中國建材(03323.HK):資產整合,價值釋放繼續,維持“買入”評級,目標價15.88港元

機構:興業證券

評價:買入

目標價:15.88港元

投資要點

中國建材擬向天山股份出售其於中聯水泥、南方水泥、西南水泥及中材水泥的股權,代價為天山股份定向發行的股份,發行價格為每股13.38元;同時,天山股份擬於建議重組完成後進行新股配售。

我們點評如下:

本次擬注入的標的公司賬面淨資產約為668億元,經中國建材權益佔比調整後的賬面淨資產為595億元,“真實”ROE為33%,其中,南方水泥和中聯水泥盈利能力較為突出。我們對標的資產估價從1.2-1.9倍PB進行情景假設分析,結果顯示,天山股份定向中國建材增發的股本數量將在53.36-84.49億股區間內,交易完成後,中國建材在天山股份的持股佔比將在85.6%-89.7%區間,“新”天山股份將持有中聯水泥100%股權、南方水泥99.93%股權、西南水泥95.72%股權、中材水泥100%股權。

資產整合已經拉開序幕,中國建材的價值正在加速釋放。中國建材的礦山、土地已較早年收購價格有明顯升值,經過連續2年合計約230億元的謹慎撥備處理,我們有理由認為中國建材擬出售資產的公允價值較賬面值低估,且中國建材在港股市場的PB長期低於1倍,本次資產整合將是中國建材價值釋放的催化劑。本次交易完成後,中國建材的大部分水泥資產將在A股單獨上市,中國建材估值將錨定A股相關標的,其在港股長期低估值狀態有望得到修復。

從更長週期來看,我們認為中國建材的競爭力當刮目相看,公司長期價值仍被低估。中聯於魯豫市場正攜手山水和同力,南方水泥牽手海螺,合作遍地開花,泛北方市場,中國建材與金隅冀東共同合作解決西北電石渣亂象,南方&西南水泥又開展了大量產能置換,中國建材的資產質量和盈利能力在大幅提升。我們的DCF模型測算結果顯示,中國建材合理估值為1216億人民幣,現值低估了19%。此外,骨料正在開啟新的業務增長點,480億市值可期,這部分我們尚未考慮到估值模型中。

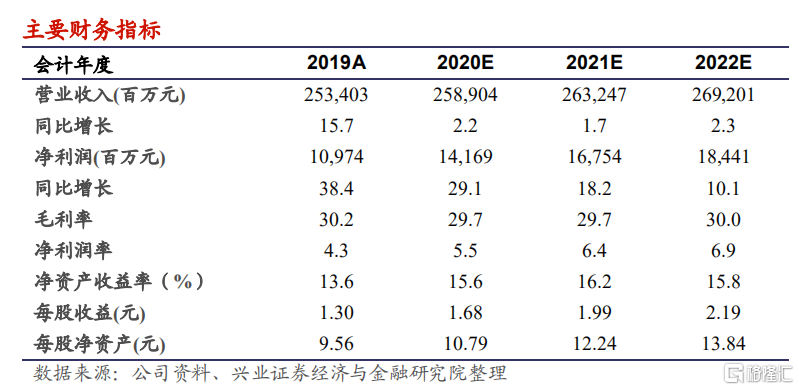

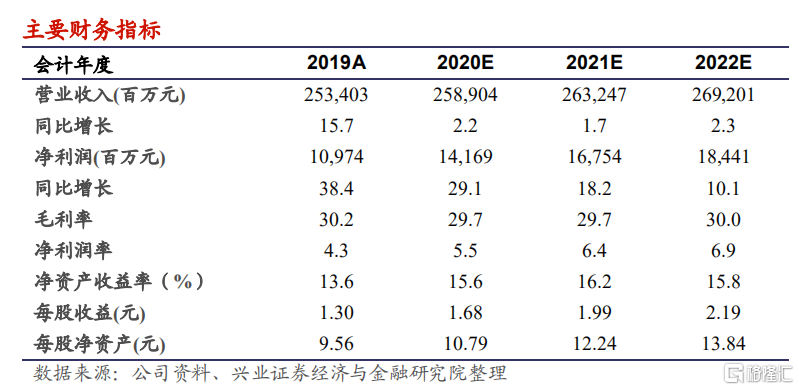

我們的觀點:我們暫維持2020-2022年歸母淨利分別為142億、168億和184億元的盈利預測不變,維持“買入”評級,本次資產整合加速中國建材估值修復,上調目標價至15.88港元。

風險提示:經濟惡化;協同破裂;原材料價格大幅波動;海外業務風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.