A股收評:新能源暴動喜迎放量開門紅,大牛市 is back?

1月4日,A股2021年第一個交易日,市場三大指數迎來放量大漲,其中滬指突破3500點,創業板站上3000點。截至收盤,上證指數報3502.96點,收漲0.86%,深證成指報14827.47點,大漲2.47%,創業板報3078.11點,大漲3.77%。

圖片來源:wind

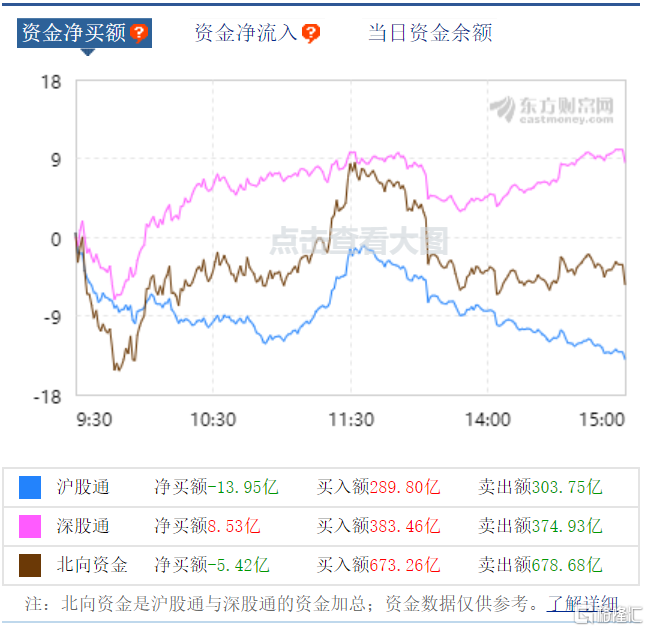

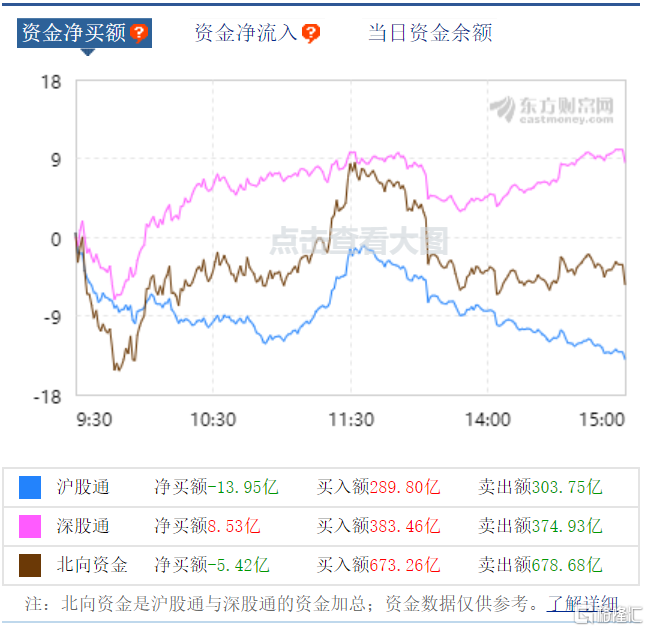

滬深兩地市場交易額破萬億,北上資金全天淨流出5.42億。市場賺錢效應極好,2791只個股上漲,133只個股漲停;1162只個股下跌,14只個股跌停。

盤面上,新能源具體暴動,大權重股寧德時代暴漲15.09%,光伏龍頭隆基股份、通威股份漲停。豬肉權重股牧原股份漲停。白酒股持續強勢,老白乾、酒鬼酒漲停。

具體來看:

鋰電池龍頭寧德時代帶動新能源板塊大漲,全行業超20只個股漲停,寧德時代暴漲15.09%,報404.10元,總市值9413.04億元。

消息面上,特斯拉正式宣佈中國製造Model Y以及全新Model 3正式發售,其中更重磅的消息是,特斯拉還將Model Y起售價下降為33.99萬元,比之前的價格下降了14.81萬元。特斯拉ModelYPerformance高性能版起售價為36.99萬元人民幣,此前為53.5萬元人民幣,下降了16.51萬元。

白酒股延續強勢行情,行業共有8只個股漲停,老白乾、酒鬼酒漲停,龍頭股持續創新高。

中金公司表示:上調貴州茅台目標價至2,739元人民幣,2021年增長有望提速,看好公司長期成長潛力及業績確定性。分析師餘馳等人在報吿中表示,作為高端龍頭,公司擁有行業強定價權,未來有望繼續分享中國高端消費擴容。預計在顯著的渠道價差下,公司隱含的長期提價期權仍然確定。2020年是公司調整年,且受到年初疫情影響,但公司仍保持了10%左右的增速,增長紮實、健康去年三季度後,公司直銷逐步放量,旺季堅定控價,且2020年報表留有餘力。

畜禽養殖表現強勢,立華股份暴漲19.02%,權重股牧原股份漲停,温氏股份大漲超6%,其餘個股紛紛跟漲。

農業農村部市場與信息化司司長唐珂近日表示,生豬產能持續恢復,豬肉價格小幅上漲後有望趨穩。目前來看,生豬生產恢復成效超出預期。國家統計局公佈,今日12月下旬生豬(外三元)價格環比上漲2.9%。

銀行表現萎靡,成都銀行、杭州銀行跌幅均超6%,興業銀行、平安銀行、招商銀行紛紛下跌。

科創板方面,中科星圖漲停、奧普特、派能科技漲幅居前,思瑞浦、鍵凱科技、石頭科技跌幅居前。

圖片來源:wind

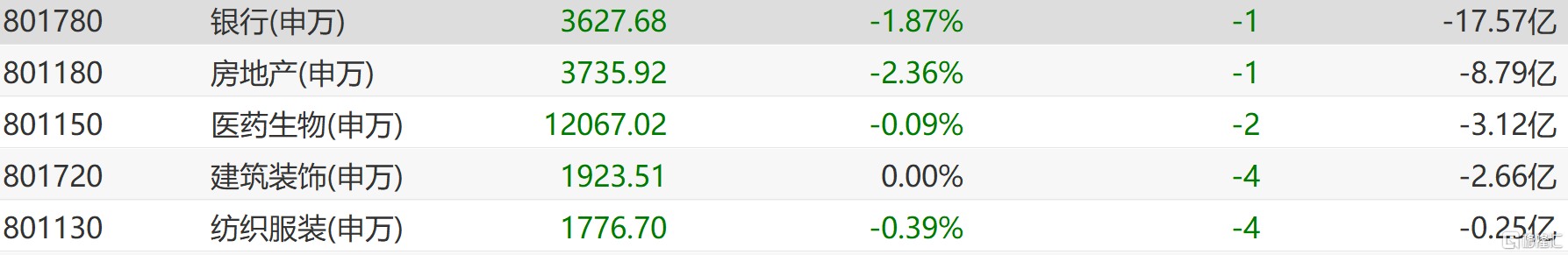

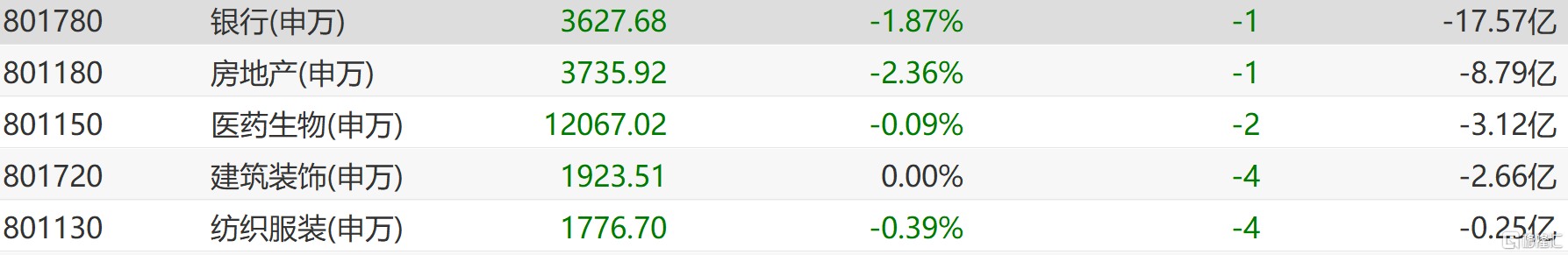

資金流向方面,電氣設備、有色金屬、農林牧漁淨流入居前,銀行、房地產、醫藥生物淨流出居前。

圖片來源:wind

北向資金方面,滬股通淨流出13.95億,深股通淨流出8.53億。北上資金全天淨流出5.42億元。

圖片來源:東方財富

招商證券表示,進入2021年1月,招商證券預計市場將會繼續保持上行趨勢,上證指數將繼續走高,上證50指數將會續創新高。主要原因在於2021年一季度將會迎來近10年最高業績增速,一季報行情可期;央行再12月繼續大幅投入流動性;年初,由於賺錢效應明顯,北上資金年初多會加倉A股,A股將會迎來一波較為明顯的增量資金。從歷史上看,當也即高增的年份,1月投資者更容易會選擇逆向思路,去年前一年表現較差的行業可能會逆襲,市場風格有可能會發生轉換。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.