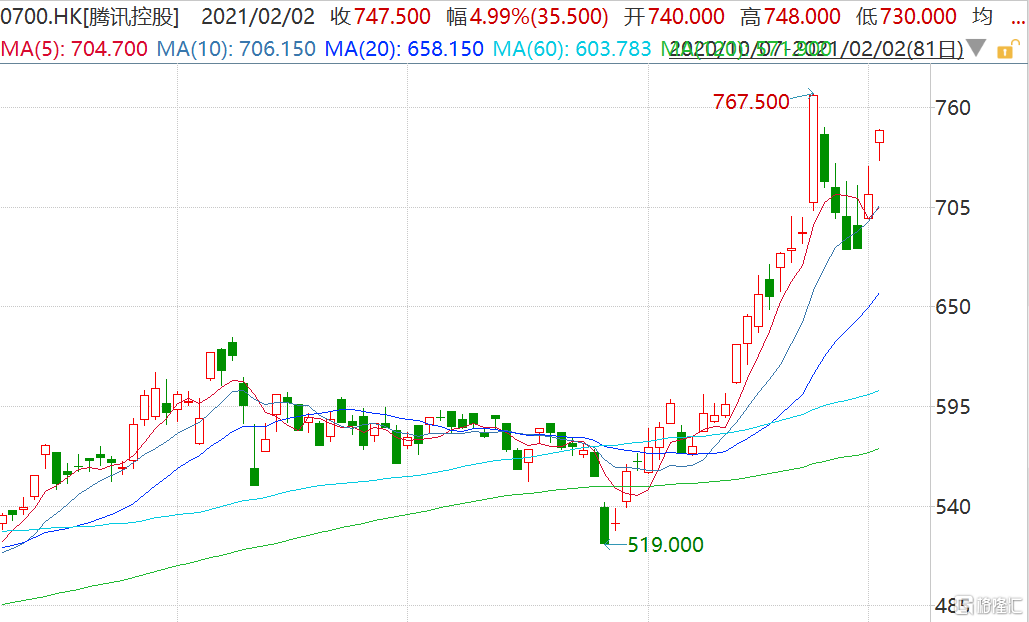

騰訊大漲5% 市值超7.17萬億

格隆匯 02-02 10:39

格隆匯2月2日丨騰訊(0700.HK)盤中拉昇一度漲5.06%至748港元,市值超7.17萬億港元。該股入選了格隆匯2021年“下注中國”十大核心資產名單,年內已累漲32%。據統計,截至2月1日,南下資金已連續27日淨買入騰訊,共計1121.88億港元。小摩將騰訊目標價上調至850港元,預計微信頻道(視頻號)將幫助騰訊贏得來自現有數字內容運營商的投入時間,從而帶來更強大的在中國互聯網領域的戰略地位。另外,即將到來的快手新股上市,將成為騰訊的主要催化劑,因騰訊持有快手逾20%股權。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.