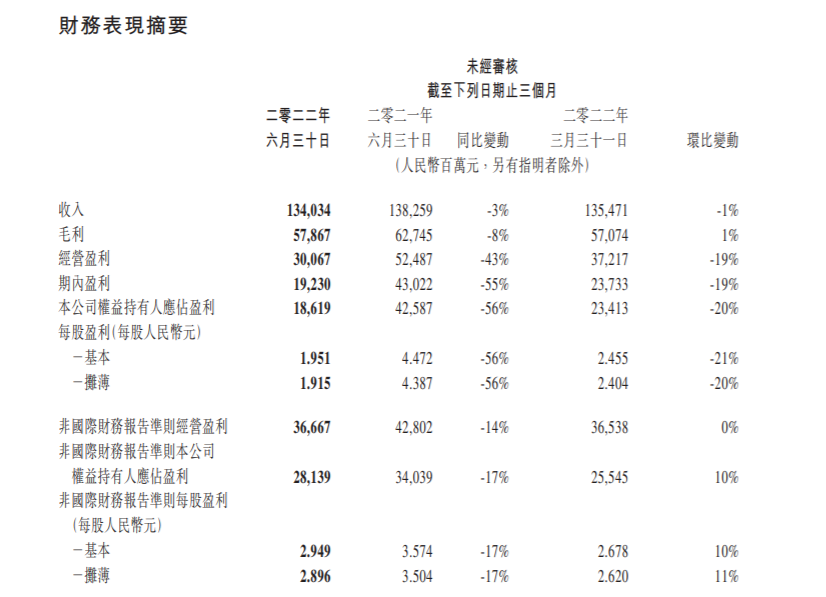

騰訊控股發佈2022年第二季度業績。財報顯示,第二季度營收1340億元,市場預期1346.03億元,去年同期1382.59億元;淨利潤186.19億元,市場預期252.86億元,去年同期425.87億元;每股收益1.915元,市場預期2.62元,去年同期4.387元;非國際財務報告準則本公司權益持有人應佔盈利281.39億元,上年同期340.39億元,同比減少17%。

截至2022年6月30日,微信及WECHAT的月活躍帳戶12.99億,同比增長3.8%,市場預估12.9億。

第二季度我們的收費增值服務付費會員數同比增長2%至2.35億。騰訊視頻付費會員數達1.22億。

增值服務業務二零二二年第二季的收入爲人民幣717億元,相較二零二一年第二季總體保持穩定。

第二季度本土市場經歷了類似的調整期,面臨一系列過渡性的挑戰,包括大型遊戲發佈數量下降、用戶消費減少以及未成年人保護措施的實施,本土市場遊戲收入下降1%至人民幣318億元。

網絡廣告業務二零二二年第二季的收入同比下降18%至人民幣186億元,反映了互聯網服務、教育及金融領域需求明顯疲軟。

第二季社交網絡收入增長1%至人民幣292億元,反映了我們的視頻號直播服務及數字內容訂購服務的收入增長,而音樂直播及遊戲直播的收入減少。

金融科技及企業服務業務二零二二年第二季的收入同比增長1%至人民幣422億元。

在第二季期間,我們主動退出非核心業務,收緊營銷開支,削減運營費用,使我們在收入承壓的情況下實現非國際財務報告準則盈利環比增長。

微信方面,視頻號的用戶參與度已十分可觀,總用戶使用時長超過了朋友圈總用戶使用時長的80%。

視頻號總視頻播放量同比增長超過200%,基於人工智能推薦的視頻播放量同比增長超過400%,日活躍創作者數和日均視頻上傳量同比增長超過100%。

我們於二零二二年七月開始推出視頻號信息流廣告,相信這將是拓展市場份額及提升盈利能力的重要機遇。

在第二季,新一輪新冠疫情短暫抑制了商業支付活動。商業支付金額於二零二二年四月放緩至低個位數同比增長,但同比增速於二零二二年六月恢復至百分之十幾。

上半年營收2695.05億元,同比下降1%;公司權益持有人應佔盈利420.32億元,同比下降53%。

截至二零二二年六月三十日止六個月內,本公司於聯交所以總代價約73.04億港元(未計開支)購回18,604,400股股份。購回的股份其後已被註銷。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.