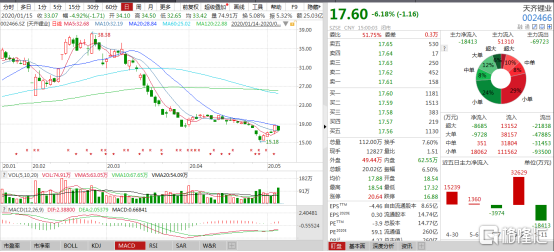

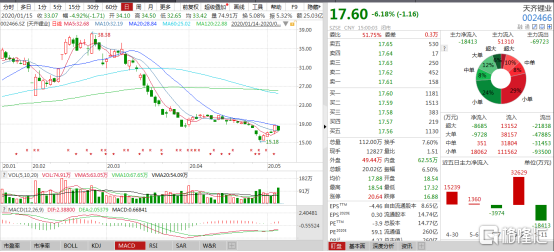

天齊鋰業(002466.SZ)大跌超6%,業績鉅虧且面臨債務困境

5月11日,天齊鋰業跌勢明顯,截止到收盤,該股大跌6.18%,收於17.60元。

來源於:Wind

值得注意的是,天齊鋰業曾在上週五午後放量漲停,而如今這一起伏的走勢顯然吸引了市場的注意。

首先,究及上週五的漲停,主要是在於市場消息稱美國雅寶有意收購天齊鋰業持有的全球最大的鋰礦——澳大利亞格林布什鋰礦股權(目前天齊鋰業擁有該鋰礦51%股權,雅寶持有49%股權)

而該公司這一舉措或將頗有“壯士斷腕”以求脱離經營困局的意味。

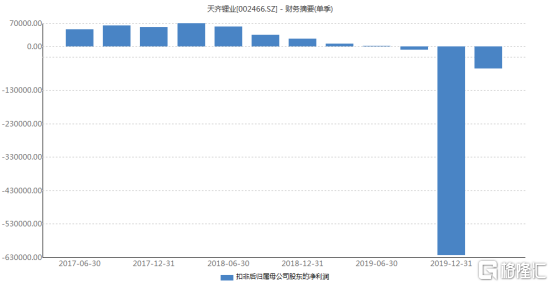

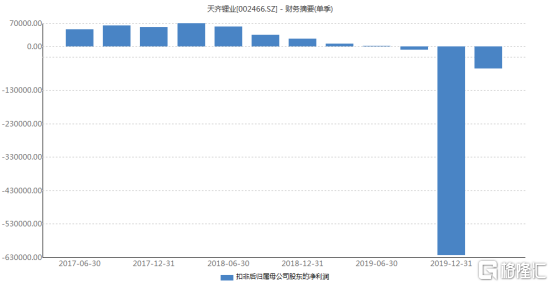

事實上,回顧近來天齊鋰業的業績,可以看出,其面臨較大的生存壓力。

根據其2019年財報顯示,受長期股權投資減值、鋰價下滑以及財務費用大增所致,2019年公司實現營業總收入48.4億,同比下降22.5%;實現歸母淨利潤-59.8億,上年同期為22億元,出現虧損狀態。同時,公司在報告期內被會計師事務所出具了保留意見的審計報告。

“出具保留意見的審計報告主要是因為年產2.4萬噸電池級單水氫氧化鋰項目”和第二期年產2.4萬噸電池級單水氫氧化鋰項目”尚未完成項目清理、未達到竣工決算條件及疫情影響而無法現場進行必要的審計程序等,因此無法獲取充分、適當的審計證據。目前兩個項目皆未按預期時間投產,賬面價值(歸於在建工程)分別為35.31億元和12.56億元。”——審計機構

而進入2020年,由於行業週期調整、突發新冠肺炎疫情等多重不利因素影響,鋰產品價格下跌,以及物流不暢與下游客户延遲開工導致銷量下滑,再加上澳元兑美元匯率下降幅度較大,導致本期財務費用匯兑損失金額較上年同期大幅增加,2020年一季度公司實現營業總收入9.7億,同比下降27.6%;歸母淨利潤-5億,同比下降549.5%,未能贏得一個業績“開門紅”。

天齊鋰業扣非後歸屬母公司股東的淨利潤

來源於:Wind

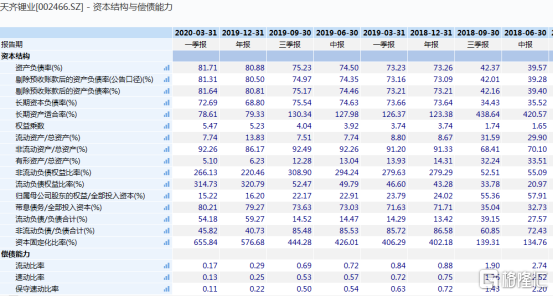

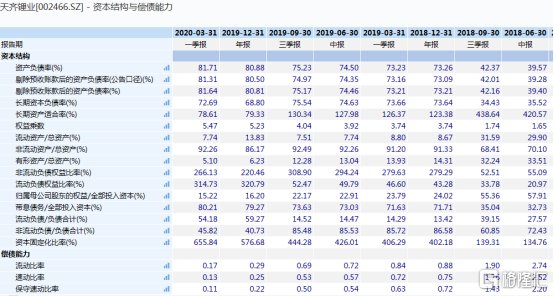

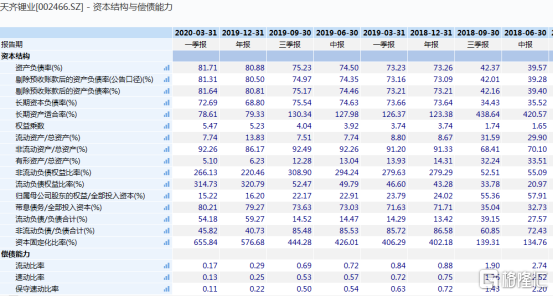

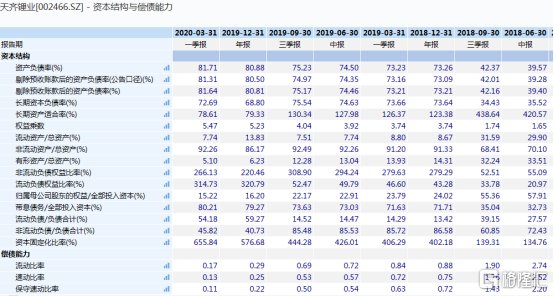

此外,由於天齊鋰業在2018年底購買SQM股權新增併購貸款35億美元這一舉措使得公司的財務費用和負債繼續攀升也引起了市場矚目。

根據最新數據顯示,天齊鋰業2019年財務費用為20.28億元,佔營業收入的41.89%,相較2016年同期(0.96億元),其增長超過20倍。同時,其資產負債率高達81.71%,且公司的流動比率和速動比率均低於0.2,公司面臨較大的違約風險非常高。

來源於:Wind

除此之外,根據最新公告顯示,控股股東成都天齊實業(集團)有限公司(下稱天齊集團)補充質押3000萬股股份給國金證券和中泰證券。截止到目前,天齊集團共計質押約3.8億股股份,佔公司總股本的25.71%,佔其所持股份比例的71.32%,或將引發平倉風險。

來源於:Wind

對此,在近期2019年網絡業績説明會上,天齊鋰業稱,公司正在持續積極論證有助於降低公司債務槓桿的各類股權融資工具和路徑(包括但不限於引進境內外戰略投資者、出售部分資產和股權等方式),以期在條件成熟時履行法定程序進行審議決策和信息披露,並從根本上優化公司的資產負債結構,提高盈利能力和現金流水平。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.