軍工板塊領跌,酒鬼酒跌停,接下來會怎樣?

作者:汪友若

來源: 上海證券報

週四早盤,A股三大股指探底回升,寬幅震盪。截至午間收盤,上證綜指跌0.29%,報收3588.28點;深證成指跌0.82%,報收15239.61點;創業板指跌0.37%,報收3118.71點。

盤面上,前期強勢的白酒、軍工板塊領跌,酒鬼酒、航天電子等多股跌停。另一方面,資金持續挖掘相對低位的龍頭個股,中國中車兩連板;調整了半年之久的科技板塊也重獲關注,科創50指數逆勢大漲4%。

白酒、軍工版塊領跌

今日早盤,鋰電、光伏等前期抱團主線再現調整,軍工、白酒板塊表現較弱,領跌兩市。酒鬼酒跌停,口子窖、金種子酒跌逾7%。

航天電子跌停,航發控制、航發動力、愛樂達等多隻個股跌逾8%。

昨日異軍突起的“中字頭”基建股持續受到資金青睞,中國中車兩連板,中國中鐵、中國化學等個股跟漲。

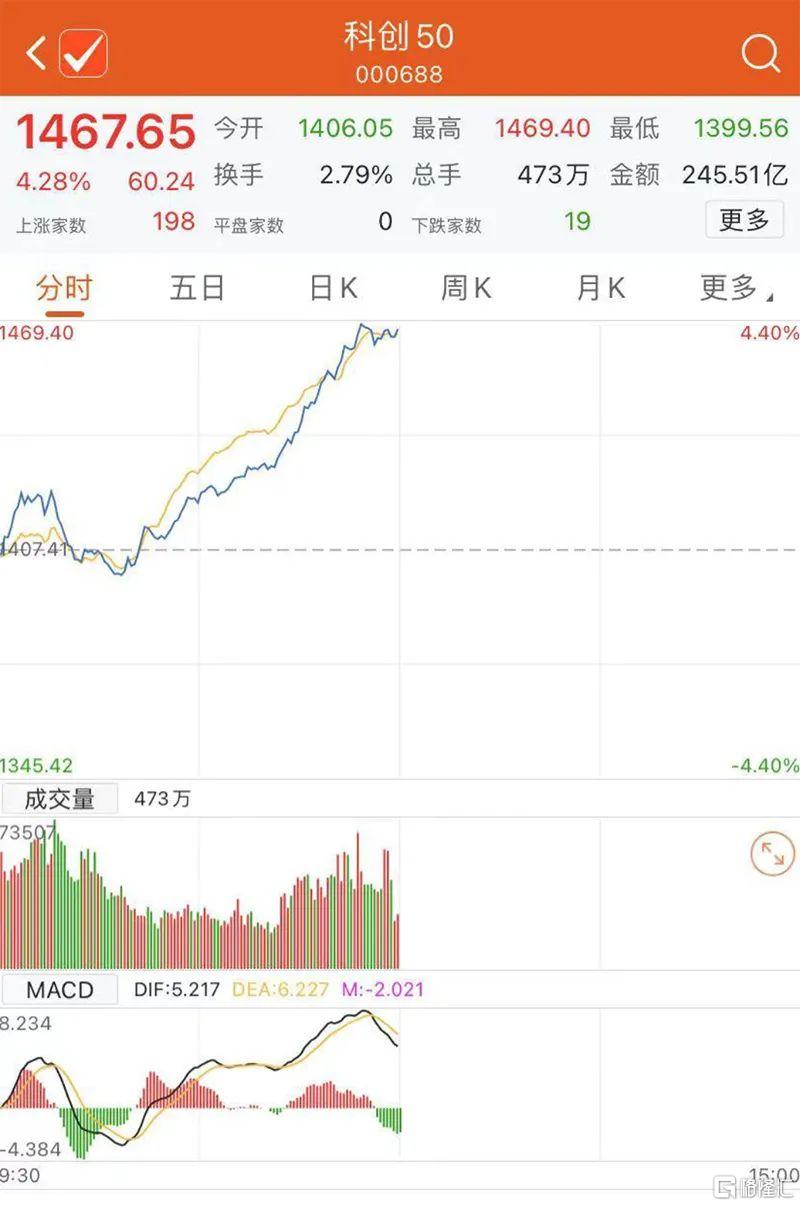

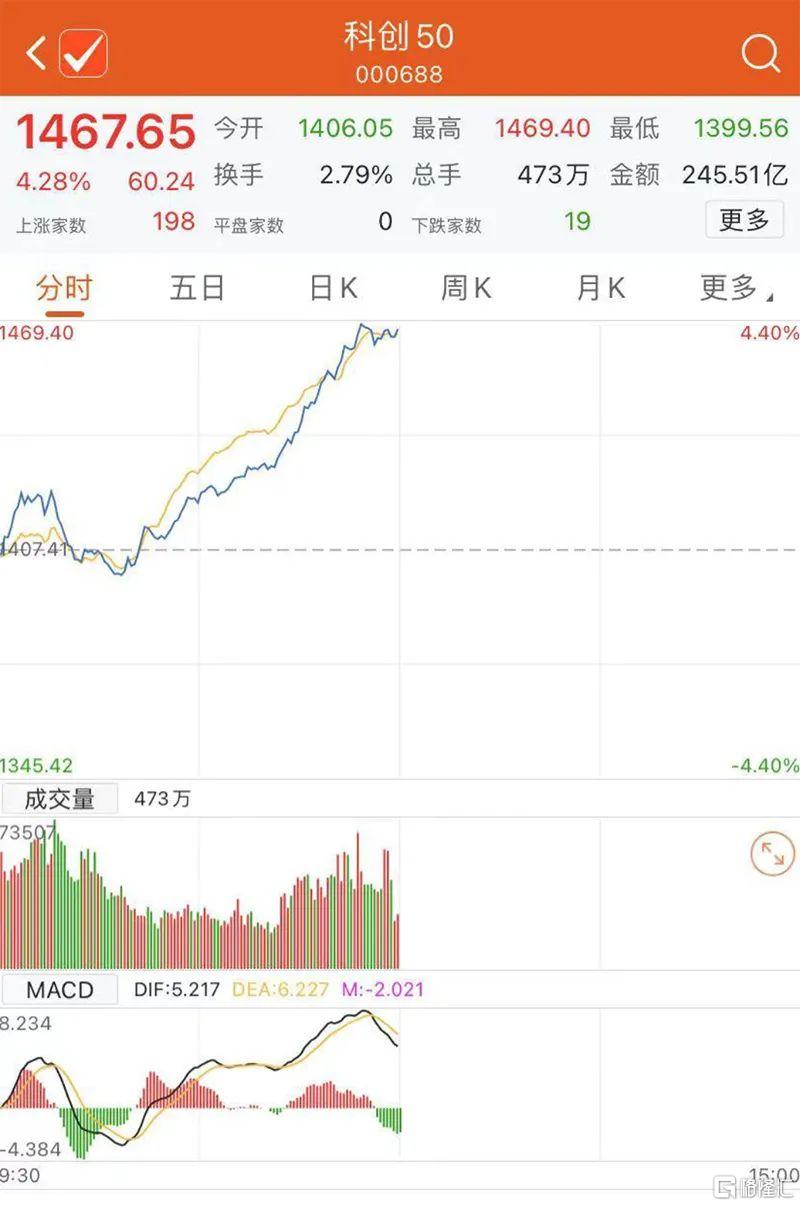

科創50指數大漲4%

值得注意的是,今日早盤活躍資金持續挖掘低位超跌股跡象愈發明顯,半導體、國產軟件等科技板塊大漲。科創50指數逆勢走強,大漲逾4%,該板塊內個股多數飄紅,滬硅產業等芯片股領漲。

將時間軸拉長來看,以5G、芯片為代表的科技股不少股價已經自高點腰斬。當前期強勢的抱團股高位盤整以後,低位超跌,尤其是業績具有確定性的低位科技股,便獲得了資金的關注。

例如,面板雙雄之一的TCL科技週二預增漲停後,週三再度大漲超7%,週四早盤微跌1.08%。京東方A週四早盤逆勢收漲2.99%。

近日來,隨着業績預吿披露,一部分中小市值公司的下跌趨勢得以扭轉,一部分大市值公司股價出現了加速拉昇。

野村東方國際證券認為,投資者應在春節來臨前對市場估值迴歸做好準備,加大對安全邊際的追尋,一是關注高業績確定性及一季度業績預增的化工、地產、家電、半導體等行業龍頭公司;二是關注高股息率、高業績穩定性且低估的銀行、保險和公用事業等板塊。

招商證券表示,如果出現市場風格的再平衡,那麼需要業績相對強弱的變化,流動性變化和增量資金結構變化的信號。從當前業績相對強弱趨勢來看,科技板塊和中小市值板塊2021年可能會有更強的業績趨勢,建議投資者關注風格轉變信號,適時做出風格再平衡操作。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.