業績爆棚!中芯國際能帶着芯片產業鏈一起飛嗎?

作者:李興彩

來源:上海證券報

登陸科創板後,中芯國際交出了第一份成績單就超乎市場預期,股民們各個微信羣裏“驚呼+驚歎”。

更值得喜悦的是,公司還透露出下半年產業仍處於高景氣度,業績優秀的集成電路類公司下半年有望繼續高歌猛進。

量增價漲!上半年盈利增長5.6倍

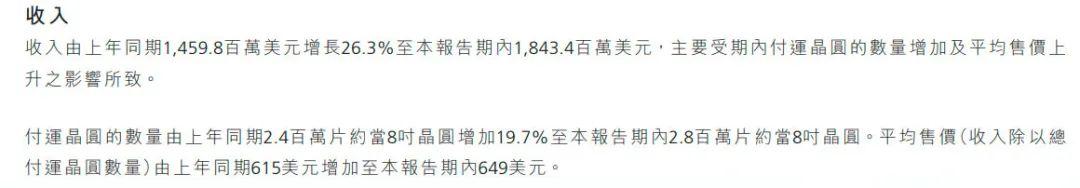

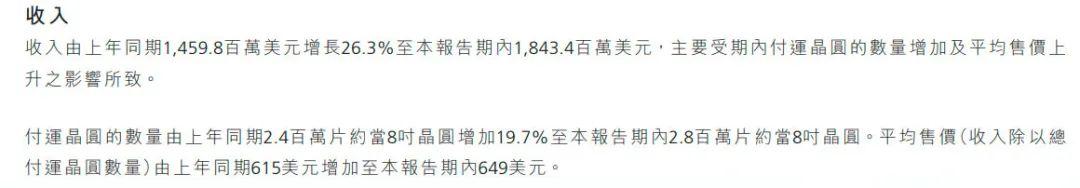

8月27日晚間,中芯國際披露了半年報,公司今年上半年實現營收18.43億美元,同比增長26.3%;歸母淨利潤2.02億美元,同比增長556%,營收利潤均創歷史新高。

業績為何爆棚?中芯國際的回答很簡單:產能提升、價格上漲。

中芯國際披露,公司上半年交付晶圓的數量280萬片(折算成8英寸晶圓),同比增長19.7%;平均售價由去年同期的615美元增加至本期的649美元。

另外,公司上半年毛利率為率26.2%,同比增長7.4個百分點;經營活動所得現金淨額為4.08億美元,同比上年同期的3.56億美元增長14.4%。

比營收利潤增長更為重要的是,中芯國際在先進製程上也保持了喜人的進展。

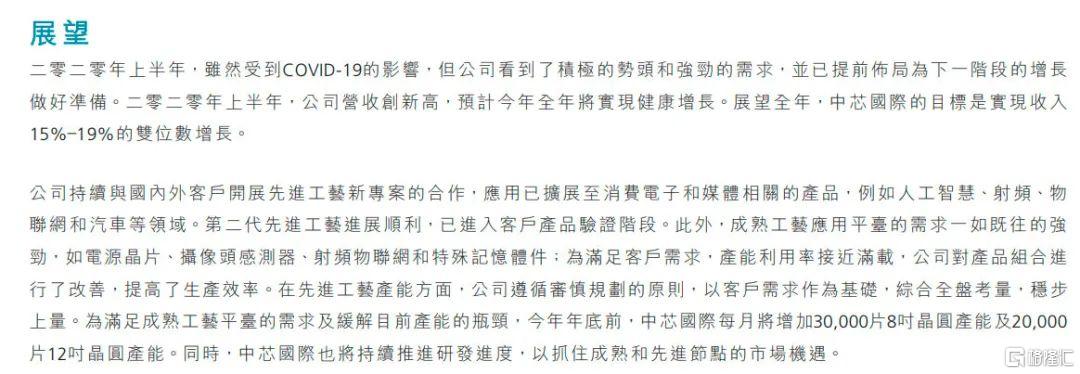

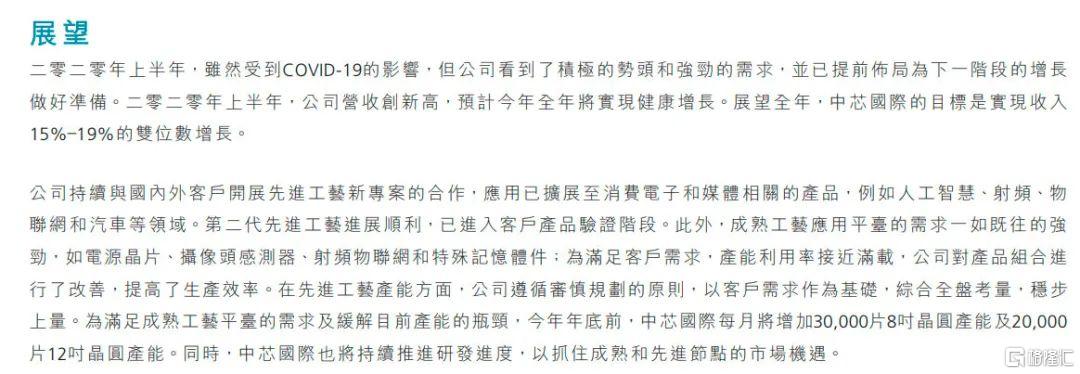

一是先進工藝已擴展至消費電子和媒體相應產品,比如人工智能、視頻、物聯網和汽車等領域;另外,第二代先進工藝進展順利,已進入客户產品驗證階段。

中芯國際表示,看到積極的勢頭和強勁需求,公司為下一階段的增長已做了提前佈局,目標是全年營收實現15%–19%的增長。

行業仍高景氣,

優秀芯片公司有望保持高增長

在新冠肺炎疫情影響下,半導體產業下半年景氣度如何,成為市場關注的重點,中芯國際的半年報給出了樂觀指引。

中芯國際預計,今年年底前,公司每月將增加3萬片8英寸晶圓產能及2萬片12英寸晶圓產能。

對此,有半導體業內人士解讀,晶圓廠是半導體景氣度的風向標,中芯國際積極增加產能,也就意味着產業景氣度高,下游公司也可以“吃飽”,業績優秀的產業鏈公司在下半年有望繼續保持高增長。

A股哪些半導體公司在上半年實現了高增長?

國內封裝“一哥”長電科技在8月21日交出了一份靚麗的半年報成績單。繼一季度大幅扭虧後,公司二季度業績繼續高揚,盈利3.66億元。公司去年同期的利潤為-2.59億元。

良好業績下,長電科技趁熱推出定增,擬向不超過35名對象,定向增發不超過1.8億股(鎖定期6個月),募集資金不超過50億元,用於年產36億顆高密度集成電路及系統級封裝模塊等項目。

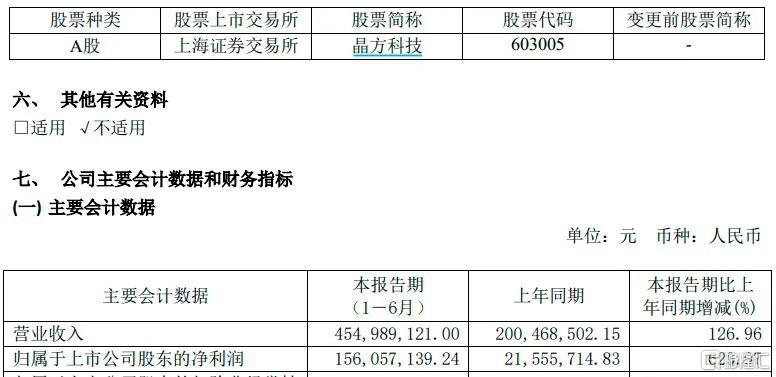

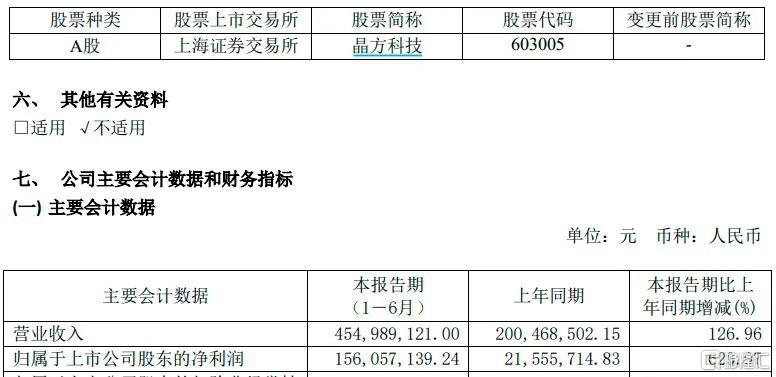

同屬半導體封裝陣營,晶方科技上半年業績增長超過6倍,華天科技上半年業績增長超過2倍。

收購豪威後,韋爾股份最主要的產品是CMOS 圖像傳感器芯片,充分受益於智能手機的多攝發展趨勢。

韋爾股份上半年營收80.43億元,同比增長41.02;歸母淨利潤9.9億元,同比暴增1206.17%。

作為內地“富士康”,立訊精密在上半年也繼續保持了高增長。公司上半年實現營業收入364.52億元,同比增長70.01%;淨利潤25.38億元,同比增長69.01%。此前,公司預計上半年增長40%至60%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.